International banking gigantic Same old Chartered is coming into the crypto area with a untouched spot buying and selling table for Bitcoin and Ethereum, as noticeable in a Bloomberg record. This construction positions Same old Chartered as one of the most first main international banks to interact at once within the buying and selling of the underlying crypto belongings, an branch that has distinguishable wary participation from main international banks basically because of stringent regulatory parks.

Same old Chartered Will Trade in Bitcoin And Ethereum

The newly established buying and selling table is built-in throughout the cupboard’s foreign currencies (FX) buying and selling unit and is strategically situated in London, an international monetary hub, resources with wisdom of the status reported. This operation is about to start out imminently, making Same old Chartered one of the most first main international banks to facilitate spot buying and selling on unedited Bitcoin and Ether belongings, diverging from the extra usually traded crypto derivatives.

The verdict to creation a place crypto buying and selling table stems from a meticulous length of making plans and regulatory consultations. “We have been working closely with our regulators to support demand from our institutional clients to trade Bitcoin and Ethereum, in line with our strategy to support clients across the wider digital asset ecosystem, from access and custody to tokenization and interoperability,” the cupboard conveyed via an respectable commentary.

This initiative isn’t Same old Chartered’s first foray into the virtual belongings area. The cupboard has actively participated within the cryptocurrency sector via important investments in similar infrastructures, akin to Zodia Custody and Zodia Markets, which grant products and services starting from virtual asset custody to classy over the counter buying and selling answers.

Additional increasing its blockchain endeavors, Same old Chartered introduced Libeara, a devoted blockchain unit aimed toward helping establishments in tokenizing conventional belongings. Significantly, this comprises an leading edge venture for the inauguration of a tokenized govt bond treasure denominated in Singaporean bucks, demonstrating the cupboard’s loyalty to integrating blockchain generation with typical monetary tools.

Past the operational main points of the buying and selling table, the cupboard’s engagement with the crypto marketplace could also be mirrored in its marketplace research and forecasts. Not too long ago, Same old Chartered’s analysts, together with Geoffrey Kendrick who leads rising markets analysis, issued a strikingly constructive prediction for Bitcoin’s worth trajectory, specifically within the context of the next US presidential elections.

“As we approach the US election, I expect $100,000 to be reached and then $150,000 by year-end in the case of a Trump victory,” Kendrick said, suggesting that political results may just considerably affect marketplace dynamics.

In the long run, Kendrick envisions Bitcoin achieving as prime as $200,000 by way of the top of 2025, pushed by way of tough and steady funding inflows into newly introduced Bitcoin spot ETFs, which he believes will draw in sustained pension-type investments.

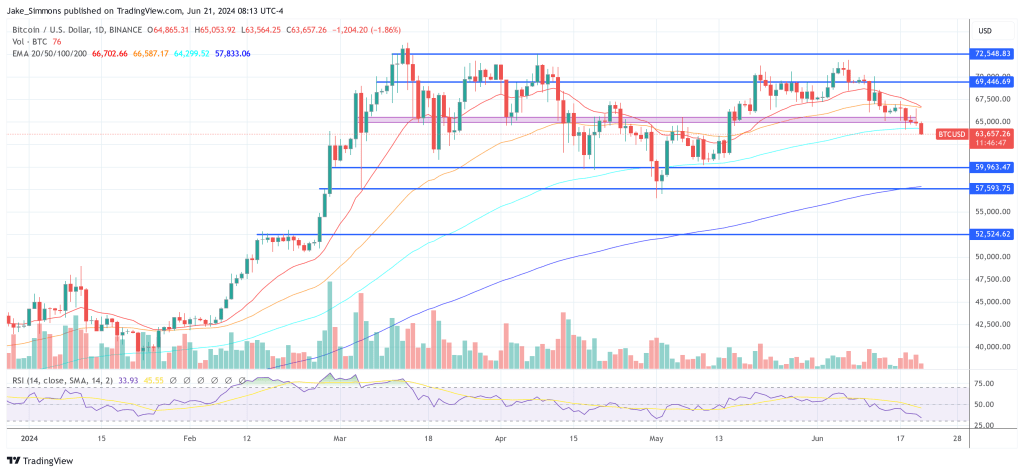

At press hour, BTC traded at $63,657.

Featured symbol from X @BTC_Archive, chart from TradingView.com