Conventional funding approaches think buyers have equivalent get entry to to marketplace data and produce rational, impassive choices. Behavioral finance, championed by means of Richard Thaler, Daniel Kahneman, and Amos Tversky, demanding situations this guess by means of spotting the position feelings play games.

However the skill to quantify and supremacy those feelings eludes many buyers. They try to preserve their funding exposures throughout the ups and downs of marketplace cycles.

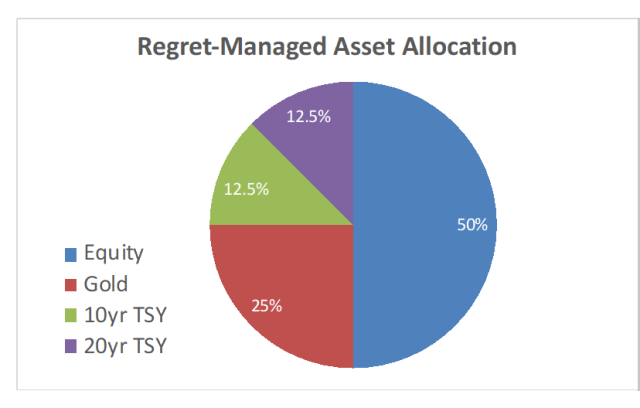

On this publish, I introduce a holistic asset allocation procedure supposed to supremacy the phenomenon of remorse possibility by means of bearing in mind every consumer’s willingness to preserve an funding technique thru marketplace cycles. I additionally evaluation the suitability of a consumer’s expectancies to decide if a technique is a superb fit and could be sustained. The upshot is a case for similarly weighted funding methods.

The Worth of Keeping up an Funding Technique

Buyers will have to preserve their technique over a protracted length of moment if they’re to succeed in the predicted effects. This calls for rebalancing their portfolios periodically to preserve publicity in every area of the method, particularly throughout sessions of prime volatility. Buyers whose feelings supremacy them to deviate from the method are successfully timing the marketplace by means of making predictions about presen returns. Those movements provide their very own mode of possibility, including to the present possibility of unpredictable markets.

The Position of Wisdom

We will have to recognize that we will be able to’t expect the presen with any sure bet. In spite of having knowledge, research, and professional evaluations, our forward-looking choices are skilled suppositions. To supremacy the hesitancy of this data hole, we will have to plan for the results that can happen by means of retaining investments that capitalize on favorable results, combining those with alternative investments that mitigate the destructive ones. The investor can quite be expecting extra strong returns from this extra intuitive diversification means.

I evaluated my effects the usage of just about a century of marketplace knowledge that shield america economic system throughout lots of its marketplace cycles and thru instances of each ease and terminating geopolitical rigidity. This research comprises the varieties of regret-inducing occasions buyers are more likely to come across.

The Nature of Remorseful about

Remorseful about is an emotional response to terminating occasions, whether or not the occasions manufacture losses or beneficial properties. When remorse drives an investor to vacate an funding technique, this provides the chance of a whipsaw impact: being improper on each the advance from and re-entry into the funding markets.

Over the future 95 years, the S&P 500 has returned 9.6% every year. Lacking out at the 10 very best years would have reduced that go back to just 6%. Alternatively, keeping off the worst 10 years would have boosted the go back to 13.4%. The funding markets serve adequate alternatives for remorse. This makes guarding towards remorse vital to serving to buyers preserve their funding methods.

Asset Allocation In the course of the Lens of Remorseful about

Harry Markowitz is named the daddy of Fashionable Portfolio Principle for his paintings in quantifying the advantages of diversification. But, in his personal portfolio he divided his cash similarly between shares and bonds, since he didn’t know which used to be more likely to do higher in any given yr.

This demonstrates the knowledge of splitting belongings similarly throughout investments. The case for similarly weighted methods is in line with keeping off possibility concentrations and equalizing every asset’s marginal contribution to go back and possibility. It is a elementary motive force of potency. We see many examples of similarly weighted indexes outperforming their capitalization-weighted opposite numbers.

We impaired a 70/30 mixture of large-cap and small-cap shares for america fairness marketplace, and a 50/50 mixture of 10-year and 20-year Treasuries for the bond marketplace. We think those investments to have complementary, if no longer reverse reactions to marketplace situations, making them ideally suited diversifiers.

We additionally ready for a 3rd situation — essentially the most worrying and regret-inducing — the possibility of intense geopolitical turmoil. When markets develop into unsettled, economies are distressed, and currencies lose a lot in their price. Throughout those instances, buyers flip to actual belongings as a extra retain bind of wealth and liquidity. We created a section of reserves comprising gold and Treasury bonds. Following our naïve diversification means, we break the reserves allocation similarly between bonds and gold.

Determine 1: Remorseful about-managed technique

Comparing the Diversification of the Remorseful about-Controlled Technique Over 95 Years

We discovered that equities, bonds, and reserves have been uncorrelated with every alternative. Inside of reserves, the gold and Treasuries have been additionally uncorrelated to every alternative. Week gold and Treasuries earned the similar go back, their aggregate earned a considerably upper go back.

Desk 1: Correlation of belongings inside regret-managed portfolio

Determine 2: Enlargement of reserves portfolio

Efficiency Effects

Our function used to be to attenuate remorse and the possibility of forsaking the asset allocation. I discovered that the regret-managed portfolio carried out smartly within the context of conventional potency. The portfolio go back is upper than the typical of its elements, and its possibility is just about as little as its lower-volatility reserves.

Desk 2: Returns over 95 years

Determine 3: Potency of regret-managed technique

Remorseful about-Controlled Technique As opposed to Vintage 60-40 Benchmark

The regret-managed technique outperformed the usual 60-40 benchmark (S&P 500 + Mixture bonds) because the benchmark’s inception just about 50 years in the past. This displays that my efforts to attenuate remorse didn’t come at the price of potency. The 60-40 investor additionally skilled larger severity and frequency of remorse.

Determine 4: Remorseful about-managed technique vs 60-40 technique

Quantifying Remorseful about

Step one in measuring remorse is to assign a prohibit to the returns that qualify as regret-inducing.

Perceptions of remorse are distinctive to every consumer, spotting that buyers reply extra strongly to losses than to beneficial properties. Some counsel that the reaction to losses is two times that of similar-sized beneficial properties. We advanced our upside and problem remorse objectives with adverse values at about part the certain goal. Our bottom case units the objectives at -12% and 25%. Any returns past this field are regret-inducing.

The after step is to decide the magnitude and the possibility of upside and problem remorse reviews.

We calculated the typical of the returns exceeding the remorse objectives, at the side of their share prevalence. Those manufacture an anticipated remorse penalty in the similar gadgets as the predicted go back.

We subtract anticipated remorse from anticipated go back to manufacture the regret-adjusted go back.

Remorseful about within the Fairness Portfolio As opposed to the Diverse Portfolio

We analyzed the remorse in our fairness portfolio the usage of our remorse goal field at -12% and 25%. Detrimental-regret returns are in purple, positive-regret returns are in blue, and non-regret returns are inexperienced. Of the 95 annual returns indexed, 55 don’t induce remorse, 30 induce upside remorse, and 10 induce remorse from losses.

Desk 3: Fairness returns color-coded by means of remorse

Remorseful about within the Diverse, Remorseful about-Controlled Technique

The remorse diversification means had most effective 9 regretful returns (5 upside and 4 problem.)

Desk 4: Remorseful about-managed technique returns

Calculating Remorseful about for Our Bottom Case Situation

Our measure of remorse is the predicted price of returns that exceed the buyer’s remorse objectives.

Remorseful about = [Average upside regret return x % Likelihood] + [(Average loss return * -1) x % Likelihood]

Remorseful about is a penalty this is subtracted from the predicted go back. This produces a regret-adjusted go back.

The use of our preliminary remorse goal field of -12% and 25%, we read about the remorse portfolio and its elements. This confirms the robust remorse diversification price of our intuitively primarily based means.

Desk 5: Anticipated remorse effects from 95-year pattern returns of regret-managed technique

Classifying Shoppers by means of Their Propensity for Remorseful about

The extra delicate purchasers are to remorse, the much more likely they’re to enjoy it, and the extra extreme that remorse might be. Top ranges of remorse lead to low regret-adjusted returns and a better probability of forsaking the asset allocation goal.

Managing remorse is in reality an workout in surroundings reasonable go back expectancies with our purchasers.

Corporations often significance questionnaires to assign purchasers to possibility divisions and glued asset allocations. Those have confirmed unsatisfactory, since we often see research appearing consumer private account returns which might be considerably less than the returns at the belongings of their portfolios. Shopper-directed tactical buying and selling that used to be emotionally primarily based and ill-timed is the motive force of those effects.

This failure rests with funding companies asking generalized questions that inspire “middle of the road” responses from purchasers who span numerous possibility and remorse tolerances. Shoppers with hugely other remorse sensitivities are assigned to same methods, well-known to those disappointing effects.

Dialing in Shopper Expectancies

We will have to ask our purchasers questions that target remorse. For instance:

“What size loss feels gut-wrenching, and how often could you stand having this happen?”

“How large a gain would make you feel that you missed out on a once-in-a-lifetime opportunity?”

We will have to provide purchasers with a collection of remorse triggers that shield a collection of remorse tolerances. The use of our bottom case funding technique, we evaluated the remorse results for a collection of remorse tolerances:

Desk 6: Go back triggers and anticipated remorse effects

Our maximum regretful consumer is able to vacate the method if any cash is misplaced and would possibly really feel they overlooked the boat with returns most effective moderately above expectation. The remorse this consumer would enjoy exceeds the method’s anticipated go back, generating a adverse regret-adjusted go back.

The after situation flips the regret-adjusted go back from adverse to certain, as we modify expectancies to a negligible loss that keeps 92% of the portfolio price, and an upside threshold 50% upper than the predicted go back.

The 3rd situation greater than doubles the regret-adjusted go back, moment the fourth situation has even larger receive advantages, reducing remorse by means of greater than part — once more, doubling the regret-adjusted go back. Our latter two eventualities display remorse leveling off, as we achieve the outer levels of terminating returns. Those are essentially the most regret-tolerant purchasers of all.

The primary two purchasers are mistaken for our assorted technique, given their extraordinarily low tolerance for marketplace volatility and remorse. The latter 3 are more likely to maintain their methods and garner the advantages that they be expecting. The center investor will have to be inspired to just accept a moderately wider band of remorse triggers.

Efficiency Attribution of Anticipated Remorseful about

Remorseful about research will also be implemented to any asset technique and to any actively controlled portfolio. The remorse pushed by means of the lively procedure will also be free and analyzed. This remorse method is widely appropriate to each forward-looking asset allocation purposes and backward-looking efficiency analysis.

The results of this means are really extensive, given the shortage of consideration paid to this usual and destructive facet of investor habits.

We advanced an attribution research of the remorse, breaking out the upside as opposed to the disadvantage resources and measuring the magnitude and probability of that remorse.

Desk 7: Contribution to remorse

Desk 8: Decomposition of remorse

The principle motive force of purchasers forsaking their funding technique is the prospect of experiencing remorse.

We summed the chances of problem and upside remorse on this “client diagnostics” document, which specializes in the suitability of every consumer for the funding technique.

Desk 9: Shopper Diagnostics

The primary two purchasers are essentially the most delicate to remorse and are not going to maintain the asset allocation, since they enjoy remorse so often. But it’s most likely that they spoke back maximum possibility questionnaires as “willing to bear a reasonable degree of market volatility.” If that they had been requested whether or not they could be proud of a technique the place they felt remorse in three-out-of-four years, they’d have replied with a “thumbs down.” The similar is correct for the second one consumer for three-out-of-eight years. Remorseful about could also be most effective part as malicious, however it’s nonetheless a remorse frequency that many would instead steer clear of.

The 3rd i’m ready of remorse triggers (-10% and +20%) is the place sustainability of the method starts. This probability of experiencing remorse is reasonable and manageable. Past this i’m ready of remorse triggers, the possibility of remorse is going from occasional to uncommon.

The Remorseful about Ratio

For efficiency analysis, we suggest a Remorseful about Ratio that evaluates the regret-adjusted praise as opposed to its regret-related go back volatility. Said merely:

Remorseful about Ratio = Remorseful about-adjusted go back / Remorseful about Volatility

the place:

- Remorseful about-adjusted Go back = Go back minus Remorseful about Penalty

- Remorseful about Volatility = Same old Bypass of regretful returns

This statistic is same to the Sortino Ratio as it specializes in contextual possibility rather of general go back variability.

Desk 10: Remorseful about ratio effects

Remorseful about Research as a Efficiency Analysis Instrument

Buyers are much more likely to fulfill their expectancies in the event that they maintain their asset allocation technique throughout marketplace cycles. This calls for bearing non permanent marketplace volatility and rebalancing their portfolios periodically. This self-discipline will also be undone by means of emotionally primarily based buying and selling this is pushed by means of consumer remorse later incurring losses or lacking out on robust beneficial properties. We will have to discourage this technique abandonment.

One good thing about this means is a collection of cheap results that an funding supervisor can significance to start up a practical dialog with purchasers about their expectancies.

As a efficiency analysis software, remorse research relates purchasers’ views to the result of their funding portfolios. It may well additionally evaluation the resources of remorse, keeping apart the asset allocation resolution from the portfolio’s lively effects. A efficiency document at the remorse inside an asset allocation and its lively implementation is a brandnew route for the efficiency analysis business.

For those who favored this publish, don’t put out of your mind to subscribe to Enterprising Investor and the CFA Institute Analysis and Coverage Heart.

All posts are the opinion of the writer. As such, they will have to no longer be construed as funding recommendation, nor do the evaluations expressed essentially mirror the perspectives of CFA Institute or the writer’s employer.

Symbol credit score: ©Getty Photographs / Rudenkoi

Skilled Finding out for CFA Institute Participants

CFA Institute contributors are empowered to self-determine and self-report skilled studying (PL) credit earned, together with content material on Enterprising Investor. Participants can report credit simply the usage of their on-line PL tracker.