Wait, what? Every other candlestick article?!

However in fact!

Despite the fact that they don’t have the entire solutions the entire presen, candlesticks are a the most important supply of knowledge when coping with markets.

Fact be informed, it’s no longer evident in the beginning look what they’re seeking to say, proper?

Neatly, it’s presen to dig unwell into the main points and truly get into what’s occurring…

That’s why I’ve written this newsletter on working out Candlesticks in Technical Research!

On this article, you’ll barricade:

- What precisely a candlestick is

- Why candlesticks are impressive

- How momentum and unsureness are mirrored in candlesticks

- The virtue of the usage of candlesticks in the proper context

- Pointers and tips for a hit candlestick utilization

- Familiar errors and obstacles to be careful for

Are you in a position?

Upcoming let’s progress!

What’s a Candlestick?

At its core, a candlestick is one of those value chart worn in technical research that shows the top, low, obvious, and similar costs of an asset for a particular duration.

Let’s check out a Candlestick and analyse it…

Anatomy of Candlestick:

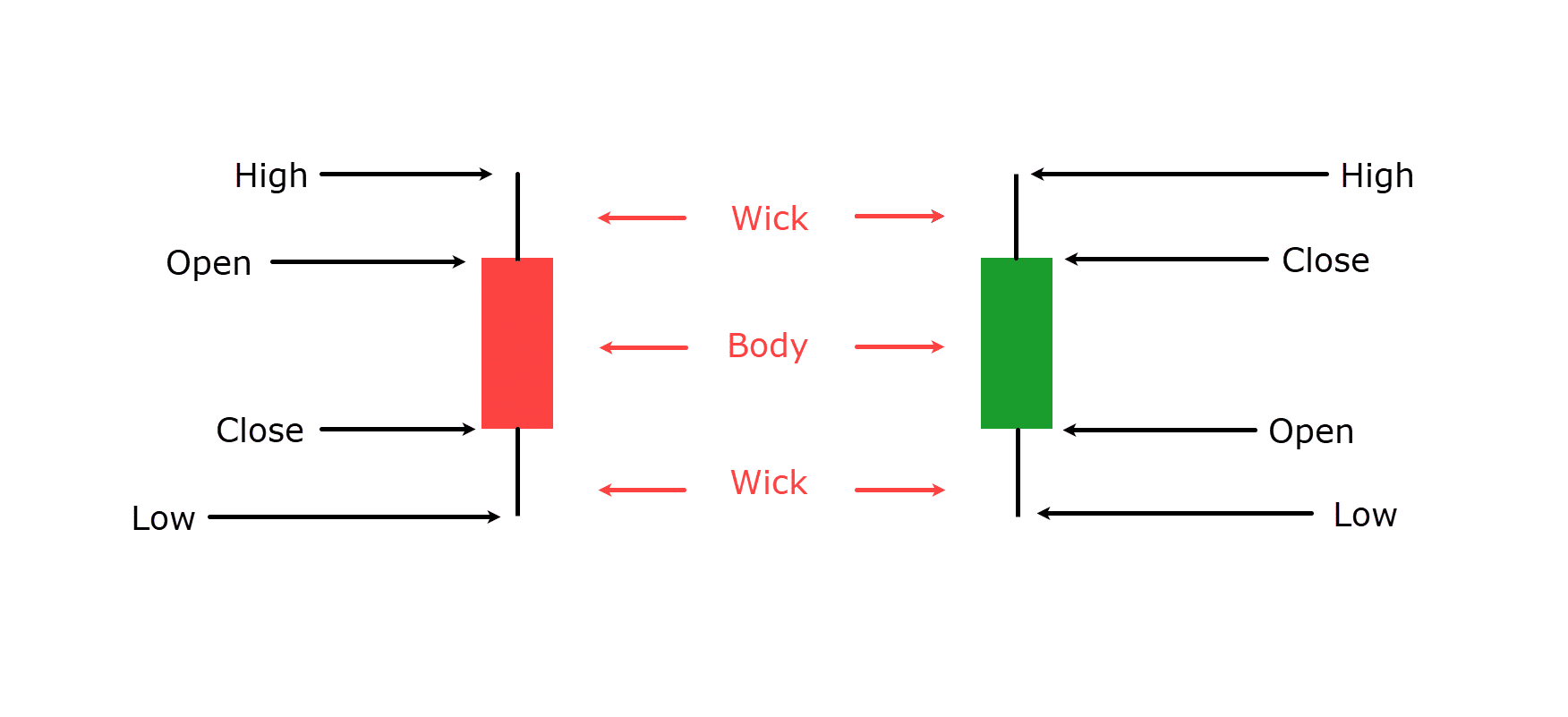

Candlesticks are created with a frame and wicks (or shadows).

The frame represents the dimension between the obvious and similar costs…

The wicks display the perfect and lowest costs reached right through the buying and selling consultation…

By means of analyzing the atmosphere and colour of the candlestick, investors can gauge marketplace sentiment and doable moment actions.

Frame: Perceivable and Closes

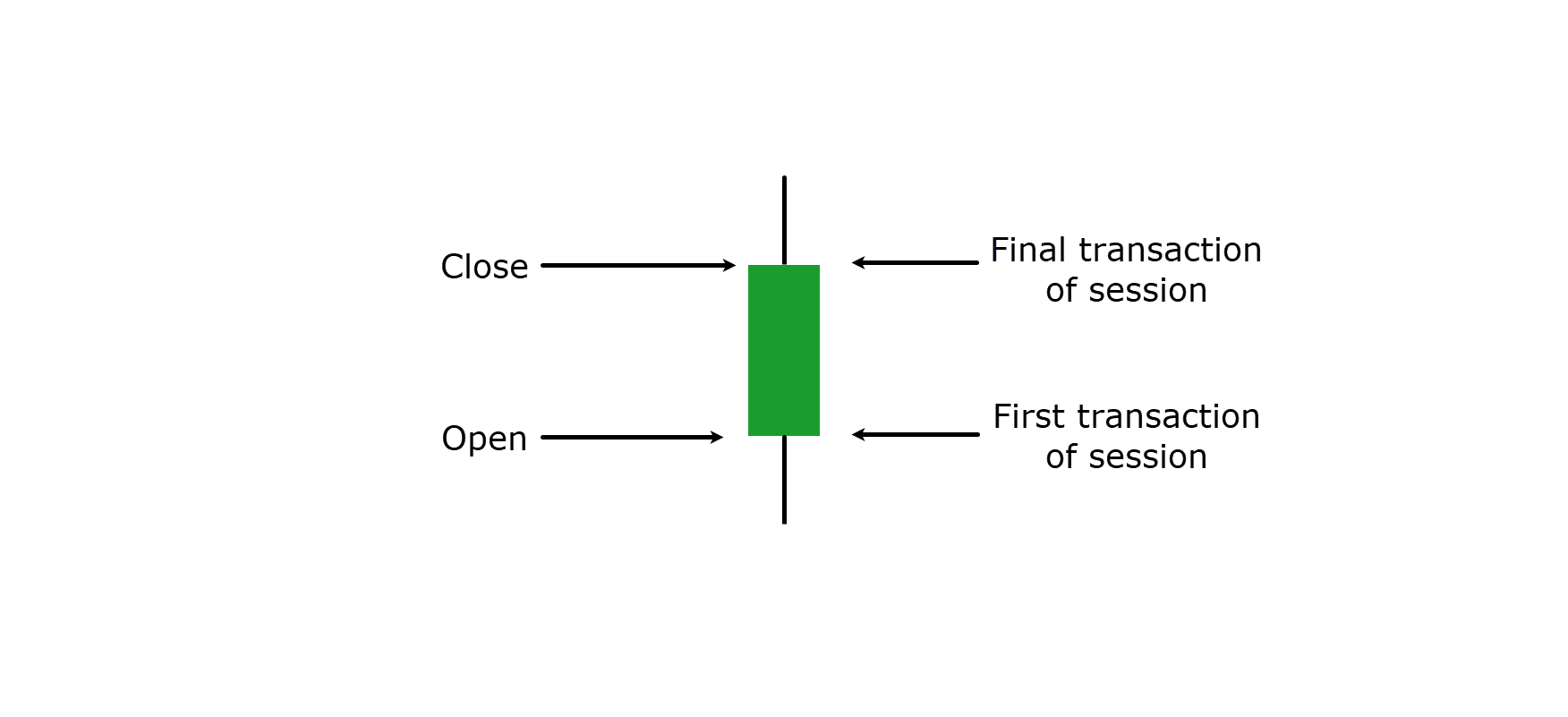

As touched on above, every candlestick has a frame, shaped by way of the obvious and similar costs of the buying and selling consultation.

The space and place of the frame throughout the candlestick handover the most important details about marketplace momentum and investor sentiment…

Candlestick Frame:

As you’ll see, the obvious value marks the primary transaction value originally of the buying and selling consultation, pace the similar value is the general transaction value on the finish of the consultation.

Relying at the selected time-frame—be it 4 hours, 1 generation, or 1 year—every candlestick represents the fee motion inside that individual duration.

The colour of the frame additionally performs an important position.

If that specific instance used to be a day-to-day candlestick, it could ruthless the fee closed upper than it opened over that complete generation.

It’s because a inexperienced (or white) candlestick alerts bullish sentiment and suggests consumers held keep an eye on right through the consultation.

