Bitcoin’s Inclusion in US Pension Plans Could Unlock Billions of Dollars in New Capital

The inclusion of cryptocurrency in US pension plans could mark a milestone for the introduction of Bitcoin and unlock billions of dollars of new capital, which, according to André Dragosch, head of European research at Crypto Asset Manager, launched the asset over 200,000 US dollar. President Donald Trump paved the way for cryptocurrency in the USA 401 (K) pension plans by signing an executive regulation on August 7 and granting the Americans access to digital assets through their pension.

The inclusion of crypto in 401 (K) plans can be even more important for the Bitcoin (BTC) Prize (BTC) than the approval of Bitcoin Bitcoin Exchange Fund (ETFS) in January 2024, said Dragosch. This “bullish” development may be “greater than the US Bitcoin -ETC itself”, which signals a new capital worth 122 billion US dollar, with a modest portfolio allocation of 1%, Dragosch CoinTelegraph said during the chain reaction daily rooms on Monday and accused a price forecast for a good measure: “The official forecast will remain $ 200,000 by the end of the year.”

Bitcoin’s Potential in 401 (K) Plans

“If you look at 401 (K) and Deferred Contribution Pension plans in the United States, you are huge,” said Dragosch, adding that 1% was a “relatively conservative” allocation estimate for the $ 12.2 billion industry. The involvement of digital assets in old-age provision plans enable 401 (K) portfolio managers to invest in Bitcoin ETFs, which can increase the price of Bitcoin to new all-time highs and another optimistic signal for the Bitcoin course goal of $ 200,000 for the Bitcoin course of $ 200,000 for the end of 2025.

Bitcoin’s Corporate Boom Throws the Nationalization of Fort Knox Up

FED Directive, Retirement Schedule Considered a Double Driver

Based on the Bitwise for Financial Advisern survey, most portfolio managers are more likely to recommend a Bitcoin allocation of 2.5% or 3% for retirement plans, which indicates significant tributaries than the initial allocation of 1%. The first Bitcoin inflows from the pension plan manager can collapse this autumn with the interest rate of the US Federal Reserve cut by the US Federal Reserve, which could lead Bitcoin to new heights, said Dragosch and added: “If you see further FED installment cuts, there will definitely be a case for $ 200,000 by the end of the year.”

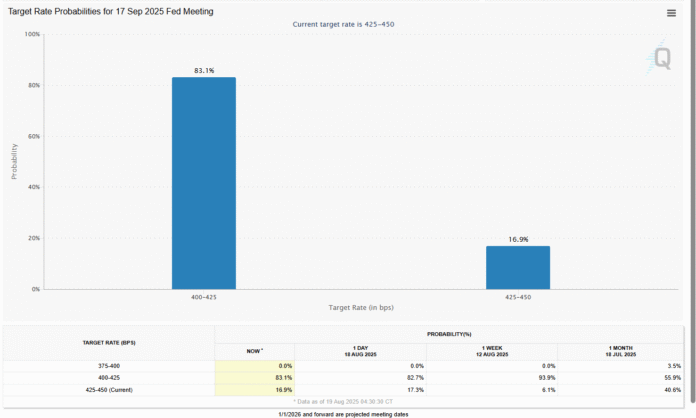

The markets have a chance of 83% that the Fed will reduce interest rates for the next meeting of the Federal Open Market Committee on September 17 by 25 basis points. This goes from the last estimates of the Fedwatch tool of the CME Group.

FED -SIES -ZUNSPRESTEMEDIENTIONS. Source: Fedwatch tool of the CME Group

Analysts See the Exhaustion of Bitcoin Buyers When Retail is Shifted to Old Coins

In addition to improving monetary policy expectations, the assumption of Bitcoin can also be accelerated by the financial incentive of 401 (K) plan providers to offer Bitcoin ETF exposure. Blackrock, Fidelity and Vanguard are among the largest pension plans in the United States. While Vanguard Krypto -Tfs does not yet have “Greenlight”, “Blackrock and Fidelity have an enormous economic incentive to add these Bitcoin ETFs to their standard plans,” said Dragosch.

US Spot Bitcoin ETF overview of the market share. Source: Dune

BlackRock is the issuer of the largest Bitcoin ETF, the Ishares Bitcoin Trust, with over $ 84 billion, which is $ 57.5% of the total market share, while Fidelity’s ETF is the second largest and second largest market share of 22.4 billion US dollar, the total market share file with the Dune market shares, Dune data information. On Friday, Paul Atkins, Chairman of the US Securities and Exchange Commission, Paul Atkins, confirmed that the regulatory authority was working with the Trump administration in order to enable access to private equity, including crypto assets, the Retan -Pension Plan for retail, but demanded the need for “proper guidelines” with regard to alternative investments.

For more information, visit https://cointelegraph.com/news/401-k-crypto-retirement-plans-bitcoin-etf-analyst?utm_source=rss_feed&utm_medium=rss_tag_regulation&utm_campaign=rss_partner_inbound