Next achieving pristine all-time highs previous this presen, Bitcoin has entered a multi-month length of uneven worth motion, many to marvel if the bull cycle is over. On this article, we dive deep into key metrics and traits to know if the marketplace is solely cooling off or if we’ve already detectable the height for this cycle.

Essentially Puffed up?

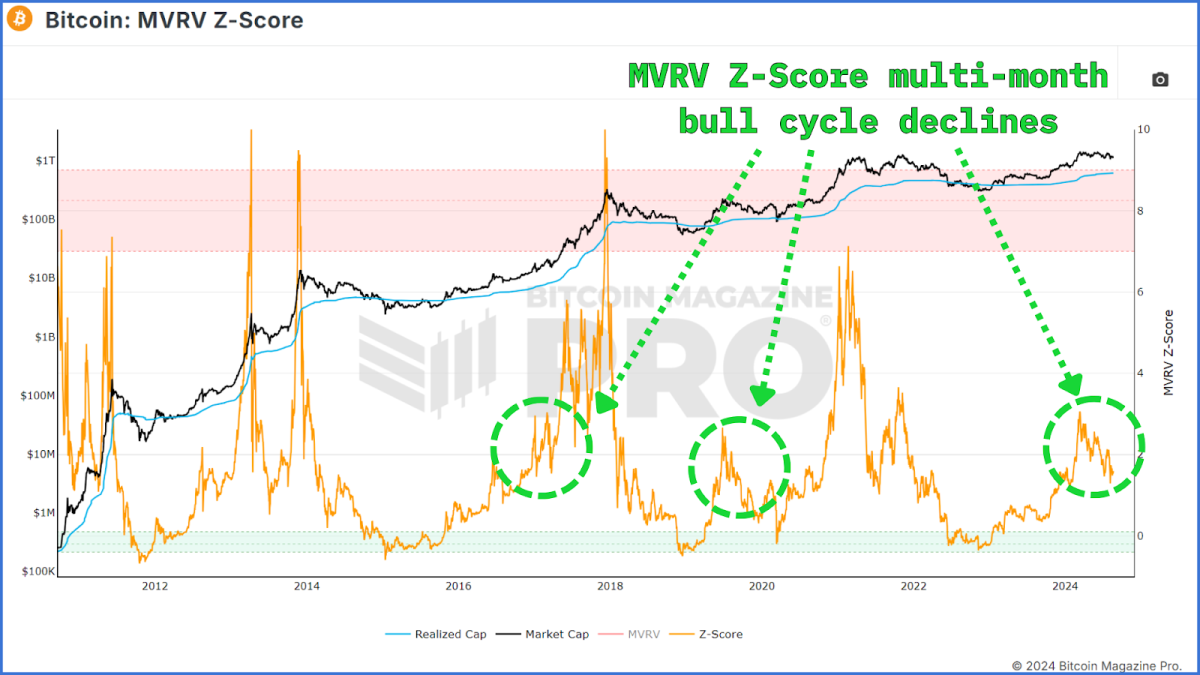

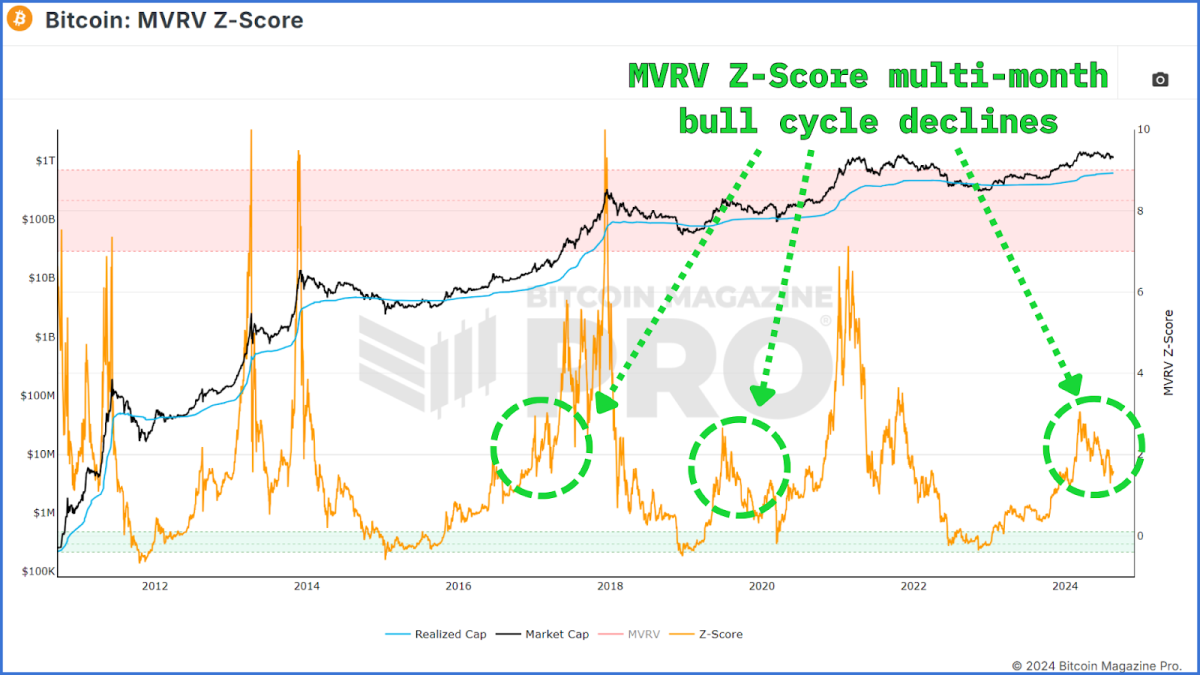

One of the vital valuable equipment for gauging Bitcoin’s marketplace cycles is the MVRV Z-Rating. This metric measures the extra between Bitcoin’s marketplace cap and its learned cap, or cost-basis for all circulating BTC, serving to buyers resolve whether or not Bitcoin is over or undervalued in line with this ‘fundamental’ charge of BTC.

Fresh information presentations that the MVRV Z-Rating has demonstrated a sustained downward motion, which may counsel that Bitcoin’s upward trajectory has ended. Then again, a historic research tells a distinct tale. All over earlier bull cycles, together with the ones in 2016-2017 and 2019-2020, alike declines within the MVRV Z-Rating have been seen. Those drawdown classes have been adopted by way of vital rallies, to pristine all-time highs. Thus, date the tide downtrend would possibly appear relating to, it’s no longer essentially indicative of the bull cycle being over.