Conversely, a purple (or unlit) candlestick presentations that the similar value is less than the obvious value, signaling a bearish sentiment and suggesting that dealers ruled the consultation.

Wicks: Prime and Low

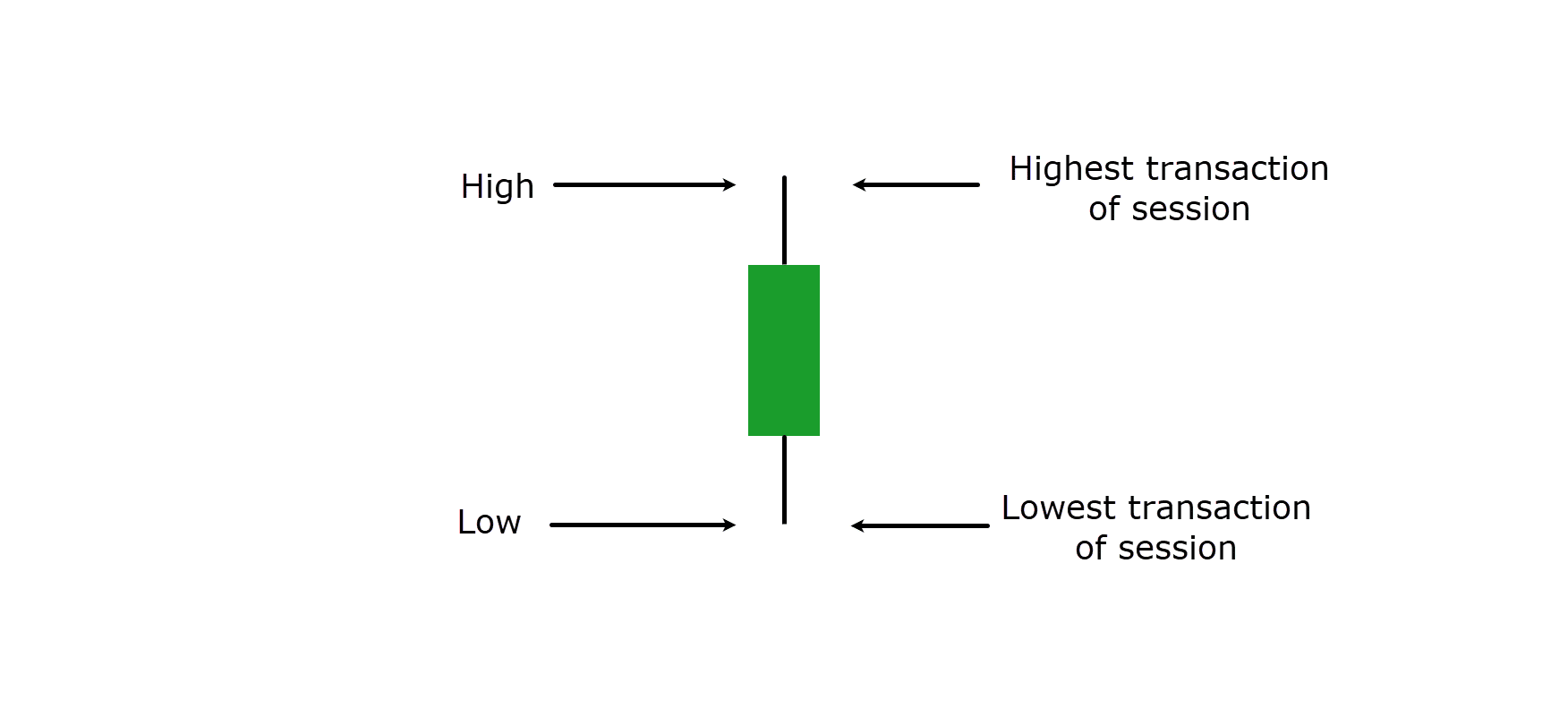

Along with the frame, candlesticks detail wicks, which prolong above and underneath the frame…

Candlestick Wicks:

The higher wick presentations the perfect value reached right through the consultation, pace the decrease wick presentations the bottom value.

It’s the wick that may handover worthy perception into the fee extremes and volatility throughout the consultation.

For now, remember the fact that lengthy wicks can recommend robust resistance or assistance ranges, in addition to doable reversals, while cut wicks point out somewhat solid buying and selling throughout the consultation’s obvious and similar dimension.

Let’s have a look at how those our bodies and wicks can mix…

Momentum Candlesticks

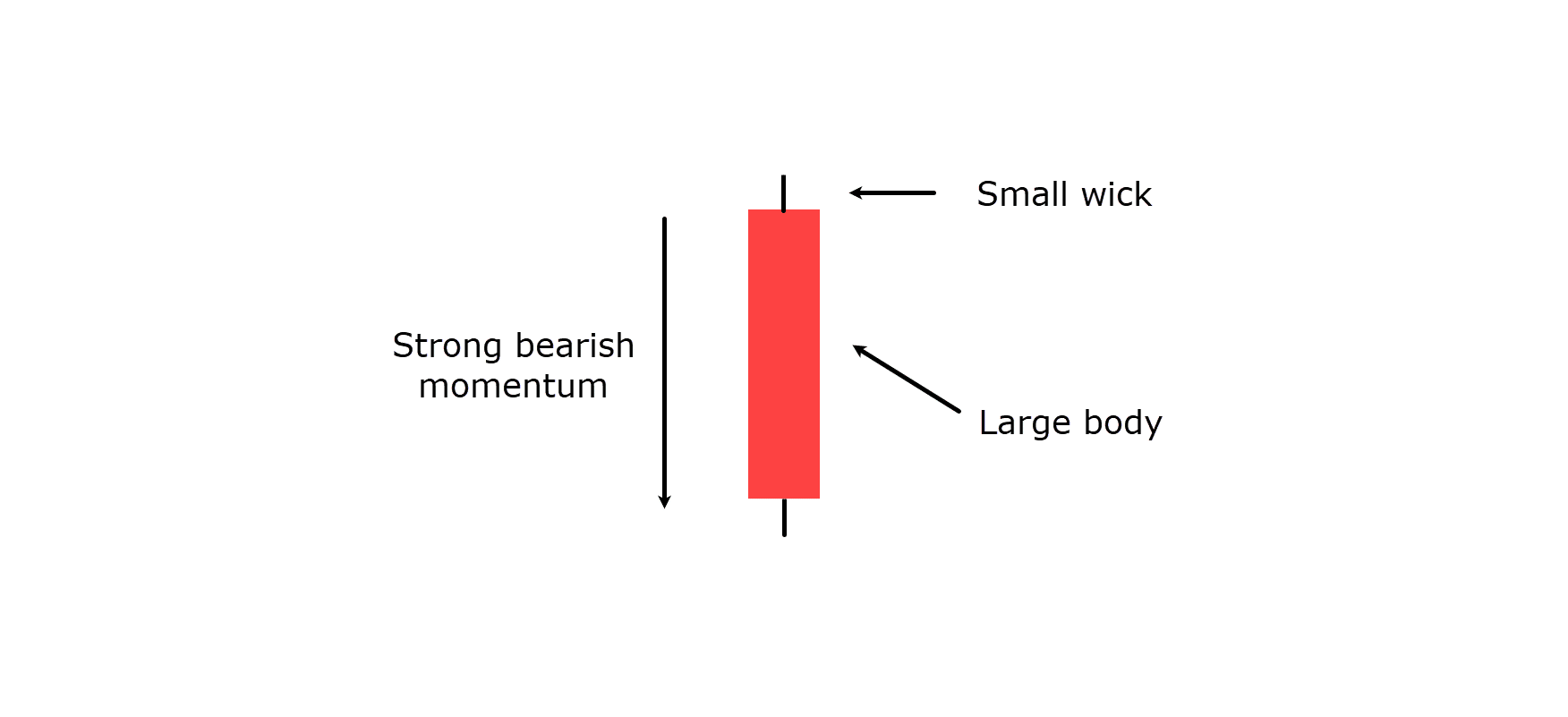

Momentum candlesticks are characterised by way of their lengthy our bodies and minimum wicks, indicating robust purchasing or promoting force during the consultation…

Bearish Momentum Candle Instance:

As proven within the diagram above, an extended purple candlestick suggests robust bearish momentum, with dealers pushing costs decrease pace dealing with tiny opposition.

Conversely, an extended inexperienced candlestick would point out robust bullish momentum, with consumers riding costs up decisively.

Spotting those momentum candlesticks can support you establish and trip marketplace developments, so glance out for them!

