Bitcoin’s Rally Faces Mixed On-Chain Data as Accumulators and Miners Clash

Bitcoin’s (BTC) recent rally in early January has been marked by a mixed bag of on-chain data, with strong accumulation demand being met by renewed miner distribution. This juxtaposition of market forces has left many wondering whether the rally will lose steam or continue to gain momentum.

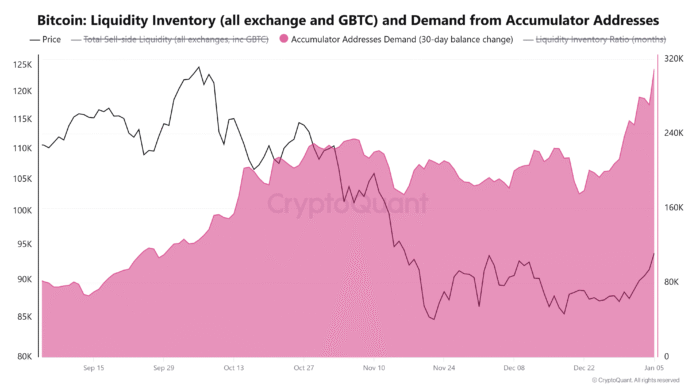

Key statistics reveal that Bitcoin accumulator addresses added approximately 60,000 BTC in just six days, signaling a significant shift in market sentiment. This surge in accumulation comes after a period of consolidation that lasted several months, during which holdings fluctuated between 200,000 and 230,000 BTC. Meanwhile, miners sent around 33,000 BTC to exchanges in early January, indicating a potential decrease in long-term holdings.

Accumulator Addresses Step Up as Price Rises

According to data from CryptoQuant, Bitcoin accumulators increased their holdings from about 249,000 BTC to 310,000 BTC within the first six days of January. This decisive shift is notable, given the consolidation period from September to December 2025, during which holdings remained relatively stable. The timing of this accumulation is also remarkable, as it has accelerated alongside Bitcoin’s recovery toward the low-$90,000 area, suggesting that long-term participants are ready to absorb available supply rather than wait for deeper declines.

The increase in accumulator activity is a positive sign for the market, as it indicates that investors are confident in Bitcoin’s long-term prospects. However, the impact of this accumulation on the broader market depends on whether spot demand can sustainably absorb new supply on the seller side.

Miners Reduce Commitment: A Potential Roadblock for the Rally

At the same time, the Bitcoin network moved about 33,000 BTC from miner wallets to Binance in the first six days of 2026, a relatively high number compared to typical miner flows. According to a QuickTake post on CryptoQuant, this behavior suggests that miners are choosing to de-risk following the recent price surge, a pattern that often occurs during periods of post-rally uncertainty.

While this selling pressure from miners may not automatically lead to a strong correction, it is essential to monitor whether counter-demand remains strong enough to accommodate this supply without lowering prices. The interplay between accumulation and distribution will be crucial in determining the rally’s sustainability.

BTC Net Taker Flow and Sentiment Point to Stabilization

Market data points to a steady recovery, with Binance’s seven-day net taker flow sentiment recording strong net sales in November, averaging $2.3 billion per day, coinciding with Bitcoin’s decline toward $84,000. December marked a transition period, and selling pressure eased at the end of 2025. January has now seen seven straight days of light but sustained net buying, averaging $410 million.

The Bitcoin Unified Sentiment Index has also returned to neutral territory for the first time since November, signaling that fear has eased even as optimism remains muted, according to Bitcoin researcher Axel Adler Jr.

These signals suggest that Bitcoin’s rally may not overheat, but its sustainability depends on whether steady accumulation continues to balance miner distribution in the coming weeks. As the market continues to evolve, it is essential to monitor these on-chain metrics and sentiment indicators to gauge the rally’s potential trajectory.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. While we strive to provide accurate and up-to-date information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of the information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information. For more information, visit https://cointelegraph.com/news/60k-btc-absorbed-as-miners-back-off-will-bitcoin-s-rally-lose-steam