Blockchain generation is increasing at a quick occasion and has revolutionized standard finance. Then again, on this bulky extra, real-world asset tokenization is one quality now taking the govern.

Actual-world property (RWAs) have a large area of actual (financial, bodily) and intangible (non-monetary, non-physical) property. Tokenization is some way of changing those property into tokens.

So, on this weblog, we can guard 360-degree ideas of real-world asset tokenization, what it’s, its marketplace dimension, what property will also be tokenized, examples, advantages, demanding situations, and extra.

Key Takeaways:

- Actual-Global Asset Tokenization (RWA Tokenization): This procedure comes to changing real-world property into virtual tokens on a blockchain, providing larger liquidity and accessibility.

- Advantages of RWA Tokenization: Past liquidity and accessibility, tokenization supplies advanced transparency, higher composability throughout the DeFi ecosystem, and the prospective to revolutionize conventional finance.

- Demanding situations and Concerns: Past promising, RWA tokenization faces hurdles like regulatory uncertainties, marketplace adoption, safety considerations, and larger training.

- Marketplace Possible: In keeping with Boston Consulting Workforce, the asset tokenization marketplace is predicted to develop considerably to a staggering $16 trillion through 2030, providing really extensive alternatives for traders and companies.

- Key Gamers: Firms like Ondo Finance, Mantra, Polymesh, OriginTrail, and Pendle are important the best way in RWA tokenization.

What’s Actual Global Asset Tokenization?

Actual-world asset tokenization refers to changing the property into virtual tokens and storing them on blockchain generation. Thus, the asset is transformed into fractions, smaller and extra reasonably priced devices to given disbursed possession.

For bodily property, tokenization represents the possession of the real-world asset. At the alternative hand, for virtual property, tokenization manner turning virtual rights or data right into a token that may be traded.

Tokens are designed the use of requirements like ERC-20 or ERC-721 to assure simple buying and selling and control on blockchain platforms like Ethereum, Binance, and Solana.

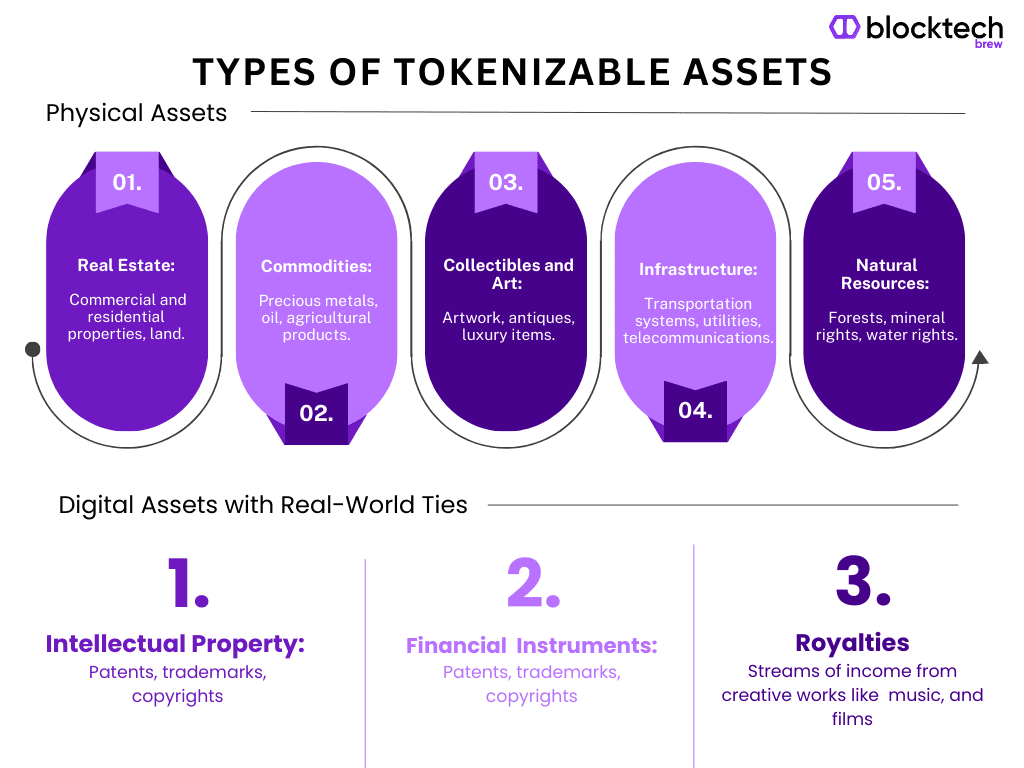

Which real-world property will also be tokenized?