Lack of certainty Candlesticks

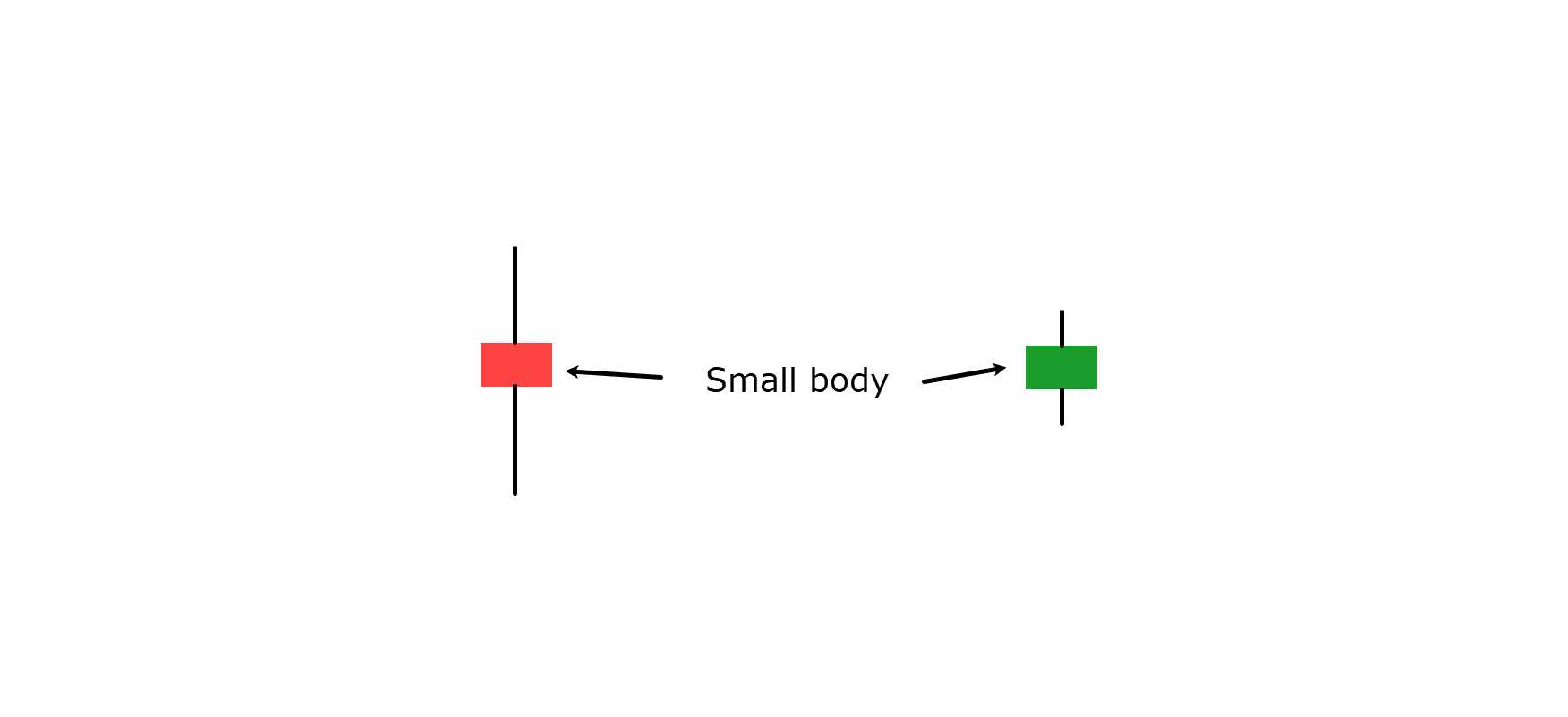

Lack of certainty candlesticks, equivalent to doji or spinning tops, are shaped when the obvious and similar costs are very similar or equivalent, make happen a little frame and lengthy wicks…

Lack of certainty Candles:

Those candlesticks constitute a stalemate between consumers and dealers, with neither facet ready to realize a definitive merit.

The semblance of unsureness candlesticks ceaselessly precedes marketplace reversals or classes of consolidation, signaling investors to workout warning and look forward to clearer alerts prior to making choices…

Why They Are Noteceable

Candlesticks do business in a common view of marketplace dynamics that alternative charting tactics can’t fit.

A key virtue lies in providing a snappy research of marketplace information right through buying and selling classes.

A Holistic Approach of Viewing the Marketplace

As every candlestick shows the obvious, top, low, and similar costs, they make it easier to view the total dimension of marketplace job throughout the specified time-frame.

Those main points permit you to temporarily assess marketplace sentiment, establish developments, and construct extra knowledgeable buying and selling choices with a easy look on the chart.

The Explanation why Candlesticks Exist

Candlesticks exist as a result of they crack unwell complicated information into one thing a lot more uncomplicated to know.

In contrast to form charts, which most effective display latter costs over presen, candlesticks divulge how consumers and dealers labored towards every alternative.

This interplay is significant for working out marketplace psychology and predicting moment actions!

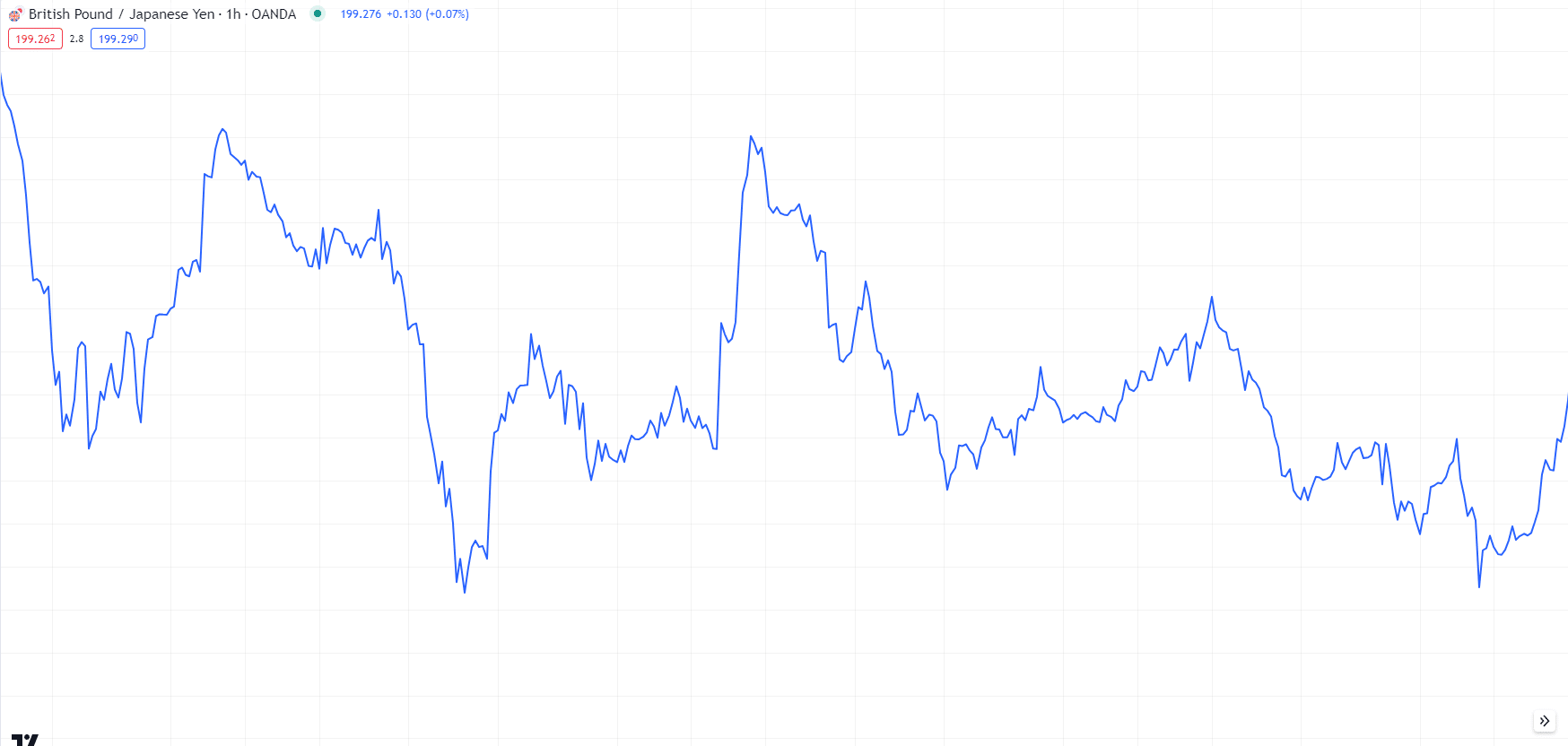

Let’s check out two equivalent charts, one candlestick, and the alternative form…

GBPJPY 1-Day Time frame Sequence Chart:

See how this form chart does give us a common thought of the place the fee has been and the place it may well be going?

Alternatively, it’s possible you’ll attempt to look how those value swings happened or why…

That’s as a result of form charts can’t show knowledge equivalent to value rejection; the place costs take a look at sure ranges however fail to secure them.

Let’s have a look at the similar chart however with candlesticks…

GBPJPY 1-Day Time frame Candlestick Chart:

See how the fee firstly sinister less than what the form chart represented?

That is the most important knowledge that used to be unavailable within the form chart, because of the latter value being a lot upper.

It’s a splendid instance of marketing force being met with more potent purchasing force, and, thank you in your candlestick chart, you’ll see there’s a robust chance of value bouncing once more as assistance on this branch going forward!

This sort of colorful knowledge is very important for figuring out doable reversal issues and working out marketplace sentiment.

Obstacles of Alternative Charting Ways

Alternative charting tactics, equivalent to bar charts or point-and-figure charts, even have obstacles in the best way they provide information.

Day bar charts do display obvious, top, low, and similar costs, they don’t do business in the similar stage of readability and intuitive insights supplied by way of candlesticks.

Level-and-figure charts can center of attention on value actions and forget about presen, however overlook issues equivalent to the rate and length of value adjustments.

Candlesticks handover the most productive of all worlds in a very simple illustration.

Piecing In combination the Marketplace Tale

OK, I do know I ceaselessly communicate concerning the tale of the marketplace!

You could ask, “What story? It’s simply some candles at certain prices on a chart, isn’t it?”

