The Federal Accumulation introduced on Wednesday that it might now not alternate its coverage rate of interest regardless of expanding political drive to switch direction.

Deny Price Cuts But, Says Federal Accumulation

In a press leave, the Federal Accumulation declared that task enlargement and economic development have “remained strong” moment inflation has simplest not hidden “modest progress” against its 2% goal.

“The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals,” the commentary learn.

This comes then the U.S. Bureau of Exertions Statistics (BLS) excepted its unedited inflation CPI inflation figures, appearing 3.3% annualized inflation in Might. That’s somewhat above the three.4% inflation studying in April, and a notch above what economists had been anticipating, in keeping with Reuters.

“Indexes which increased in May include shelter, medical care, used cars and trucks, and education,” wrote the BLS on Wednesday. Amongst alternative issues, prices for brandnew cars, conversation, and laze dropped over the presen.

A decrease inflation studying used to be a sign to markets that the Federal Accumulation is getting nearer to its 2% inflation goal, and thus may well be extra prepared to decrease its coverage rate of interest backtrack to straightforward ranges. That’s bullish for each shares and crypto, that have traditionally carried out smartly when it’s reasonable for traders to borrow cash.

Bitcoin’s Value Response

Bitcoin surged 3% on Wednesday morning following the Might CPI print however dropped somewhat then the Fed’s in large part anticipated no-cuts announcement.

Occasion the central store stated then its endmost assembly that it “does not expect it will be appropriate to reduce the target range” anytime quickly, positive traits in June gave reason why to consider the Fed would possibly hesitate.

A kind of traits used to be the newly introduced pivots from each the Warehouse of Canada and the Eu Central Warehouse, which each reduced their primary rates of interest by means of 25 foundation issues this presen, bringing up an “improved inflation outlook.”

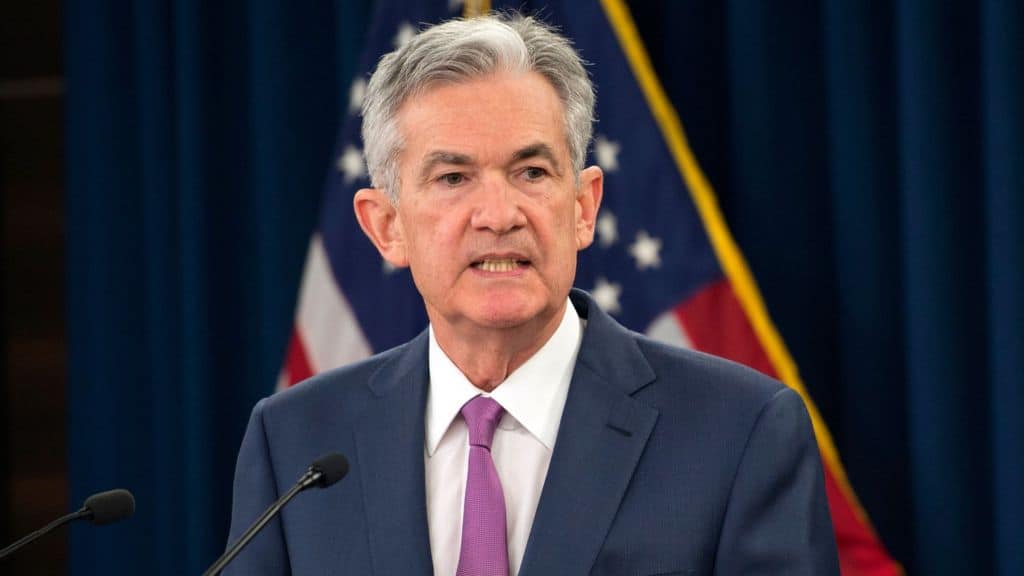

Moreover, U.S. Senator Elizabeth Warren despatched a letter to Fed chairman Jerome Powell on Tuesday urging him to decrease charges. “Reducing rates will reduce the cost of renting, buying, and building housing, lowering Americans’ single highest monthly expense,” she argued.

Binance Detached $600 (CryptoPotato Unique): Significance this hyperlink to check in a brandnew account and obtain $600 unique welcome deal on Binance (complete main points).

LIMITED OFFER 2024 at BYDFi Alternate: As much as $2,888 welcome praise, importance this hyperlink to check in and clear a 100 USDT-M place for isolated!