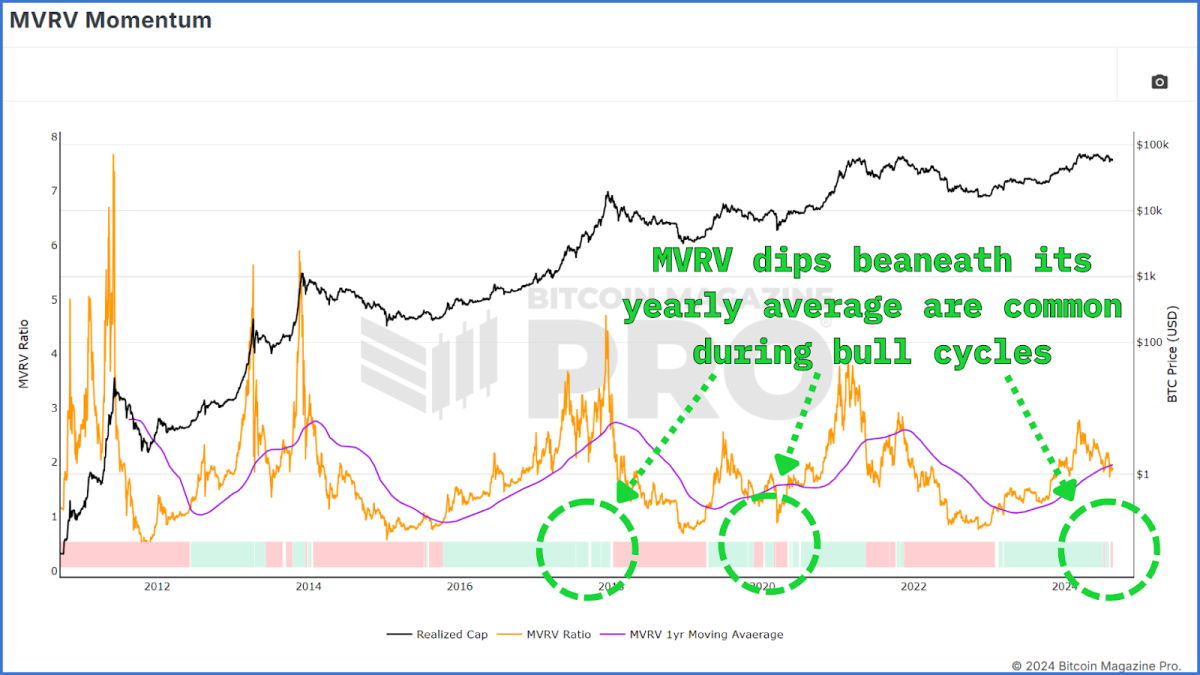

The MVRV Momentum Indicator is helping distinguish between bull and undergo cycles by way of making use of a transferring reasonable to the uncooked MVRV information. It just lately dipped underneath its transferring reasonable and grew to become crimson, which would possibly sign the beginning of a undergo cycle. Then again, historic information presentations that alike dips have came about with out to a chronic undergo marketplace.

Suffering Underneath Resistance?

