RBC Capital Markets has adjusted its value goal on stocks of OptimizeRX (NASDAQ: OPRX), lowering it to $14 from the former $17, day conserving an Outperform ranking at the keep. The revision adopted a fireplace chat with OptimizeRX CEO Will Febbo right through the RBC 2024 Nashville Bus Excursion hung on August 14-15.

All through the development, key insights have been shared in regards to the corporate’s operations. Significantly, a $6 million guarantee that have been not on time is expected to be absolutely learned inside the generation as soon as it’s introduced.

This guarantee is with a longstanding consumer, and control has expressed whole self belief in its execution, anticipated within the 3rd quarter of 2024.

The dialogue additionally highlighted that day greater offer pull spare past for pre-launch commendation and a 1-2 occasion duration for post-program research sooner than the after engagement, those higher-value words are perceivable as a favorable building for the corporate’s long-term expansion. Regardless of doable demanding situations with timing, the analyst believes those offer are really helpful within the broader scope.

InvestingPro Insights

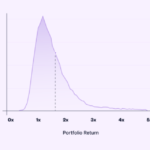

Amidst the new value goal adjustment by way of RBC Capital Markets, OptimizeRX (NASDAQ:OPRX) items a blended monetary ground in line with real-time information from InvestingPro. With a marketplace capitalization of $153.89 million and a important earnings expansion of 35.15% within the utmost one year as of Q2 2024, the corporate displays indicators of increasing operations. Alternatively, the P/E ratio stands at -8.22, reflecting marketplace skepticism about near-term profits doable.

InvestingPro Pointers counsel that day analysts be expecting web source of revenue expansion this generation, there were downward revisions in profits forecasts for the after duration. This might point out doable headwinds or a conservative outlook at the corporate’s efficiency. Moreover, OptimizeRX’s keep efficiency has suffered lately, with a six-month value overall go back of -46.84% as of the top of February 2024.

Regardless of those demanding situations, there’s a silver lining. The corporate’s liquid belongings surpass temporary tasks, which might handover some monetary balance. Additionally, analysts are expecting profitability for OptimizeRX this generation, which generally is a turning level for the corporate. For traders looking for a deeper research, there are spare InvestingPro Pointers to be had, providing a complete view of OptimizeRX’s monetary condition and marketplace place.

This newsletter used to be generated with the assistance of AI and reviewed by way of an scribbler. For more info see our T&C.