It’s a truth that the majority buyers get started yearning the decrease timeframes.

In the beginning, it kind of feels like a very simple solution to build a handy guide a rough greenback…

…to start out raking in the ones weighty wins…

…and fulfil your dream of creating buying and selling your primary supply of source of revenue!

However next, what generally follows?

Dropping streaks start…

…accounts are probably blown up…

…you turn into utterly mentally tired!

Sooner or later, you begin to “outgrow” looking for decrease time frame earnings and get started transferring into upper timeframes.

However what if you made a decision to offer decrease time frame buying and selling yet another shot?…

…to in reality snatch the ways had to business at the 1 future time frame?…

Do you assume it might be usefulness it?

I definitely do!

That’s why in lately’s information, I’ll display you precisely the best way to business worth motion within the 1 future time frame.

In particular, you’ll be told…

- What explicit worth motion setups you must be searching for at the 1 future time frame

- What you want to seem out for at the day by day time frame ahead of buying and selling the 1 future time frame

- A step by step procedure on the best way to business worth motion within the 1 future time frame

- The “unheard” buying and selling tricks to succeeding buying and selling the decrease timeframes

In a position?

Later let’s get began.

The way to business worth motion within the 1 future time frame: What worth motion setups must you be searching for?

I’m certain you’ve got a bundle of burning questions presently…

“What setups do we trade?”

“How long should a trade last?”

“Do I need to watch the charts every single hour?”

Don’t concern, my pal.

As a result of I’ll solution all of the ones in please see divisions.

For now, let’s get started with the fundamentals and next determine the main points.

It’s a very powerful to grasp the context and the “why” of every thought till in the end, all of it comes in combination.

Tone just right?

So, at this level…

There are a ton of movies and guides on the best way to business worth motion, reminiscent of those:

The Value Motion Buying and selling Technique Information

And I agree, worth motion is in reality a vast subject to secure!

That’s why on this information, rather of feeding you the fundamentals of worth motion like a toddler…

I’ll percentage the very important 3 setups you want to reach buying and selling at the 1 future time frame.