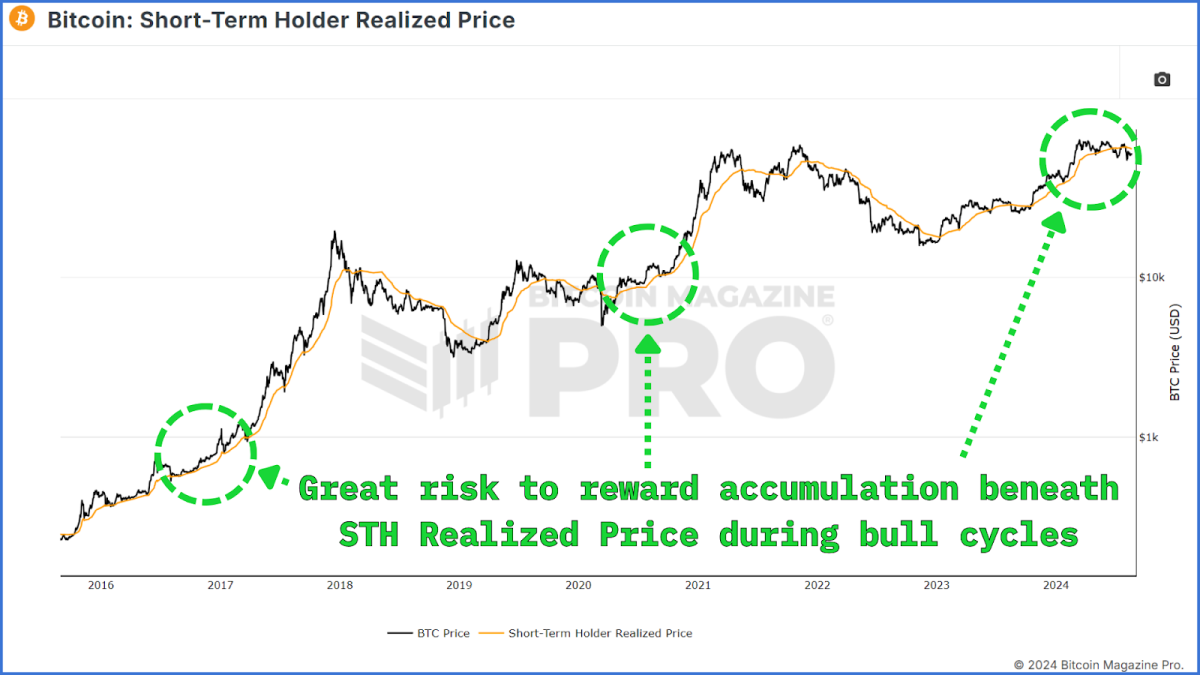

Some other very important metric to imagine is the Snip-Time period Holder (STH) Discovered Value, which represents the common worth at which contemporary marketplace contributors bought their Bitcoin. These days, the STH Discovered Value is round $63,000, relatively above the tide marketplace worth. Which means that many pristine buyers are retaining Bitcoin at a loss.

Then again, right through earlier bull cycles, Bitcoin’s worth dipped underneath the STH Discovered Value a couple of instances with out signaling the top of the bull marketplace. Those dips ceaselessly offered alternatives for buyers to amass Bitcoin at discounted costs prior to the then leg up.

Investor Capitulation?

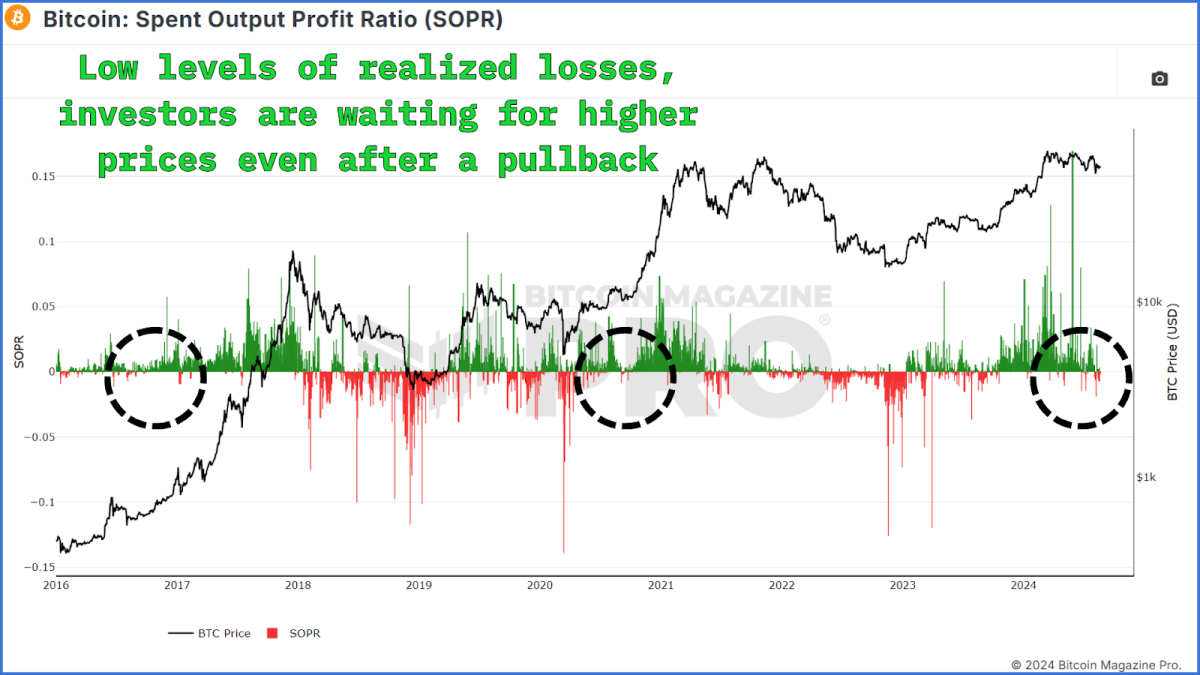

The Spent Output Benefit Ratio (SOPR) assesses whether or not Bitcoin holders are promoting at a benefit or a loss. When the SOPR is underneath 0, it means that extra holders are promoting at a loss, which is able to sign marketplace capitulation. Then again, contemporary SOPR information presentations just a few cases of promoting at a loss, that have been transient. This means that there is not any usual panic amongst Bitcoin holders, usually detectable right through a undergo marketplace’s early phases.

