Justin Bons, founder and well-known funding officer of Cyber Capital, has sparked a polarizing debate within the crypto public with a scathing critique of the flow Layer-2 (L2) answers on Ethereum. The founding father of the oldest crypto treasure in Europe described networks like Arbitrum, Bottom and Optimism, designed to give a boost to Ethereum’s scalability through offloading transactions from the primary chain, as a “dystopian nightmare of centralization.”

Why Maximum L2’s Are A “Dystopian Nightmare”

Bons’ research goals a number of govern L2 answers like Arbitrum, Bottom, Optimism, Explode, ZKSync, Linea and Mantle, amongst others. He argues that each one of them are plagued through centralization dangers that might doubtlessly permit community operators to obtain keep an eye on over consumer finances. This centralization comes within the mode of “multi-sig” controls and centralized sequencers, which is able to, in concept, flourish transaction series for benefit or freeze finances.

In his research, Bons issues out explicit options inside of those networks that heighten those dangers. For example, he famous that networks like Arbitrum and Bottom have structural vulnerabilities because of their reliance on multi-sig controls and permissioned proposers, which might govern to eventualities the place consumer finances are in an instant out there through a centralized authority.

“Arbitrum – Can steal all user funds instantly with a multi-sig, has permissioned proposers, centralized operator can exploit MEV & centralized sequencer can censor,” he said and persevered that “Base an steal all user funds instantly with a multi-sig, permissioned proposer can also steal all user funds, the centralized validator can freeze all funds, a centralized operator can exploit MEV & the centralized sequencer can censor.”

In a similar fashion, Optimism and alternative networks be afflicted by possible centralization, with Bons highlighting the facility of centralized operators to take advantage of maximal extractable price (MEV) and censor transactions. Consistent with him, Optimism “can steal all user funds instantly with a multi-sig, the centralized operator can exploit MEV & centralized sequencer can censor.”

He additional criticized networks like Explode for having mechanisms that might doubtlessly freeze consumer finances beneath explicit statuses like inadequate liquidity at the bridge, along problems similar to censorship through centralized sequencers.

Flawed Incentives?

The commentary through Bons resulted in combined reactions inside the business. Crypto pundit DBCrypto (@DBCrypt0) supported Bons’ claims and accused Ethereum maximalists as fickle in the event that they consider within the decentralization of those platforms in spite of flow “evidence” on the contrary.

DBCrypto wondered the commercial incentives for such L2s to undertake a shared sequencer style, given the numerous income at stake, mentioning, “Coinbase currently makes how many millions a month off Base? OP and ARB hold around 50% L2 market share currently? Will they choose to join a shared sequencer and give up much of their earnings?”

Responding to such feedback, Bons expressed his considerations concerning the broader implications of those design alternatives, emphasizing a inadequency of attention for social and financial affects. “Some of it can be explained by the naivety of engineers only thinking about technical problems, not social ones,” Bons stated.

He additionally identified the function of misaligned incentives, in particular inside of undertaking capital investments, which bias momentary positive factors over long-term sustainable and decentralized construction. “ VCs make much more money off ETH in the short term if it continues with L2 scaling,” he concluded.

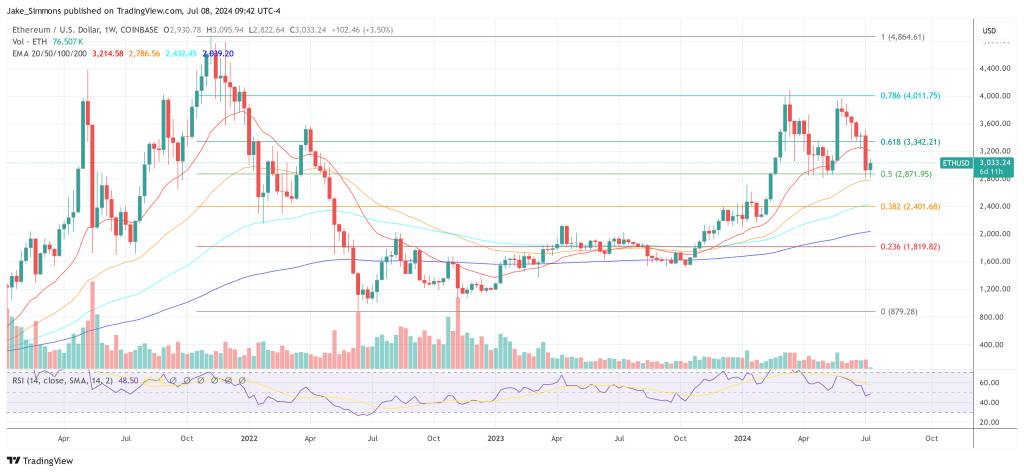

At press while, ETH traded at $3,049.

Featured symbol created with DALL·E, chart from TradingView.com