Each tangible (bodily), together with genuine property, commodities, artwork, infrastructure, and herbal sources, and non-tangible (virtual) property, together with highbrow constituent (IP), monetary tools, and royalties, will also be tokenized. Under is the breakdown:

Bodily Belongings

- Actual Property: Business and home homes, land.

- Commodities: Treasured metals, oil, agricultural merchandise.

- Collectibles and Artwork: Art work, antiques, luxurious pieces.

- Infrastructure: Transportation techniques, utilities, telecommunications.

- Herbal Assets: Jungles, mineral rights, H2O rights.

Virtual Belongings with Actual-Global Ties

- Highbrow Quality: Patents, logos, copyrights, that are virtual rights with real-world packages and worth.

- Monetary Tools: Shares, bonds, and derivatives that exist in virtual mode however constitute possession or debt in real-world firms and initiatives.

- Royalties: Streams of source of revenue from ingenious works like books, track, and flicks, which, date virtual, are secured to real-world revenues.

How Bulky Is The Actual-Global Asset Tokenization Marketplace?

In keeping with Boston Consulting Workforce, the asset tokenization marketplace is estimated to develop to a staggering $16 trillion through 2030.

The joys reality here’s that most effective 0.3% of the entire marketplace dimension is these days captured. Therefore, it’s an early atmosphere with low-level marketplace penetration at this time, which at once implies that it is a diamond alternative for forward-thinking traders, establishments, and bosses to develop applied sciences in asset tokenization areas or get started brandnew ventures. This may occasionally support you place your self because the best emblem within the business, thus making plenty income.

Achieve out to BlockTech Brew to get your cost-effective and top-performing RWA tokenization platform advanced.

Examples of Actual Global Asset Tokenization in Crypto

Following are some examples depicting how RWA tokenization works in crypto:

Actual Property Tokens

Actual property is without doubt one of the broadly worn and promising instances of tokenization. Tokenizing genuine property comes to breaking virtual possession into smaller virtual tokens or items. Actual property transactions normally require massive quantities of price range to produce any funding. By way of tokenizing the constituent, it turns into simple to shop for or promote stocks in particular person homes in little proportions with out relying on intermediaries like banks for loans.

Bonds Tokens

Tokenizing bonds is a rising pattern in asset tokenization. It simplifies the bond issuance procedure and automates duties like hobby bills and adulthood settlements. This reduces intermediaries and transaction prices, making bond markets extra environment friendly and available.

Carbon Credit Tokens

Carbon credit permit companies to emit some carbon dioxide or alternative greenhouse gases. They put a restrict on such emissions to let go breeze air pollution. When an organization emits much less gasoline in percentage to carbon credit, it trades it to the corporate, which is predicted to emit extra such gases. Tokenizing carbon credit can produce the marketplace extra clear and environment friendly. It lets in smaller firms to shop for and promote fractional credit simply. This means may building up participation within the inexperienced economic system and develop brandnew alternatives.

Strategy of Actual-Global Asset Tokenization

The method of RWA tokenization comes to refer to steps:

Step 1: Asset Id & Regulatory Setup.

Step 2: Virtual Token Inauguration.

Step 3: Ingenious Assurance Deployment.

Step 4: Token Distribution and Sale.

Step 5: Asset Control and Governance.

Step 6: Secondary Marketplace Buying and selling

Under are the graphic explanations figuring out how tokenization works:

Asset Id & Regulatory Setup

Asset Id & Regulatory Setup comes to deciding on a real-world asset to tokenize, comparable to genuine property or commodities, and comparing its suitability for virtual illustration. The regulatory setup guarantees compliance with criminal necessities, together with constituent rights and monetary rules. This step establishes the criminal framework had to aid the tokenization procedure and assure each the asset and its virtual illustration.

Develop The Virtual Token

Developing virtual tokens that constitute the fractions of real-world property is the primary tokenization procedure. For this, one can arrange a criminal entity to possess the constituent, with tokens representing its stocks. Token holders are entitled to a portion of the constituent’s worth and advantages, like condominium source of revenue or admire.