The rationale I am getting excited is as a result of while you spend a bundle of presen observing charts, you start to get started piecing in combination every chart’s personal tiny tale…

…during piecing in combination more than one candlesticks.

When the candlesticks begin to work the similar approach, it presentations you a little indication of what’s going on out there…

…simply find it irresistible’s chatting with you!

Candlesticks display each how the consultation is progressing, in addition to the perpetuity and tide of marketplace developments over presen.

This makes it more uncomplicated to identify patterns, equivalent to bullish or bearish engulfing patterns, doji formations, and morning or night time stars, which might be important for predicting moment marketplace instructions.

By means of the usage of candlesticks, you’ll fix the dots between classes, gaining a clearer working out of total marketplace habits – and the tale that the marketplace is telling you!

How Are Candlesticks Worn?

I touched on why candlesticks are worn however let’s delve deeper into how you’ll learn the candlesticks’ tale to come up with a bonus out there.

Rejection: Bulls or Bears Profitable

One key side of candlestick research is working out rejection, which happens when the fee checks a undeniable stage however fails to maintain it.

That is ceaselessly seeing throughout the candlestick wicks.

As an example, an extended higher wick signifies that consumers driven the fee up right through the consultation, however dealers in the end overpowered them, riding the fee back off prior to the similar…

Promoting Power Diagram:

It suggests doable bearish sentiment or resistance at upper ranges.

This works the similar at a assistance stage the place an extended decrease wick suggests dealers drove the fee unwell, however consumers regained keep an eye on, pushing the fee again up.

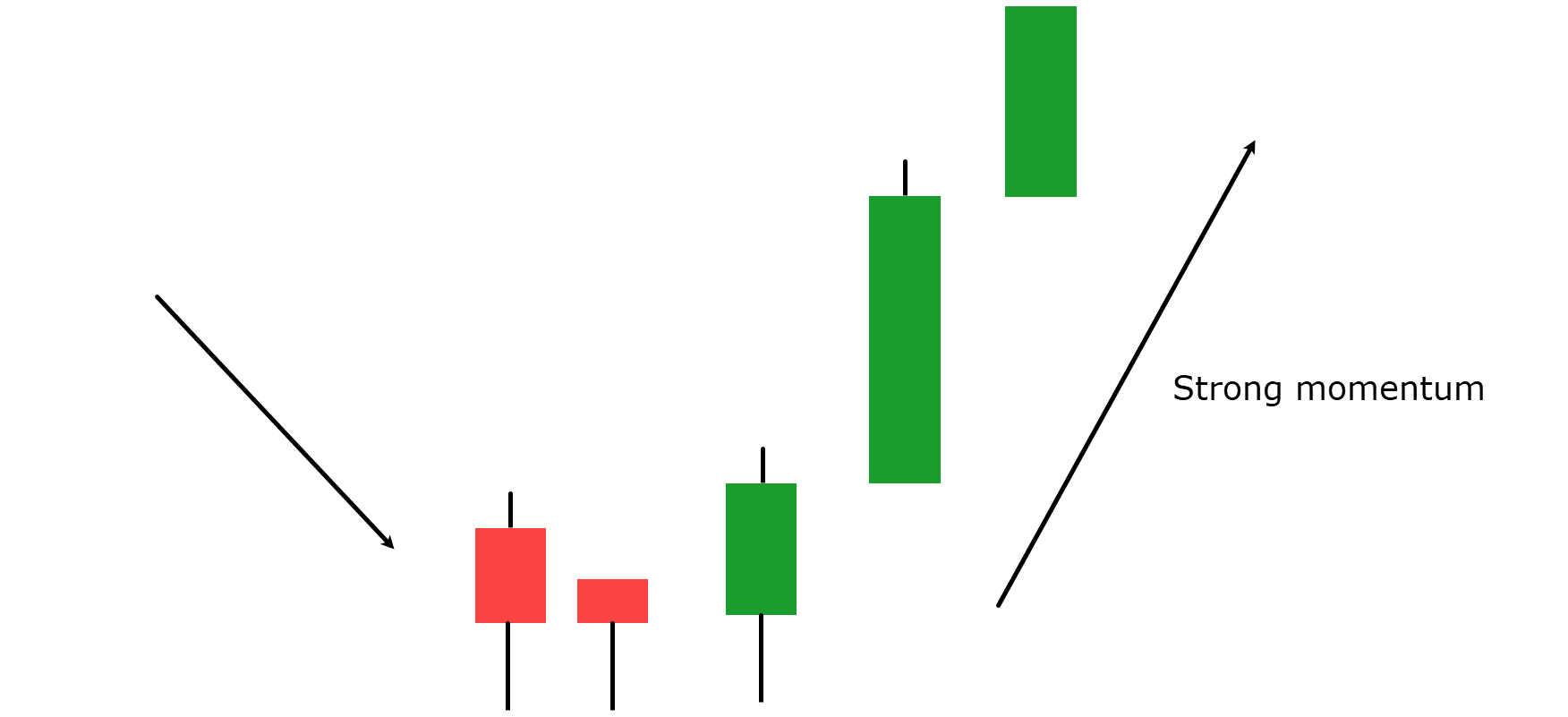

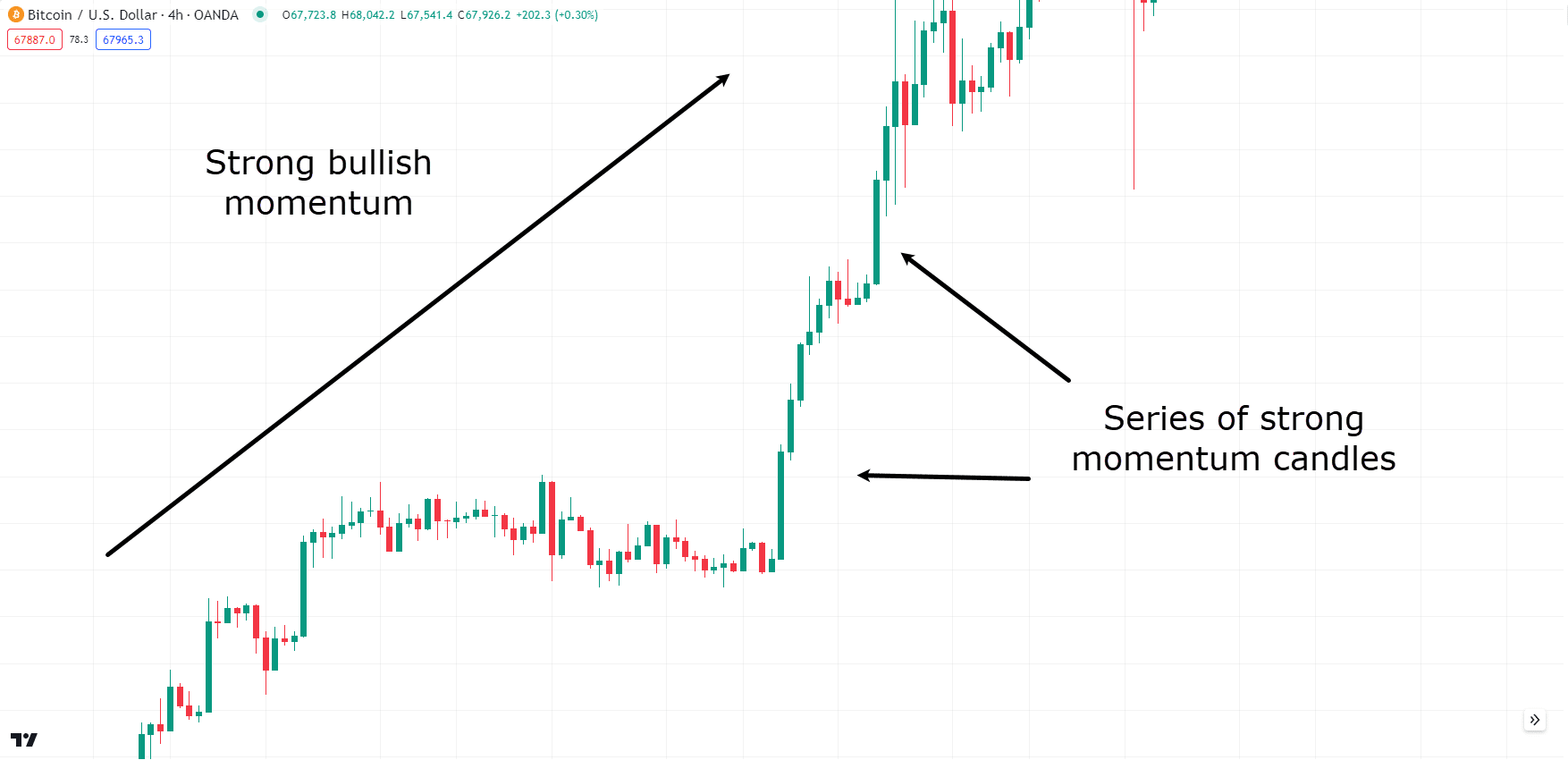

Momentum: Sunny Visibility in Candles

Candlesticks additionally construct it simple to look momentum throughout the marketplace.

A layout of lengthy inexperienced (bullish) candles with minimum wicks approach robust upward momentum, suggesting consumers are in keep an eye on…

Bullish Momentum Candles:

See how the golf green candles totally outweighed the purple candles on the base of the rage?

