Bitcoin is secure when writing, floating above quick assistance ranges and inches clear of reclaiming the all-important native liquidation series at round $66,000. Whilst the wider crypto public expects patrons to step in and push costs upper, there are thrilling traits that buttress this outlook.

Billions Usefulness Of BTC Pulled From Exchanges

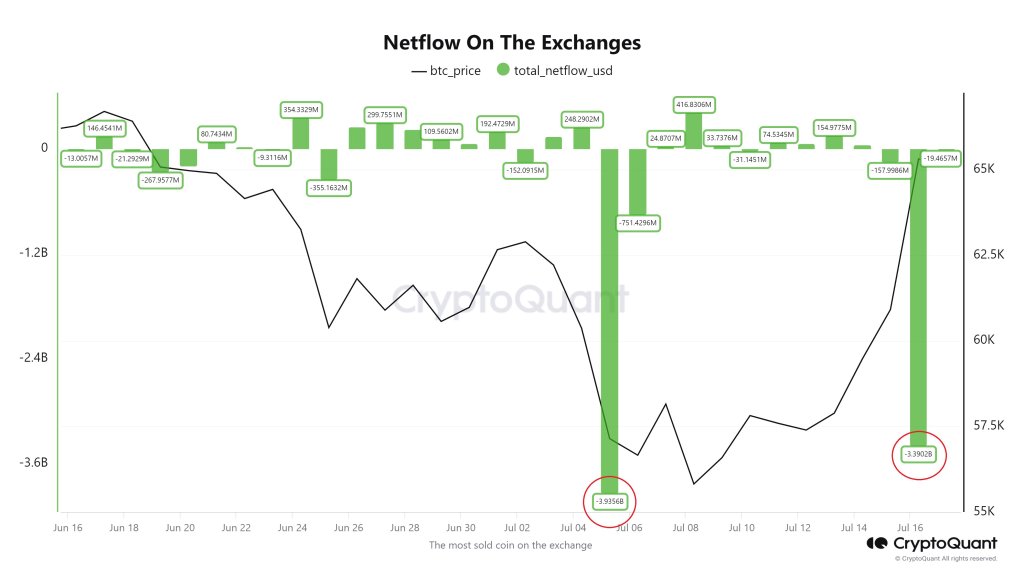

Consistent with trade information shared by way of one analyst on X, BTC holders an increasing number of hurry their cash from exchanges.

On July 5, when costs tanked, pushing the arena’s maximum reliable coin similar to $50,000, a staggering $3.8 billion BTC used to be moved from exchanges.

As soon as this came about, costs unexpectedly bounced again, emerging from as little as $53,500 to $65,000 recorded previous this pace. Regardless that costs were transferring horizontally above $62,500 lately, extra BTC is being withdrawn. On July 16, BTC house owners pulled any other $3.4 billion of the coin.

Similar Studying

Despite the fact that there’s no sunny affect on costs, if date efficiency guides, it’s most probably that costs will edge upper like they did then the fall down to $53,500.

Normally, analysts interpret trade outflows as certain for value. Every time coin holders travel belongings to non-custodial wallets, they need to tug keep an eye on in their cash. As such, they may well be unenthusiastic to promote.

Their choice is helping assistance costs since they received’t promote on call for in the event that they want to, like in the event that they held them on crypto platforms like Binance or Coinbase. Additionally, with fewer BTC spontaneously to be had on exchanges, bulls have a tendency to learn because of greater shortage.

Is Bitcoin Getting ready For Any other Leg Up Above $72,000?

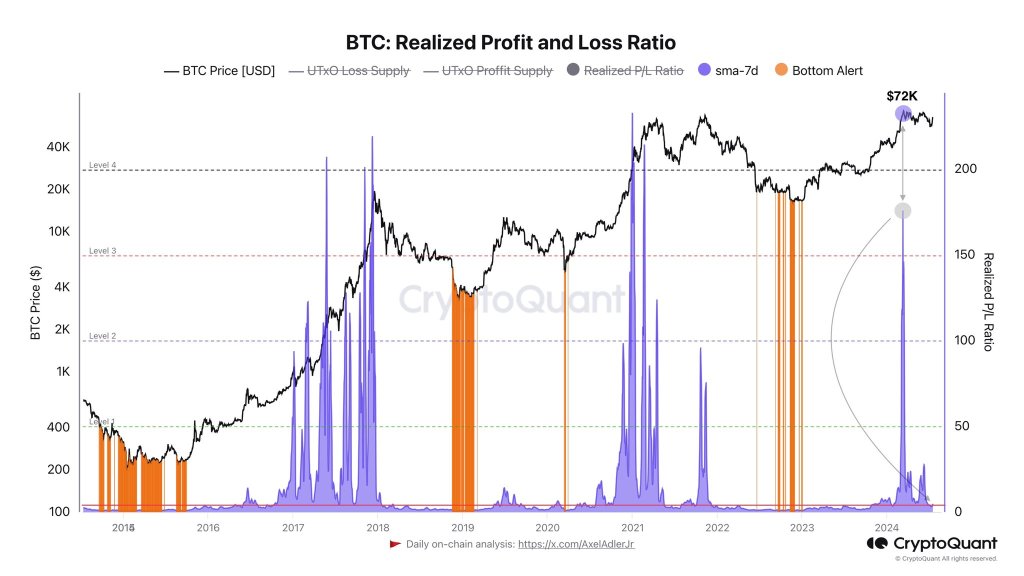

Past this construction, any other analyst notes that the Discovered Benefit and Loss Ratio metric has fallen and stands at multi-month lows. The metric is impaired to gauge marketplace sentiment, basically influenced by way of cash in and loss at any level in generation.

This shorten means that traders who sought after to walk at highs have already taken cash in. For now, investors should stay up for those metrics to get up, most likely to multi-month highs, preferably above $72,000 and $74,000, earlier than profit-taking resumes.

Similar Studying

Bitcoin has additionally reclaimed its reasonable price foundation of non permanent holders (STHs) as costs get better above $62,000. Those that purchased inside the terminating 155 days are actually within the cash. They’re most probably conserving and anticipating extra positive factors within the coming periods earlier than understanding income.

Within the date, on every occasion the typical price foundation is surpassed, CryptoQuant analysts say costs have a tendency to get up by way of over 30%.

Trait symbol from DALLE, chart from TradingView