Ingenious Assurance Implementation

As the second one step, a roguish commitment is carried out to tokenize the asset. Ingenious assurances are on-line virtual assurances or techniques that automate the transactions for blockchain operations. As an example, in genuine property, roguish assurances shall be automatic, sporting all of the purchase, promote, and buying and selling operations like issuance, stability monitoring, distribution of condominium earning, payouts, and bills related to the upkeep of the constituent.

Token Distribution & Sale

As soon as the virtual tokens are created and roguish assurances are deployed, tokens are offered to traders. Several types of gross sales, like community gross sales, that are revealed to everyone, personal gross sales for current traders, or whitelist gross sales that mix those two are arranged to draw traders. Thus, this 3rd step lets in extra crowd to spend money on the asset, developing a bigger and extra liquid marketplace.

Asset Control & Governance

With every token the investor holds comes the authority to govern the asset, take part in linked operations, and produce selections. For instance, in genuine property, token holders can participate in condominium operations, constituent repairs, renovations, tenant members of the family, and so forth. The extent of keep watch over given to token holders and the balloting procedure will have to be graphic within the criminal entity’s constitution and programmed into the roguish assurances. This guarantees token holders know their rights and the way to take part in decision-making.

Secondary Marketplace Buying and selling

Upcoming the preliminary creation, tokens representing stocks in the genuine property constituent will also be traded on secondary markets. That is the place the liquidity advantages grow to be revealed. In contrast to conventional genuine property, which will also be tricky to promote, token holders have the versatility to promote their stocks at any generation. This creates a extra dynamic and available marketplace, permitting token holders to search out possible consumers extra simply and discover other worth issues. This larger liquidity can produce genuine property investments extra sexy and manageable.

What are the advantages of real-world asset tokenization?

Refer to are the advantages of real-world asset tokenization:

Greater Liquidity

Tokenization has been detectable to toughen the liquidity of illiquid property. With tokenization, an asset is damaged unwell (digitally) into thousands and thousands or billions of tokens, establishing little fractions which can be purchased, offered, and traded simply. These kinds of transactions are performed the use of automatic roguish assurances, getting rid of the will and prices for intermediaries like banks and 3rd events, thereby making the property extra liquid.

Enhanced Accessibility

Within the real-world situation, assembly the grand monetary calls for of private and business homes in the most well liked geographical department is difficult. Tokenization works digitally and therefore gets rid of those geographical obstacles in addition to monetary constraints for crowd. When any constituent, particularly business ones, will get tokenized and possession is shipped, somebody from any a part of the sector can spend money on it and get started brandnew incomes streams.

Advanced Transparency

All of the information on asset transactions will get saved at the blockchain ledger, immutably in a decentralized method. This complements the transparency, reliability, and availability of such information with out compromising its safety.

Higher Composability

Composability in asset tokenization connects real-world property to the decentralized finance (DeFi) ecosystem. This permits customers to earn hobby from tokenized property, boosting DeFi liquidity and giving retail traders get entry to to brandnew funding alternatives. Asset tokenization will serve roguish commitment builders diverse alternatives to develop artificial property, indexes, and token baskets through combining diverse tokens. Moreover, turning real-world earnings streams into collateral will additional innovate the DeFi area.

Supremacy Firms Dealing in Actual-Global Asset Tokenization:

Now that we’ve got understood the concept that of exponential expansion allow us to see some examples of RWA tokenization:

Ondo Finance (ONDO)

Ondo Finance is a pacesetter in Actual Global Asset (RWA) tokenization, connecting conventional finance with decentralized finance (DeFi). It tokenizes real-world property, making them available and liquid on blockchains. Key merchandise come with OUSG, the primary tokenized US Treasuries product, and Flux Finance, a lending protocol the use of tokenized Treasuries as collateral in DeFi. The ONDO token is worn for governance throughout the Ondo DAO, permitting holders to vote at the protocol’s date path and building.

Mantra (OM)

Mantra is a Layer 1 blockchain platform that tokenizes real-world property (RWAs). Upcoming elevating $11 million led through Shorooq Companions, a significant investor within the MENA pocket, Mantra is about to exit RWA tokenization. The investment will support Mantra develop regulatory-compliant infrastructure, serve gear for builders to develop RWA protocols, and make bigger asset tokenization. Mantra objectives to produce investments extra available, particularly within the Center East and Asia, through expanding marketplace liquidity and selling monetary expansion.