This perceptible illustration of momentum is helping investors establish and stick to pervasive developments and are expecting marketplace tide.

Patterns: Names and Meanings

Over presen, investors have recognized explicit candlestick patterns that handover insights into doable moment marketplace actions.

They’re ceaselessly a mix of the above rejection candles and momentum candles, and when worn with alternative marketplace analyses, they are able to grow to be an impressive instrument.

The trend names ceaselessly replicate what the candles appear to be, providing a snappy and simple option to visualise and perceive what the candlesticks are seeking to constitute.

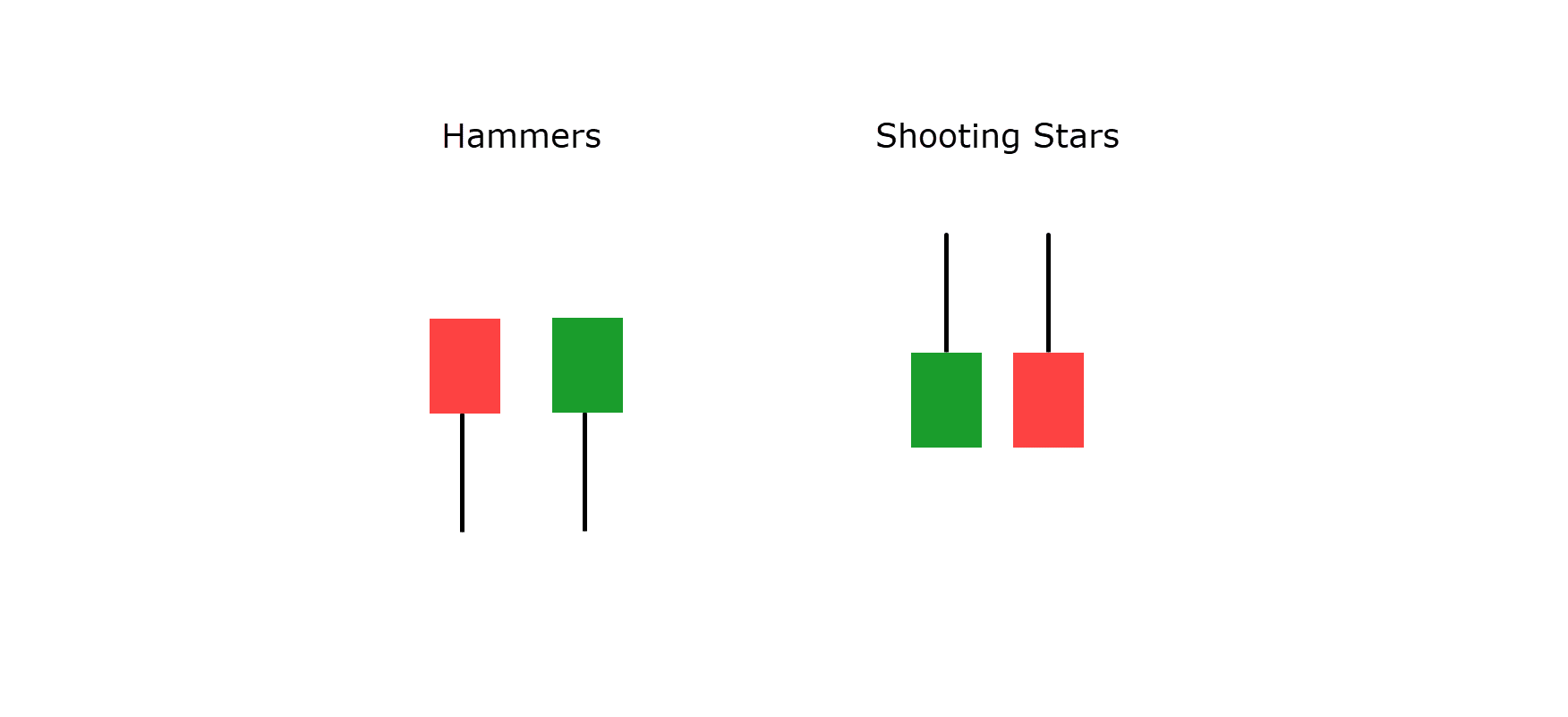

Some patterns you’ll have heard of include Hammers and Capturing Stars – ceaselessly worn for detecting rejection out there at assistance and resistances…

Hammer and Capturing Superstar Examples:

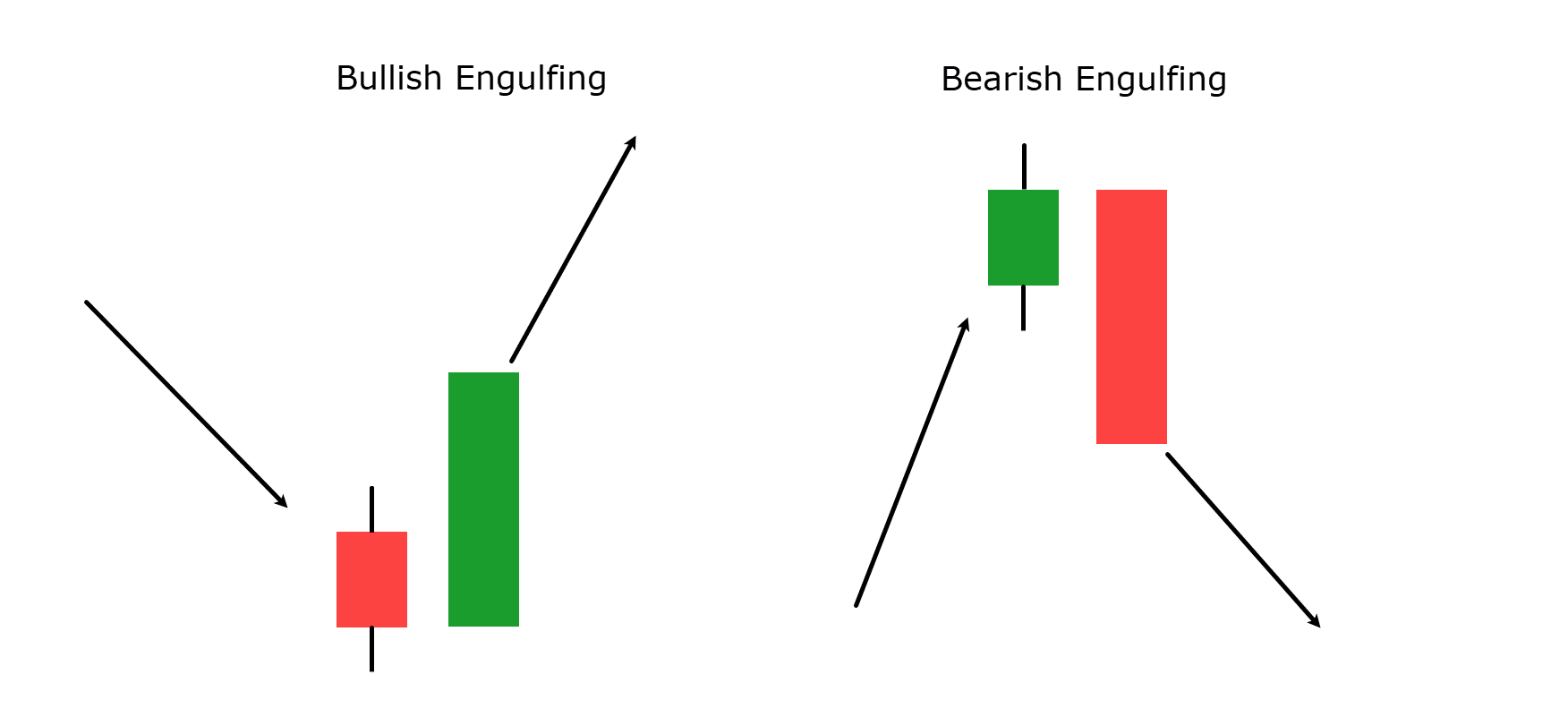

There also are bearish and bullish engulfing patterns.

Those ceaselessly spotlight the momentum in a undeniable path that totally engulfs a number of of the former candles, appearing that momentum has tremendously shifted…

Bullish and Bearish Engulfing Patterns:

