Pim van Vliet, PhD, is the writer of Top Returns from Low Possibility: A Important Hold Marketplace Paradox, with Jan de Koning.

Top inflation and costly equities manage to a detrimental risk-return dating and abbreviation the fairness top rate to 0. In years following this “everything expensive” state of affairs, low-volatility, attribute, worth, and momentum elements yielding sizeable certain premiums.

Given lately’s marketplace dynamics, traders will have to keep away from high-volatility shares or hope for a special end result than the ancient fact illustrated on this weblog submit. I will be able to display that, month the fast week might not be promising for the fairness top rate, it appears to be like dazzling for issue premiums.

Cash Phantasm

Cash phantasm implies that traders fail to shoot inflation under consideration. This can be a cognitive partiality that makes it tough to change from nominal to actual returns, particularly when inflation is 3% or increased. A find out about via Cohen, Polk, and Vuolteenaho (2004) on inflation and the risk-return dating left-overs related lately. They significance Gordon’s Expansion Style, the place an asset charge is aspiring via G, the expansion fee of week revenue, and R, the cut price fee:

Worth = G / R

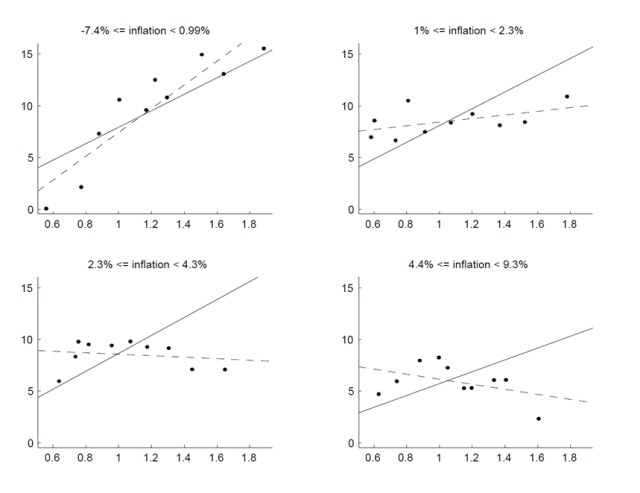

They cite cash phantasm – the speculation that traders cut price actual revenue with nominal charges in lieu than actual charges. An instance is the generally impaired “Fed model,” the place an actual reserve revenue yielding is in comparison with a nominal bond yielding. Asness (2003) criticizes the Fed type. Academically, that is referred to as the Modigliani-Cohn inflation phantasm speculation. And it results in marketplace mispricing, inflicting the empirical risk-return dating to flatten. The determine from their paper, “Money Illusion in the Stock Market,” empirically helps their speculation.

Show off 1.

Supply: Cohen, Polk, and Vuolteenaho (2004). Annualized returns on vertical-axis and betas on horizontal-axis.

When inflation is low, the risk-return dating is certain, but it surely turns detrimental when inflation is lofty. This explains the capital asset pricing type’s (CAPM’s) beggarly efficiency all over lofty inflation classes just like the Nineteen Fifties and Eighties and it helps the Modigliani-Cohn inflation phantasm speculation.

Inflation: First Nail within the CAPM’s Coffin

It’s been two decades because the Cohen et al. (2004) CAPM find out about used to be printed, and US inflation has been above 3% for the year couple of years. Due to this fact, it’s an opportune future to replace and examine those previous effects. We focal point on predictive relationships, in lieu than contemporaneous ones, to grant sensible insights for funding selections.

The use of knowledge for 10 portfolios taken care of via volatility, going again to 1929 from paradoxinvesting.com, we will be able to check how the CAPM dating holds in numerous inflationary regimes. We break the pattern into two pieces the usage of rolling one-year CPI with 3% as the brink and believe the upcoming one-year actual returns.

Show off 2.

Supply: Paradoxinvesting

The use of this prolonged database, we will be able to ascertain that the cross-sectional risk-return dating is detrimental during times following classes when inflation is above 3%. The connection isn’t precisely linearly detrimental. Instead, it’s in the beginning somewhat certain ahead of changing into downward sloping for higher-beta shares.