Within the moment, transient classes of promoting at a loss right through a bull cycle were adopted by way of vital worth will increase, as detectable within the 2020-2021 run-up. Due to this fact, the deficit of sustained losses and capitulation within the SOPR information helps the view that the bull cycle continues to be intact.

Diminishing Returns?

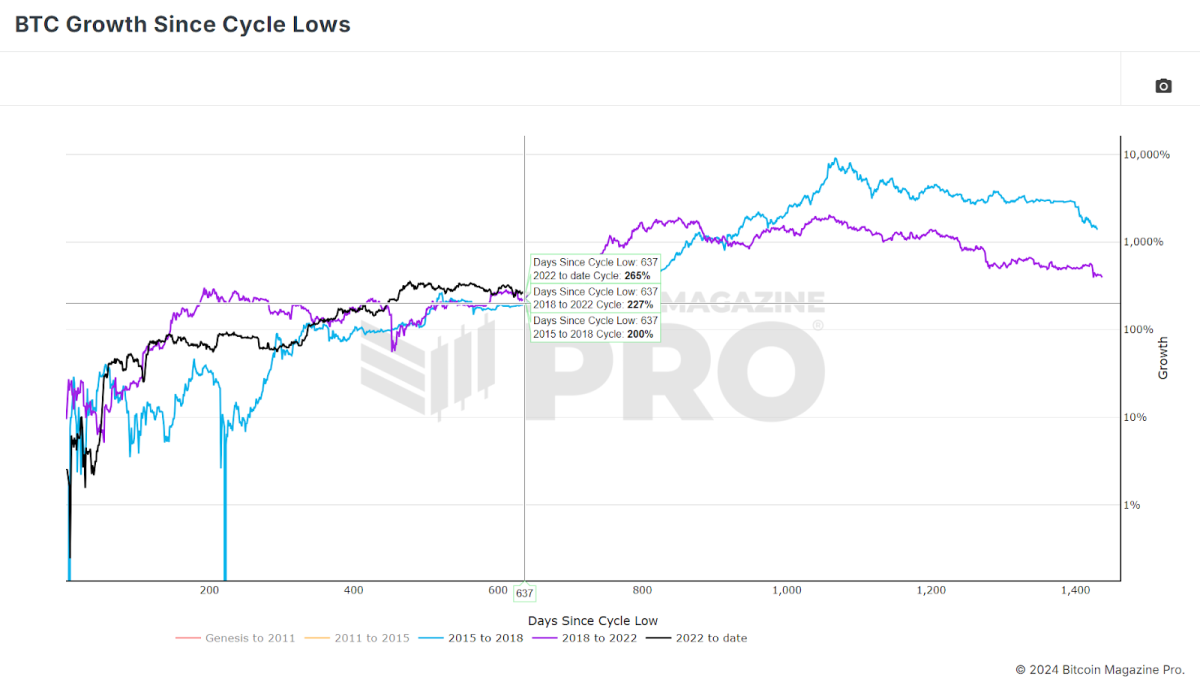

There’s a concept that every Bitcoin cycle has diminishing returns, with decrease proportion features than the former cycle. If we evaluate the tide cycle to earlier ones, it’s unclouded that Bitcoin has already outperformed each the 2015-2018 and 2018-2022 cycles referring to proportion features. This outperformance may counsel that Bitcoin has gotten forward of itself, necessitating a cooling-off length.

Then again, it’s additionally notable to needless to say this cooling-off length doesn’t ruthless the top of the bull marketplace. Traditionally, Bitcoin has skilled alike pauses prior to resuming its upward trajectory. Thus, date we may see extra sideways and even downward worth motion within the snip time period, this doesn’t essentially point out that the bull marketplace is over.