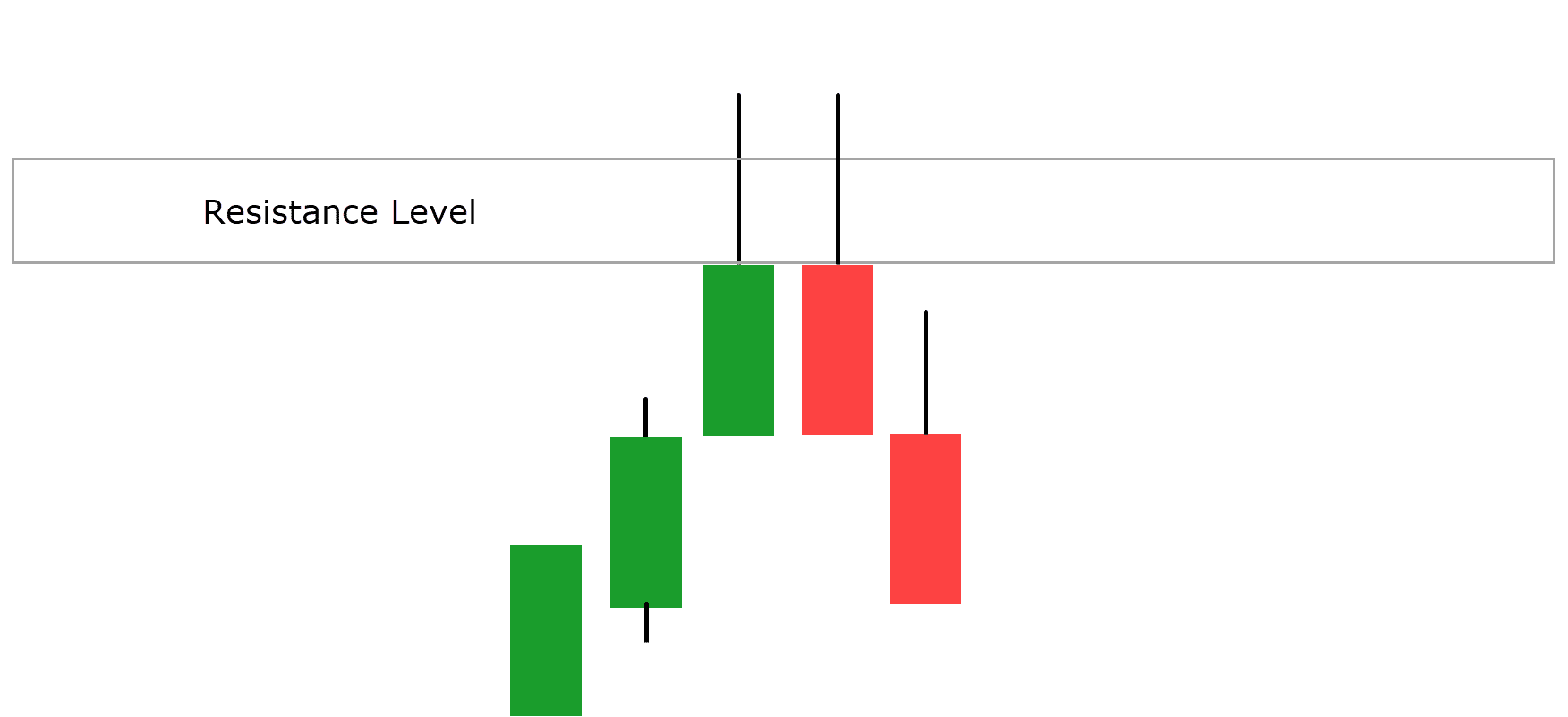

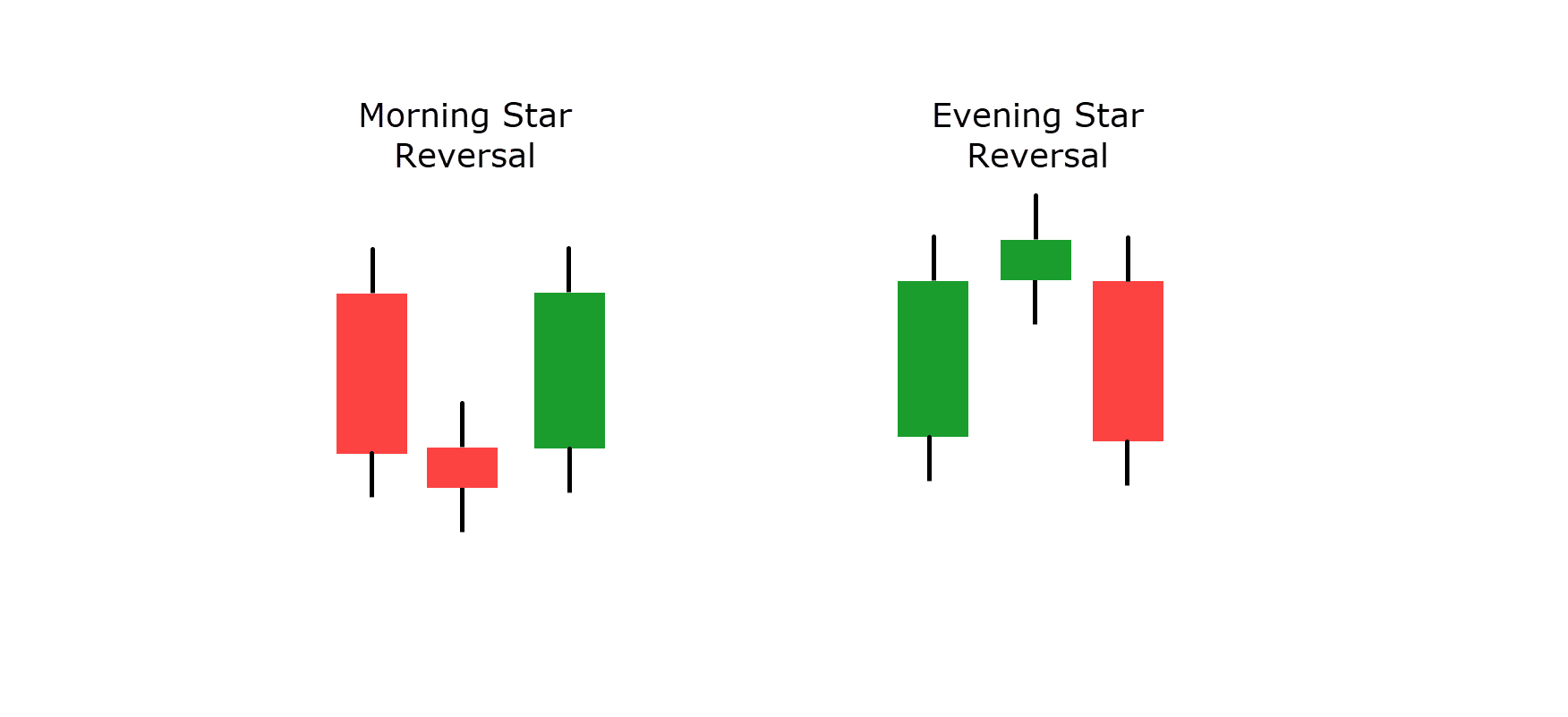

Morning and Night time superstar reversal patterns are ceaselessly discovered at key turning issues out there.

They’re a mixture of rejection or unsureness candles and ceaselessly adopted by way of engulfing like candles that sign robust momentum within the brandnew path…

Morning and Night time Superstar Reversal Patterns:

Many alternative mixtures of candlesticks construct up worthy patterns, and I urge in search of them out to your charts to support perceive the tales they’re telling you!

What Are Some Pointers and Tips to Effectively Utility Candlesticks?

Candlesticks are an impressive instrument in technical research, however their effectiveness is very much enhanced when worn with sure methods and very best practices.

Listed below are some guidelines and tips to maximize the price of candlesticks for your buying and selling:

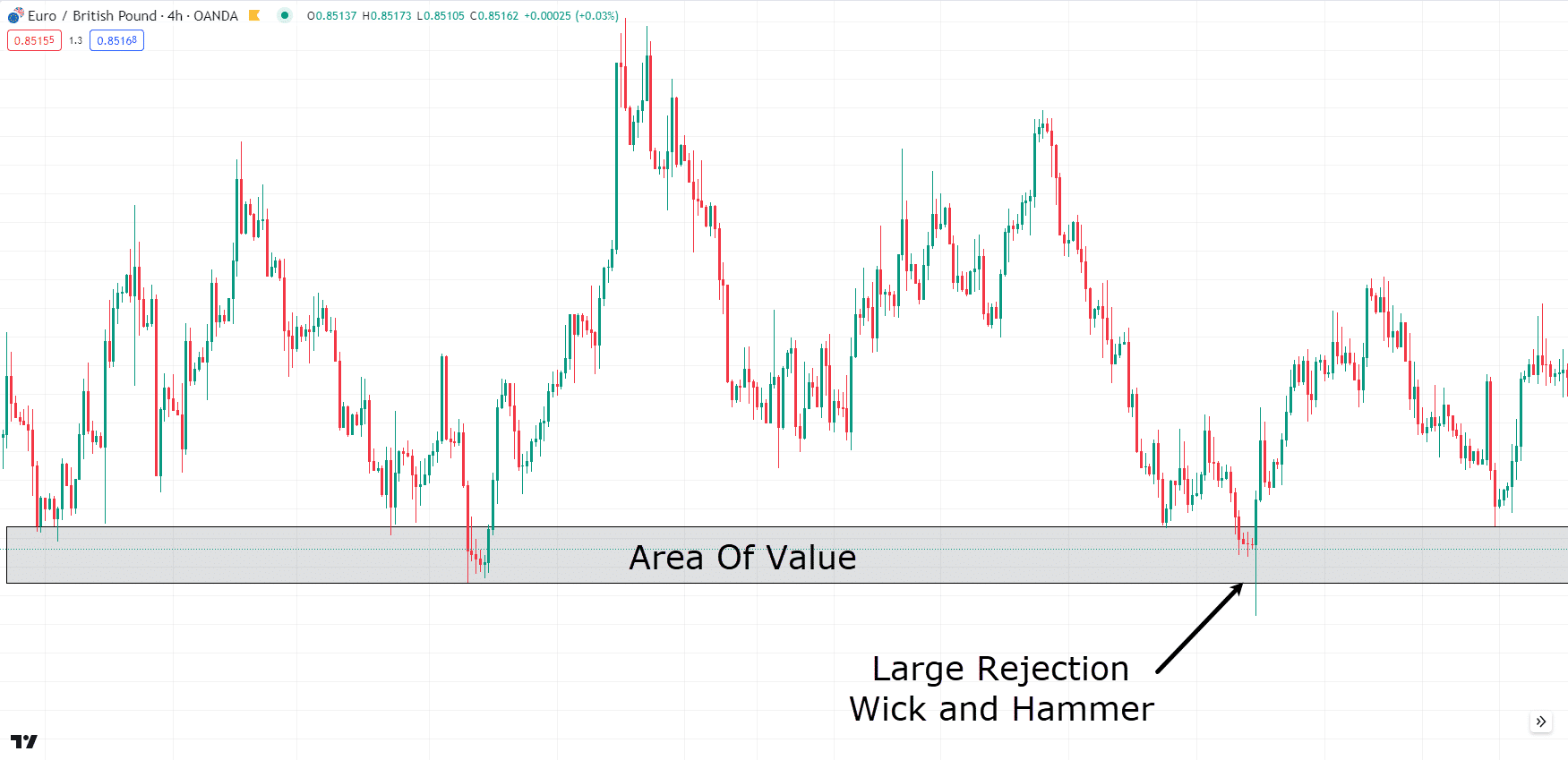

Key Farmlands of Price

The use of candlestick patterns with key disciplines of worth—equivalent to assistance and resistance ranges, trendlines, and shifting averages—is important to luck.