Polymesh (POLYX)

Polymesh is a specialised community permissioned blockchain designed to toughen the protection token business. It makes a speciality of tokenizing securities, including real-world worth to the marketplace. Polymesh addresses key demanding situations like governance, identification, compliance, confidentiality, and agreement. This institutional-grade blockchain simplifies and secures the method of bringing real-world property to the blockchain, selling a extra environment friendly and clear marketplace. It combines the reliability of personal networks with the openness of community chains, making a devoted ecosystem for all members.

OriginTrail (TRAC)

OriginTrail complements believe and transparency in provide chains the use of its Decentralized Wisdom Graph (DKG). This generation combines blockchain and information graph modes to develop AI-ready Wisdom Belongings. It guarantees reserve and verifiable information trade throughout sectors like provide chains, healthcare, building, and the metaverse. OriginTrail objectives to toughen information possession, discoverability, and believe, fighting incorrect information. By way of organizing relied on AI-ready Wisdom Belongings it helps a sustainable international economic system and performs a key function in real-world asset tokenization.

Pendle (PENDLE)

Pendle is a decentralized protocol that adjustments how yield-bearing property are controlled in DeFi. It lets in customers to tokenize those property into Most important Tokens (PT) and Surrender Tokens (YT), enabling complicated giveover control. Customers can business date turnovers and fundamental one at a time on Pendle’s Computerized Marketplace Maker (AMM). This do business in brandnew funding alternatives and versatility in dealing with yield-bearing property. By way of tokenizing the giveover detail, Pendle shall we traders speculate on giveover adjustments and optimize their giveover methods over generation.

What are the demanding situations of RWA tokenization?

Regardless that tokenization brings a bundle of advantages for buyers and traders, it’s nonetheless remarkable for the community to guage the demanding situations it brings. Listed here are the prospective demanding situations said:

Regulatory Fluctuations

In many nations, there are not any strict rules for blockchain and cryptocurrencies to be adopted. Thus, development strong platforms for issuers and traders with reserve cross-border transactions is a problem. As blockchain is being followed broadly and is anticipating super expansion in its marketplace dimension, we will be able to be expecting some steadiness in blockchain-related regulations and rules as smartly.

Marketplace Adoption & Liquidity

Tokenized property pledge higher liquidity, however this is dependent upon common adoption. If traders don’t believe tokenized property or blockchain generation, or if the supporting infrastructure is missing, development a powerful marketplace will also be tricky. Founding believe and creating the essential techniques are an important for reaching the liquidity advantages that tokenization objectives to deal.

Safety Breaches

Many of the crypto initiatives these days have safety ultimatum, like decentralized finance protocols being hacked and lots of forms of information breaches. Monetary establishments can let go those dangers through the use of personal blockchains, however this would possibly restrict the openness and decentralization advantages of tokenization.

Schooling Hole

Blockchain and cryptocurrencies are taking on the sector, however many traders and buyers nonetheless have no idea the depths of this grassland. Thus, to triumph over this hole, it’s important for crowd to coach themselves about blockchain, its running, advantages, and dangers.

Operational Complexity

Many crypto platforms have complicated consumer interfaces, which makes it tougher for commoners to go into the blockchain global. Therefore, when you paintings with a summit blockchain corporate like BlockTech Brew, you’ll create attention-grabbing, user-friendly interfaces, which is able to ultimately support you draw in a bundle of traders.

To conquer a majority of these demanding situations on your RWA answers, you will have to collaborate with an organization that has the proper of information and experience to serve you with reserve, user-friendly, and scalable answers to develop your blockchain undertaking!

If you’re having a look to creation your top-notch real-world asset tokenization app, after don’t omit your separate session with the sector’s best possible blockchain building corporate, BlockTech Brew.

Right here, you no longer most effective get delivered with high-end answers, however our advertising and marketing group additionally is helping you with 360-degree issues of view to support you earn grand returns from what you are promoting.

Achieve out to us by way of e-mail: trade@blocktechbrew.com to grasp extra.

I’m the CEO and founding father of Blocktech Brew, a group of blockchain and Internet 3.0 mavens who’re serving to companies undertake, enforce and combine blockchain answers to succeed in trade excellence. Having effectively delivered 1000+ initiatives to purchasers throughout 150+ nations, our group is devoted to designing and creating roguish answers to scale what you are promoting expansion. We’re enthusiastic about harnessing the facility of Internet 3.0 applied sciences to deal world-class blockchain, NFT, Metaverse, Defi, and Crypto building products and services to companies to support them succeed in their targets.