Unencumber the Writer’s Digest for distant

Roula Khalaf, Writer of the FT, selects her favorite tales on this weekly e-newsletter.

From the bakery aisle to the dairy case, and the beef counter to the ice cream freezer, surging inflation for groceries has caused an surprising truth: American citizens are purchasing much less meals on the shop.

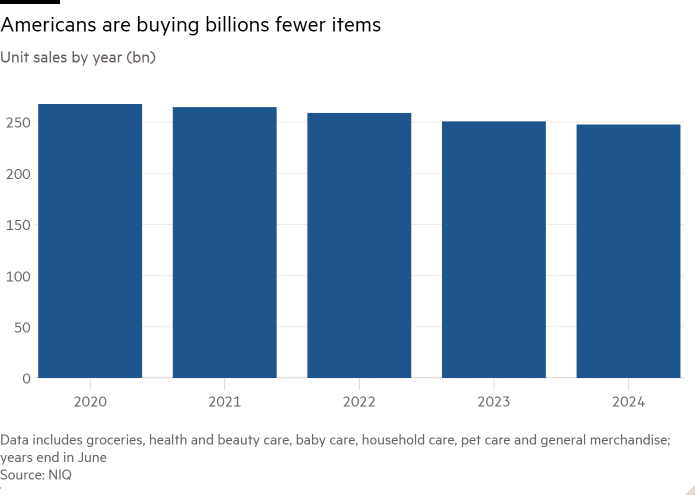

Customers have put billions fewer pieces of their grocery carts within the future few years when compared with pre-pandemic ranges, resorting rather to a mix of on-line purchases, bulk purchasing — and easily eating much less, particularly in lower-income families. They’re doing so in accordance with costs that experience jumped for meals, but additionally alternative necessities comparable to housing and insurance coverage that experience taken a chunk out in their wallets.

Manufacturers of client packaged items had been in a position to spice up earnings by means of elevating costs right through the run of top inflation lately. However now, whilst costs have moderated, outlets and manufacturers are speeding to reinvigorate gross sales volumes with markdowns and promotions.

“Increased prices mean smaller basket sizes, and more consumers seeking to eliminate products they deem non-essential,” analysis company NielsenIQ mentioned in a up to date research of gross sales of perishable items.

Shoppers had been smartly conscious about meals inflation at a Key Meals grocery in Brooklyn, Untouched York, visited by means of the Monetary Occasions this while. Cabinets of goods, together with tomato sauce, pasta and frozen shrimp, bore labels promoting value offer.

“It’s more expensive than it used to be,” mentioned Mezjine Dorvil, a consumer on the shop.

The USA discards up to 40 in step with cent of its meals provide every future, greater than any alternative nation, in step with Feeding The usa, a national meals depot community. The acquisition of fewer pieces — two baggage of tortilla chips rather of 3, one pint of ice cream rather of 2 — may modestly drop that misspend.

Adjusted for inflation, American citizens on reasonable spent 3.1 in step with cent much less on meals at house in 2023 than in 2022, in step with Wilson Sinclair, an economist at america Branch of Agriculture. Checkout terminals at US shops scanned 248bn pieces within the future one year, ill 3bn from the prior future and 20bn fewer than the future eminent as much as June 2020, in step with NielsenIQ knowledge.

The declines have put power on outlets and their distributors to deal reductions. Year consumers are visiting shops extra frequently, they’re buying fewer pieces in step with commute, analysts say.

Goal, with just about 2,000 US shops, introduced value cuts on 5,000 pieces in June, together with groceries comparable to milk, meat, bread, espresso and fruit and veggies. Christina Hennington, Goal’s leading expansion officer, informed analysts on an profits name extreme generation that the corporate used to be reducing costs to get customers again available for purchase and power gross sales volumes again up.

Kroger, the most important US grocery store operator by means of earnings, this while mentioned its personnel aimed to go back to unit quantity gross sales expansion. Providers had been providing more cash for in-store promotions and reductions than within the future, leading government Rodney McMullen informed analysts upcoming the corporate reported vulnerable same-store gross sales expansion of 0.5 in step with cent.

Walmart has mentioned it’s providing so-called rollbacks on costs for approximately 7,000 merchandise, 50 in step with cent greater than a future in the past within the grocery division. “We think that we’re appropriately investing in this area of our business to help drive unit volume,” John Rainey, leading monetary officer, mentioned at an business convention this generation.

A central authority value index for meals eaten at house used to be 1 in step with cent upper in Would possibly from a future earlier than, lower than a 3rd of the headline inflation fee of three.3 in step with cent. However in 2022, meals costs had been galloping forward at a median annual fee of greater than 10 in step with cent, day the inside track used to be filled with tales of “shrinkflation”: smaller programs bought on the similar or upper costs.

The surge in meals inflation early in President Joe Biden’s time period has been attacked by means of Donald Trump on this future’s election marketing campaign. This while, Biden’s Council of Financial Advisers printed a weblog submit pronouncing that day costs are upper, client buying energy has additionally larger.

“Because wage growth has outpaced grocery price growth, it takes slightly less work to purchase a bag of groceries relative to a year ago,” the council mentioned.

Even though some meals purchases have shifted to alternative venues, they don’t absolutely account for the lessen in meals gross sales at shops.

Spending at eating places is on the lowest stage in seven months, and buyer visits were declining for 13 consecutive months, in step with the Nationwide Eating place Affiliation. Even though on-line grocers and bargain shops have made beneficial properties, they had been outweighed by means of the amount declines at conventional meals shops, McKinsey discovered. The consultancy additionally concluded the growth in weight-loss prescription drugs has had restricted have an effect on on meals outlets.

Greater than three-quarters of customers cited costs because the lead explanation why they’re buying fewer grocery pieces, in step with a McKinsey survey printed previous this future.

“You can’t keep raising prices . . . and not expect an impact,” mentioned Nick Fereday, a meals analyst at Rabobank.