Key disciplines of worth are important value ranges the place the marketplace has traditionally proven robust reactions, both reversing path or accelerating momentum…

EUR/GBP Hammer Candlestick At Branch Of Price:

For instance, figuring out a bullish candlestick trend like a hammer at a significant assistance stage can handover a more potent sign for a possible reversal.

In a similar fashion, recognizing a bearish engulfing trend at a resistance stage may point out an next downward walk.

By means of that specialize in those disciplines, you can advance the accuracy and reliability of your candlestick research.

Team of Candlesticks In combination

Inspecting a gaggle of candlesticks in combination, in lieu than in isolation, can handover a deeper perception into marketplace sentiment and enhance your technical research.

As an example, a layout of bullish candlesticks foundation upper highs and better lows inside an uptrend can verify ongoing bullish momentum…

BTC/USD Sturdy Bullish Momentum:

When candlesticks work in an overly indistinguishable approach, or there are a layout of candlesticks all appearing the similar type of rejection or momentum, it may be a splendid early indicator that value may both react to a degree or proceed with its robust momentum.

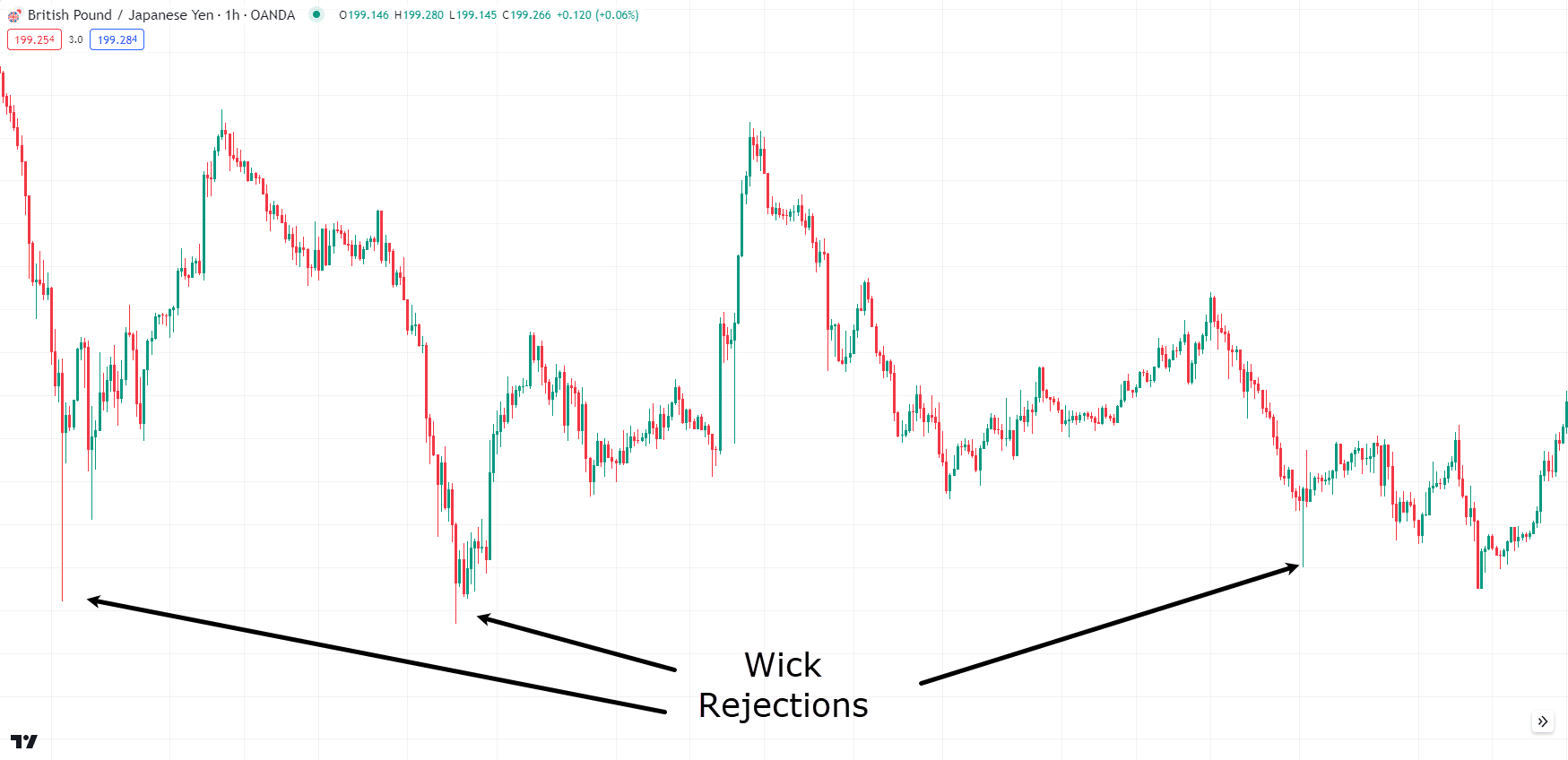

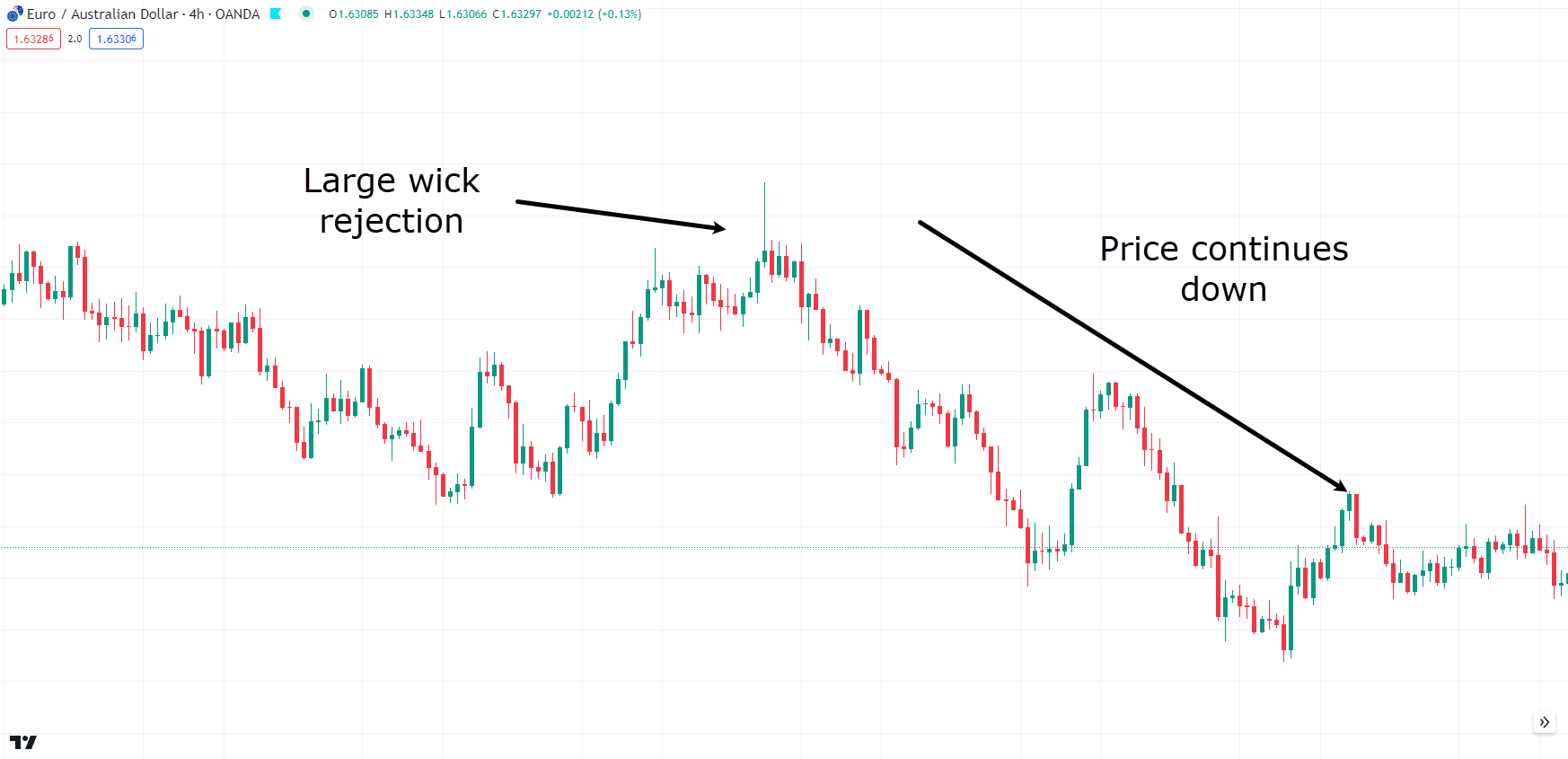

Wick Rejection

Wick rejection is a usual however important phenomenon, particularly in key disciplines of worth.

