Ethereum (ETH) has been making waves in the cryptocurrency market, with its price reaching new heights and showing no signs of slowing down. Despite a recent downturn, several data points suggest that the ETH price still has more room to grow in 2025. In this article, we’ll explore the key factors driving Ethereum’s success and what it means for the future of the cryptocurrency market.

Strong Institutional Demand

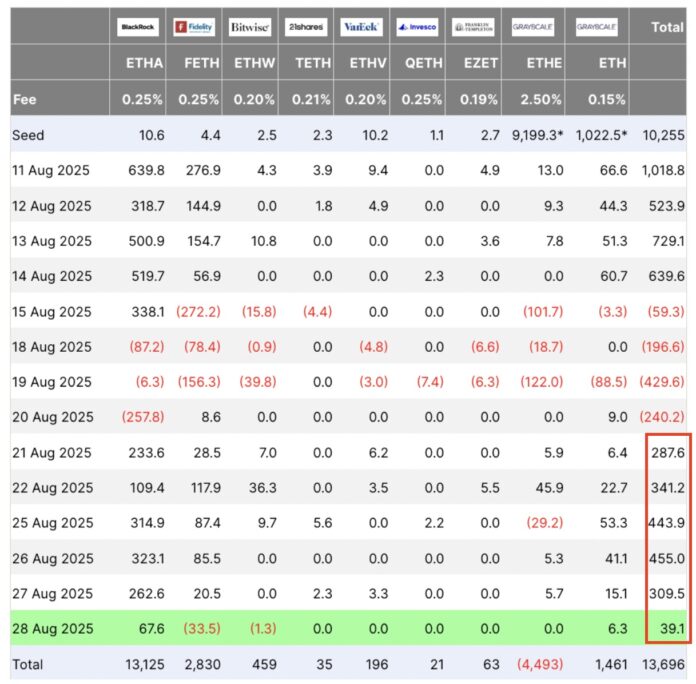

The institutional interest in ETH has been increasing, with record ETF inflows and the adoption of corporate treasury. Spot Ethereum ETFs in the US have seen unprecedented demand, with one-day inflows reaching a record $1.02 billion on August 11 and cumulative net inflows of over $13.7 billion since the start of July 2024. These investment products continue to attract capital, with net inflows of $39.1 million on Thursday, extending their inflow streak to six consecutive trading days, according to data from Farside investors.

Ether is also growing as a corporate reserve, with Bitmine Immersion Technologies buying 78,791 ETH worth $354.6 million. With the latest acquisition, the company holds ETH worth around $8 billion, making it the largest corporate owner.

Network Activity on the Rise

The fundamentals of the Ethereum network seem stronger than ever. The monthly average transactions increased from 31.7 million to 49.8 million in July, representing a 57% increase, according to data from Nansen. Active addresses rose by 24% to 9.6 million in the same period.

In the second week of August, weekly DEX volumes reached an all-time high of $39.2 billion, according to Defillama data. Increasing transaction activity, a rise in active addresses, and record DEX volumes indicate growing demand for Ethereum.

ETH Price Gains Against BTC

Ether has risen by 195% since April, outperforming Bitcoin (BTC) by more than double. The ETH/BTC pair has also been on the rise since April, reaching a 12-month high of 0.043 BTC on August 24.

This rally has led the MACD to flash a bullish cross on the ETH/BTC monthly chart for the first time in five years, a signal that has historically preceded significant price increases.

Technical Setups Indicate New All-Time Highs

The technical setups for Ether are also looking bullish, with several indicators pointing to new all-time highs. The ETH has shown strength after breaking out of a rounded bottom chart pattern in the daily chart, with a measured target of $12,130 or 180% compared to the current price.

Other analysts, such as retailer Jelle, point to a bullish “megaphone” pattern in the weekly chart, which could take the price to around $10,000.

While some technical setups indicate that the ETH price could increase to up to $20,000 in the coming months, it’s essential to remember that every investment and trade move carries risk, and readers should conduct their own research before making any decisions.

For more information on Ethereum’s price movements and the cryptocurrency market, visit Cointelegraph.