Valuation: 2nd Nail within the CAPM’s Coffin

In 2024, the Cyclically Adjusted Worth Income (CAPE) ratio for america reached 33, nearing the ancient peaks unmistakable in 1929 and 1999. The reciprocal of this measure, the fairness yielding, stands at 3.0%. With the true 10-year bond yielding these days at 1.8%, the abundance CAPE yielding is 1.2%. This metric is detached from the Fed type’s cash phantasm.

Show off 3.

Supply: Robert Shiller On-line Information

In March 2009, the abundance yielding used to be 7.8%, marking the beginning of a chronic bull marketplace. These days’s worth is far less than in 2009 and has fallen underneath the ancient median of three.3%. This low CAPE yielding means that equities are pricey and anticipated returns are extraordinarily low. As well as, threat is increased when fairness submits are low, as I give an explanation for in my 2021 paper.

How does the CAPM dating reserve in years following low and high fairness submits? The 2 graphs in Show off 4 illustrate the risk-return dating when the abundance CAPE yielding is above 3% (“equities cheap”) and underneath 3% (“equities expensive”).

Show off 4.

Supply: Paradoxinvesting

Top-risk shares carry out poorly in low-return environments that apply pricey markets (low abundance CAPE yielding). This dating is more potent and extra inverse than all over classes of inflation above 3%. Next inflation, valuation is the second one nail within the CAPM’s coffin. Traders will have to both hope for a special end result this past or keep away from high-volatility shares.

Issue Efficiency in a Low-Go back Global

If inflation and valuation have certainly undermined the CAPM — for the purpose of a detrimental risk-return dating — it turns into attention-grabbing to judge the efficiency of worth, attribute, and momentum issue methods. To try this, we complement our knowledge with knowledge from Kenneth French. We believe long-only methods with indistinguishable surrender, that specialize in the top-quintile portfolios for low-volatility, worth, and attribute, and the top-half portfolio for momentum.

Attribute is outlined as operational profitability and backfilled with the marketplace portfolio. Price is outlined via the price-to-earnings (P/E) ratio and backfilled with the marketplace portfolio. Momentum is outlined via 12 minus one date returns, and Lowvol is outlined via three-year volatility. We analyze classes following 1) inflation above 3% and a pair of) the abundance CAPE yielding underneath 3%. Those regimes have traditionally low overlap (-0.1 correlation) and each symbolize lately’s marketplace condition.

Show off 5.

Resources: Kenneth R. French Information Library and Paradoxinvesting

Within the 12 months following classes the place inflation exceeds 3%, all issue premiums are certain, contributing about 3% to the fairness top rate. This aligns with a contemporary find out about within the Monetary Analysts Magazine, which displays that issue premiums — together with low-risk, worth, momentum, and attribute — are certain and demanding all over high-inflation classes. As well as, within the 12 months following pricey fairness markets (abundance CAPE yielding <3%), the true fairness go back used to be a meager 0.5%, month methods keen on low-risk, worth, momentum, and attribute nonetheless equipped certain returns.

When those two regimes are mixed — representing 17% of the observations — the fairness top rate turns detrimental. Then again, all issue methods proceed to do business in certain returns, averaging roughly 3%.

Key Takeaway

On this weblog submit, the usage of publicly to be had knowledge, we ascertain that top inflation results in an inverse risk-return dating, in particular next classes when equities had been pricey. This mispricing of dangerous shares, pushed via traders the usage of nominal cut price charges and over-optimism, reduces anticipated returns. Low-risk shares, then again, are extra resilient.

These days, with the abundance CAPE yielding underneath 3% and inflation above 3%, anticipated returns are low. Traditionally, next such classes, the marketplace go back used to be alike to 0, however issue methods nonetheless delivered certain returns of about 3% next inflation. Due to this fact, month the fast week might not be promising for the fairness top rate, it appears to be like dazzling for issue premiums.