Understanding the Impact of Ether Options Expiry on the Cryptocurrency Market

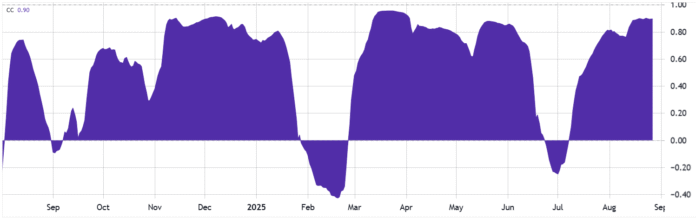

The recent surge in Ether’s (ETH) price, with a 22% increase over the past 30 days, has brought the cryptocurrency to a critical juncture. As the $5 billion ETH options expiry approaches, bullish strategies are poised to dominate the market, offering dealers an advantage as prices rise. This phenomenon is particularly notable when considering the historical correlation between Ether’s price movements and the S&P 500 index, which has been observed to be over 80% in recent times.

According to data from Tradingview, the 40-day rolling correlation between ETH/USD and the S&P 500 index has been steadily increasing, indicating that Ether’s price is closely tied to the movements of the broader stock market. This correlation is significant, as it suggests that Ether traders are applying a similar risk assessment to both assets. As a result, the upcoming company earnings reports, particularly in the artificial intelligence sector, are likely to have a significant impact on Ether’s price.

The open interest in Ether call (buy) options is currently $2.75 billion, surpassing the $2.25 billion in put (sell) options. This imbalance is expected to have a significant impact on the expiry result, which will depend on the price of ETH at 8:00 a.m. UTC on Friday. Deribit, the leading exchange, dominates the ETH options market with a 65% share, followed by OKX at 13% and CME with 8%.

Bearish Ether Strategies and the Impact of Options Expiry

Despite the rejection of $4,800, retailers pursuing bullish strategies are well-positioned to benefit from the monthly expiry of $5 billion. Notably, only 6% of ETH put options were placed at $4,600 or higher, indicating that most neutral to bearish structures were ineffective. In contrast, 71% of call options were positioned at $4,600 or lower, with notable clusters at $4,400 and $4,500.

Based on current price trends, there are four probable scenarios in Deribit, which appreciate theoretical profits based on imbalances with open interest rates. These scenarios include:

-

Between $4,050 and $4,350: Calls of $820 million compared to puts of $260 million, favoring calls by $560 million.

-

Between $4,350 and $4,550: $1.05 billion calls compared to $140 million puts, favoring calls by $915 million.

-

Between $4,550 and $4,850: $1.4 billion calls compared to $45 million puts, favoring calls by $1.35 billion.

-

Between $4,850 and $5,200: $1.82 billion calls compared to $2 million puts, favoring calls by $1.8 billion.

While Ether’s price is expected to continue its upward trend, the expiry result will depend on the mood of traders, particularly in response to Nvidia’s revenue report and the general evaluation of global economic growth risks. As the cryptocurrency market continues to evolve, it is essential to stay informed about the latest developments and trends. For more information, visit https://cointelegraph.com/news/will-5k-eth-follow-friday-s-5-billion-ether-options-expiry?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound