As the cryptocurrency market continues to evolve, Bitcoin (BTC) predictions for 2026 are becoming increasingly important. With traditional finance playing a larger role in the cryptocurrency space, it’s essential to examine the historical chart patterns and market realities that may impact Bitcoin’s price. In this article, we’ll delve into the expert outlook for Bitcoin’s price until 2026, exploring the forecasts and technical indications that may shape the cryptocurrency’s future.

Expert Outlook for Bitcoin Price Until 2026

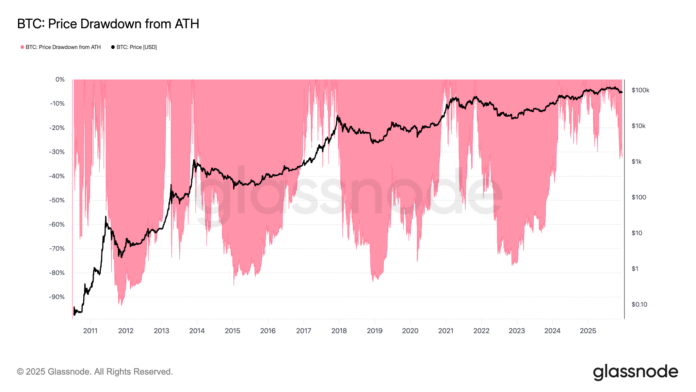

The post-2024 halving cycle brought significant gains at the start of the year; however, the consolidation and volatility at the end of 2025 led to a decline due to macroeconomic uncertainty and fluctuations in ETF flows. The 47% decline from October’s all-time high of $126,000 saw Bitcoin’s price fall to $80,500 in November.  Source: Glassnode

Source: Glassnode

Analysts are largely optimistic about 2026, although their forecasts are muted compared to previous euphoria. Standard Chartered has cut its 2026 Bitcoin target to $150,000 from $300,000 after the firm announced moonshots for 2024 and early 2025, citing slower institutional buying via ETFs. Bernstein analysts also expect Bitcoin to reach $150,000 by the end of 2026, with the expected price at $200,000 by the end of 2027.

Strategy CEO Michael Saylor predicts Bitcoin will be worth $150,000 by 2026, arguing that despite the recent price correction, the cryptocurrency has “become much less volatile,” contradicting the predictions of many crypto analysts. More optimistic views, such as those from Fundstrat, see a potential of $200,000 to $250,000, while conservative estimates are around $110,000 to $135,000.

BTC Price Technicals Clash with Optimistic Forecasts

Previous halving patterns suggest BTC price peaks 12 to 18 months afterward when reduced issuance takes effect – and this is starting to be reflected in the charts. Analyst and trader Rekt Capital suggested that the current cycle is over 93% complete and that the market may peak in the fourth quarter of 2025.  Source: Rekt Capital

Source: Rekt Capital

Other technical indicators also reflect bear market conditions, suggesting that Bitcoin’s four-year cycle remains intact and that BTC could continue its downward trend into 2026. Bitcoin’s weekly chart shows that the SuperTrend indicator issued a bearish signal, with its “sell” signal confirmed by BTC’s decline below the 50-week moving averages (MAs), a scenario that has marked the end of bull markets in the past.  Source: Cointelegraph/TradingView

Source: Cointelegraph/TradingView

Benjamin Cowen, founder and CEO of Intocryptoverse, said that the BTC/USD pair is likely to return to the 200-day SMA, currently $108,000, before resuming the downtrend and possibly bottoming out at the 200-week MAs between $60,000 and $70,000 in 2026.  Source: Benjamin Cowen

Source: Benjamin Cowen

As Cointelegraph reported, Bitcoin’s 200-day moving average turned downward in November when it hit a “death cross” as it fell below the shorter-term 50-day moving average, predicting a year of declines in 2026. Polymarket predicts a 41 percent chance of BTC rising above $130,000 and a 25 percent chance of it reaching $150,000 before the end of 2026.  Source: Polymarket

Source: Polymarket

Overall, the consensus is trending upwards, driven by structural changes rather than traditional boom-bust cycles. While the technical indications suggest a possible sharp decline, the expert outlook for Bitcoin’s price until 2026 remains optimistic. For more information, visit https://cointelegraph.com/news/bitcoin-price-in-2026-predictions-vs-charts-and-reality