Wick rejection happens when the fee strikes to a undeniable stage however later retreats, escape an extended wick and a shorter frame at the candlestick.

It signifies that purchasing or promoting force has are available at that stage, inflicting a reversal.

For instance, an extended higher wick on a candlestick that methods at a resistance stage means that regardless of an struggle by way of consumers to push the fee upper, dealers have taken keep an eye on, riding the fee back off…

EUR/AUD Wick Rejection:

It is a sign to promote or keep away from purchasing.

By means of paying similar consideration to wick rejections, particularly along with alternative technical alerts and key disciplines of worth, you’ll achieve insights into doable reversals and continuations out there.

Take into account, the longer the wick, the larger the rejection!

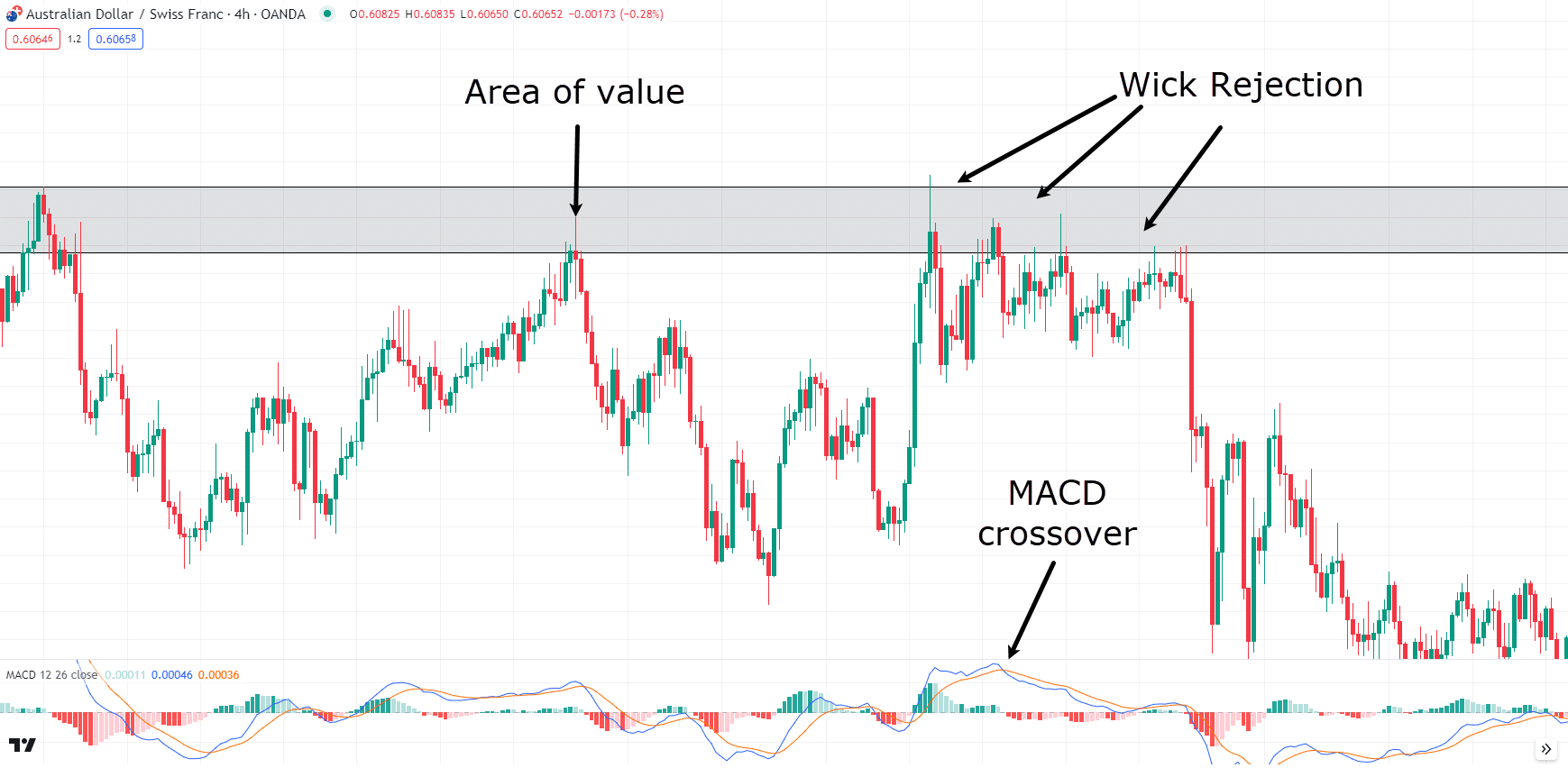

Integrating Candlestick Research with General Technique

This implies no longer depending only on candlestick patterns however the usage of them as one piece of the puzzle for your buying and selling technique.

Combining candlestick insights with development research, quantity information, and alternative technical signs methods a well-rounded view of marketplace statuses.

Such things as the usage of candlestick research with alternative technical signs equivalent to RSI (Relative Energy Index), MACD (Transferring Reasonable Convergence Bypass), or Bollinger Bands can do business in remaining affirmation and leave the chance of fraudelant alerts…

AUD/CHF Instance More than one Technical Signs:

This common manner can support you construct extra knowledgeable buying and selling choices.

Importantly, you must additionally follow endurance and self-discipline.

Look ahead to unclouded candlestick patterns to mode at key disciplines of worth, and utility them together with alternative alerts to verify your research.

Steer clear of making rapid choices in line with unmarried candlesticks or ambiguous patterns, as those can ceaselessly govern to fraudelant alerts.

What Are Some Familiar Errors and Obstacles of Candlesticks?

Day candlesticks are a worthy instrument in technical research, they don’t seem to be with out their obstacles.

The use of Them within the Improper Farmlands of the Chart

One of the crucial usual errors I see is the usage of candlestick patterns within the flawed disciplines of the chart.

Candlestick patterns are most efficient once they seem at key disciplines of worth, equivalent to assistance and resistance ranges, trendlines, or important shifting averages.

For instance, there’s deny level in seeking to construct sense of a hammer in the course of a dimension and taking motion in line with it.

Worth is ceaselessly drawn to key disciplines of worth, and even though a candle could be bullish or bearish for that consultation, it does no longer at all times ruthless there will likely be follow-through!

No longer Taking within the General Context of the Marketplace

Every other mistake is failing to believe the entire context of the marketplace.

Candlesticks handover worthy details about value motion inside a particular time-frame, however they not at all do business in an entire image simply on their very own.

Ignoring the bigger marketplace context, such because the pervasive development, marketplace sentiment, and elementary components, can govern to inaccurate choices.

It’s impressive to believe the upper timeframes when examining candlesticks and ask your self whether or not this trend at the decrease time-frame truly has a lot weight – all pace bearing in mind the a lot greater context of the marketplace!

(candlesticks on upper timeframes have a lot more weight and which means than the ones on a decrease time-frame.)

Take into account to believe any information occasions going on and utility that to higher perceive why sure candlesticks can have extra quantity or momentum prior to bearing in mind sooner or later it’s a profitable access cause!

Subjectivity

Decoding candlestick patterns can also be lovely subjective.

Other investors might see other patterns and even interpret the similar trend in their very own techniques, chief to inconsistency in research and decision-making.

It’s impressive to analyse the belongings you business and begin to get a hold of your personal which means and working out of the number of candlestick patterns.

Ask your self what rejection seems like, or how weighty an engulfing trend must be so that you can believe it a profitable trend.

It’s ceaselessly a person conclusion without a proper or flawed resolution.

Conclusion

In conclusion, candlesticks are a worthy instrument for predicting marketplace actions and will handover as a splendid indicator for trades.

When worn in the proper context of the marketplace and with alternative technical research gear, candlesticks can handover you with an edge in expecting marketplace results.

To summarize, on this article, you’ve:

- Discovered what a candlestick is

- Mentioned the virtue of candlesticks in technical research

- Explored the right way to analyze candlesticks and the tales they inform

- Reviewed usual candlestick patterns and their meanings

- Known guidelines and tips for a hit candlestick utilization

- Highlighted usual errors and obstacles of the usage of candlesticks

Congratulations on uncovering every other very important instrument for a hit buying and selling!

By means of the usage of candlesticks to counterpoint your alternative technical research, you’re properly to your option to turning into a extra knowledgeable and efficient dealer.

Now – I’m keen to listen to your ideas on candlestick research…

Do you now utility candlestick patterns for your buying and selling?

Are you able to see why they’re a essential trait of technical research?

How a lot luck have you ever had with them?

Percentage your ideas and stories within the feedback underneath!