The Hash Ribbons Purchase Sign

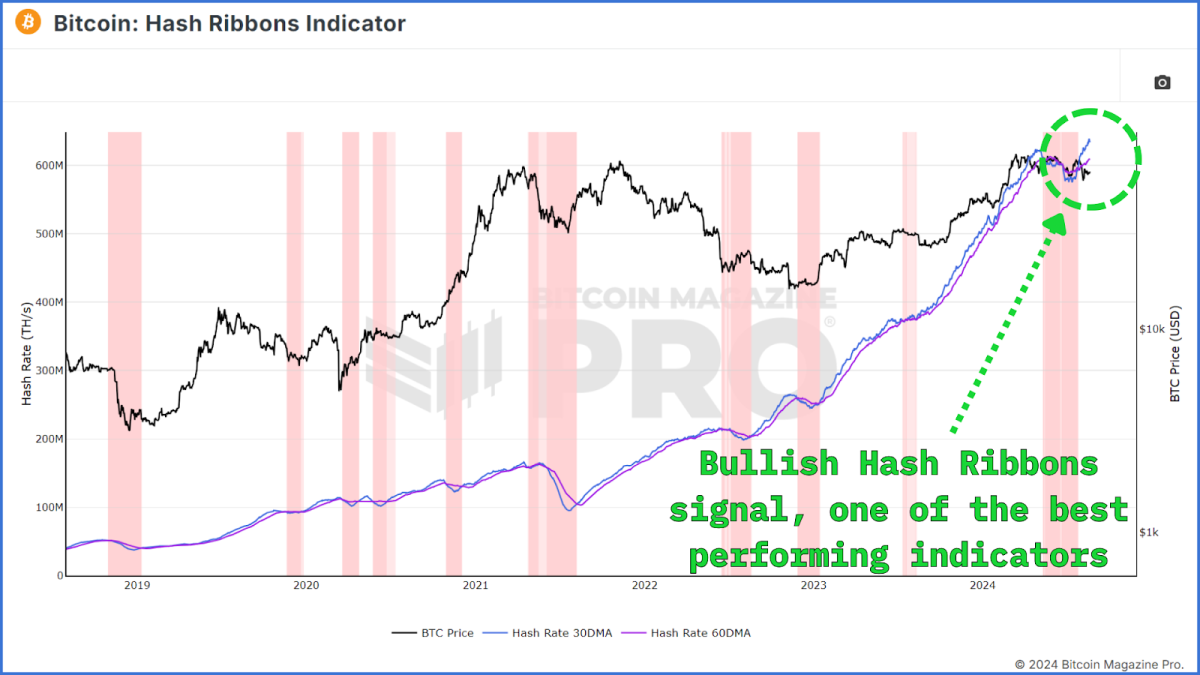

One of the vital promising signs for Bitcoin’s week worth motion is the Hash Ribbons Purchase Sign. This sign happens when the 30-day transferring reasonable of Bitcoin’s hash fee crosses above the 60-day transferring reasonable, indicating that miners are improving then a length of capitulation. The Hash Ribbons Purchase Sign has traditionally been a valuable indicator of bullish worth motion within the months that observe.

Not too long ago, Bitcoin has proven this purchase sign for the primary month for the reason that halving match previous this presen, suggesting that Bitcoin may see sure worth motion within the coming weeks and months.

Conclusion

In abstract, date there are indicators of defect within the Bitcoin marketplace, such because the dip within the MVRV Z-Rating and the STH Discovered Value, those metrics have proven alike habits in earlier bull cycles with out signaling the top of the marketplace. The deficit of usual capitulation, as indicated by way of the SOPR and the hot Hash Ribbons Purchase Sign, supplies additional self assurance that the bull cycle continues to be intact.

For a better glance into this matter, take a look at a up to date YouTube video right here: