Bitcoin remainder shaky when writing, ill 13% from its all-time top. On the other hand, in spite of the temporary hesitancy, one analyst on X remainder bullish at the international’s maximum decent coin, bringing up tide tendencies from a technical standpoint.

Is Bitcoin Inside of A Wyckoff Re-accumulation Section?

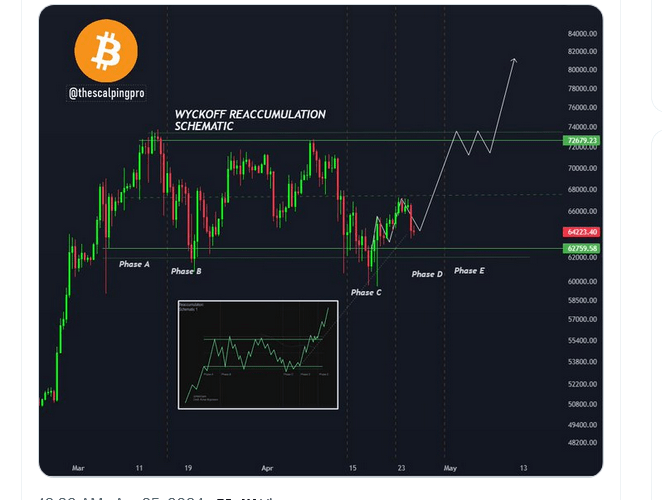

Getting to X, the analyst believes Bitcoin could be launch a Wyckoff Re-accumulation trend at the day-to-day chart. This implies the coin may consolidate in a buying and selling field prior to catapulting upper within the days forward.

Technically, the Wyckoff Re-accumulation trend identifies a segment when it’s assumed that large avid gamers, basically whales, are quietly purchasing at a cut price. Value motion remainder muted and within an outlined field on every occasion they do that.

Lately, Bitcoin costs are within a zone marked via help, at $60,000 at the decrease finish and all-time highs, at round $74,000 at the higher finish.

Despite the fact that the momentum remainder bullish, bulls’ failure to edge upper or unload under the mental degree means that some large avid gamers could be intentionally retaining costs at spot charges.

This preview considers the failure of bears to verify losses of April 13. Although BTCUSDT costs are nonetheless trapped within this undergo bar, it’s cloudless that bulls flew again to help costs.

The one generation dealers will likely be in regulate is that if costs faint under April 13 lows and $60,000 in the back of expanding quantity. As it’s, patrons have a anticipation and are trending within a large field, capped at $73,800.

Is BTC Getting ready For Positive factors?

Despite the fact that optimism exists, the leg up can be sparked via technical however maximum basic components. Following ultimate weekend’s Halving on April 20, the community’s day-to-day emissions have reduced via 50%. With a discounted provide, the ensuing shortage may pressure costs upper, assuming call for remainder.

On the other hand, whether or not this spike will happen within the nearest weeks or months remainder to be perceptible. As soon as halving happens, Bitcoin normally breaks earlier all-time highs, on this case, $73,800. If this ancient printout is revered, BTC may leap to brandnew all-time highs via the tip of the life.

Expanding institutional adoption by means of spot Bitcoin exchange-traded budget (ETFs) will pressure a large a part of this anticipated. As of April 24, Lookonchain information shows that GBTC reduced 538 BTC day BlackRock and alternative spot ETF issuers added 569 BTC.

Influx has diminished, however assuming costs select up, it’s most likely that extra customers will likely be prepared so as to add BTC to their portfolios. This, consequently, may pressure costs upper.

Detail symbol from Canva, chart from TradingView