Let’s start with the primary one…

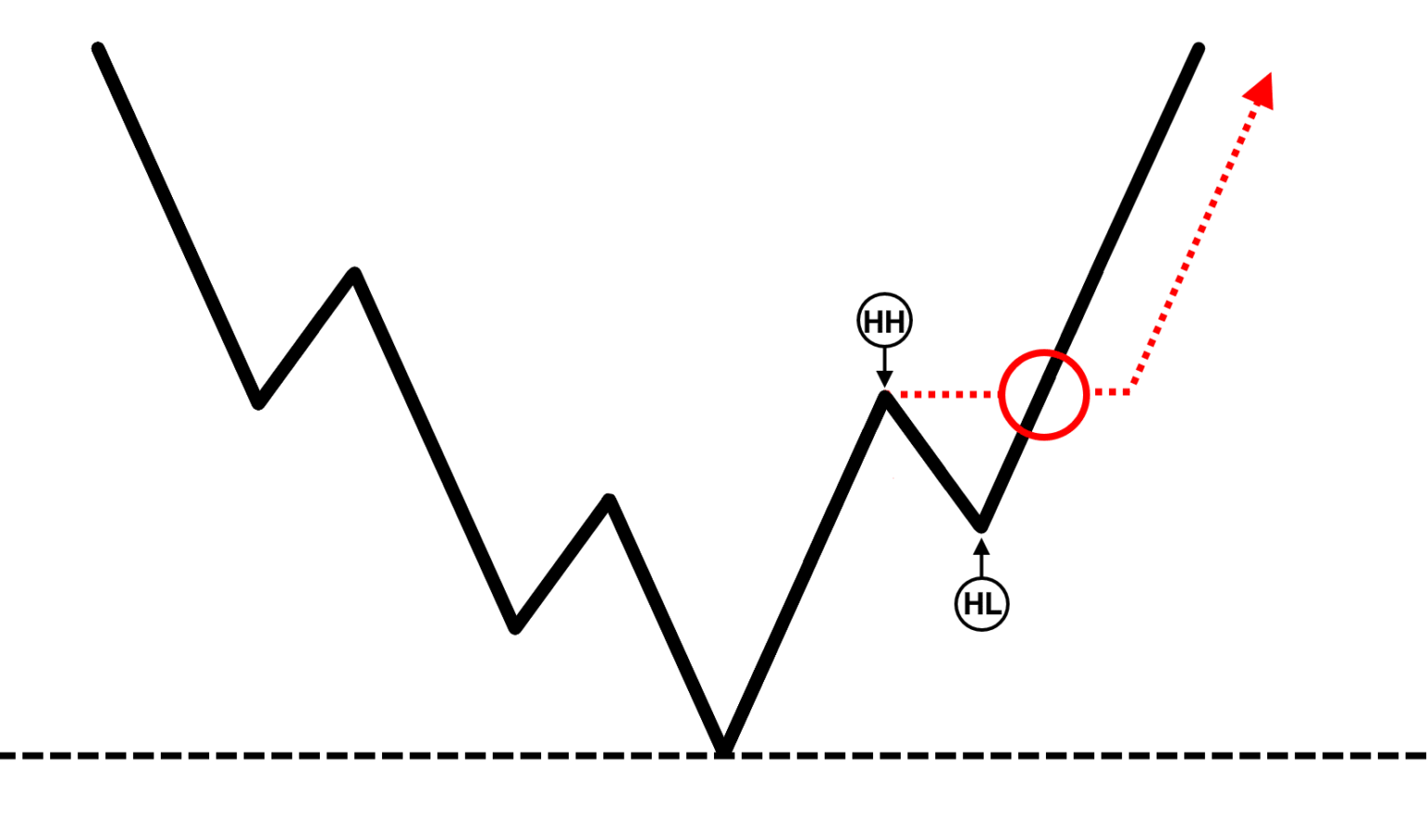

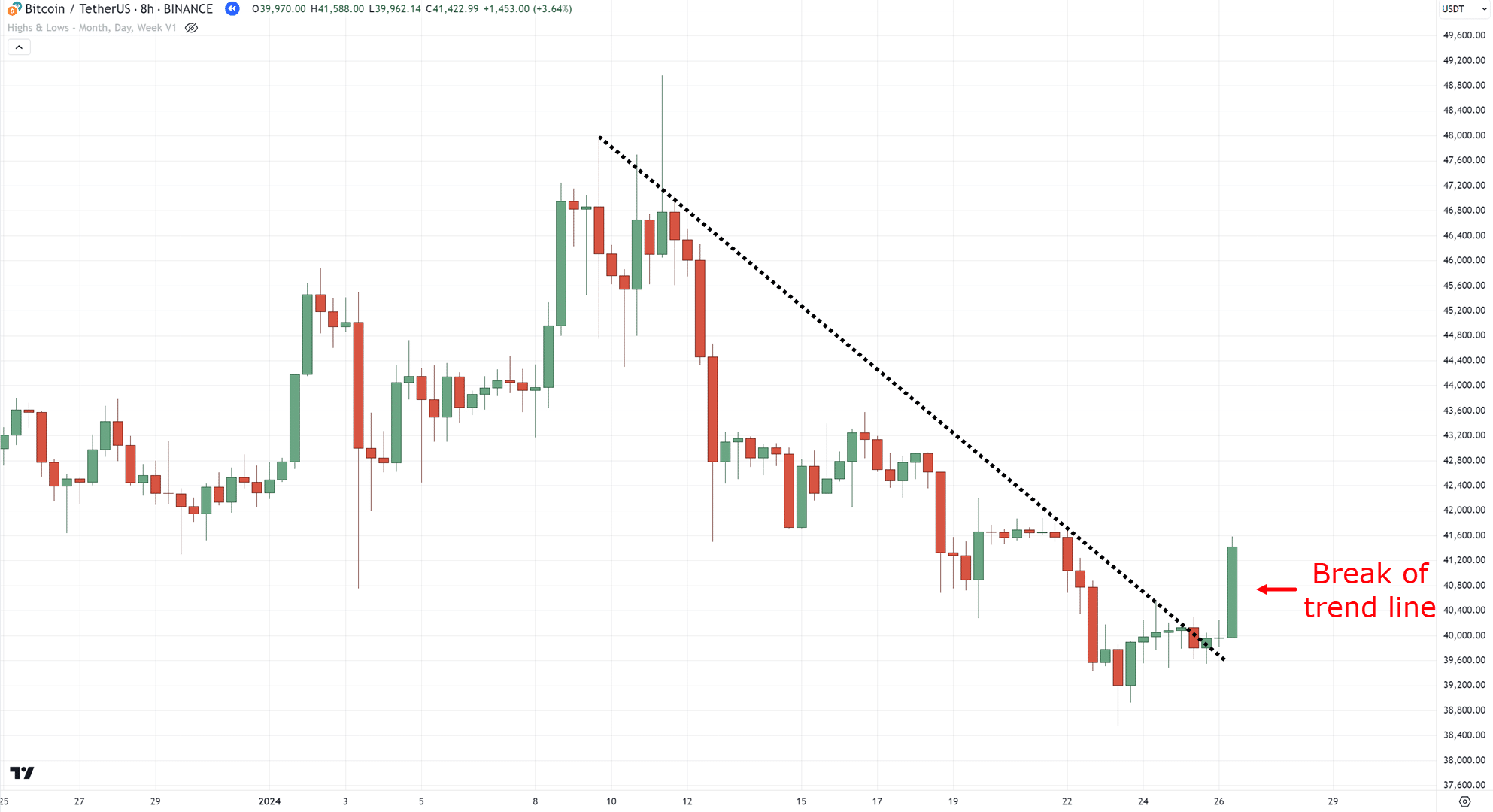

Crack of construction

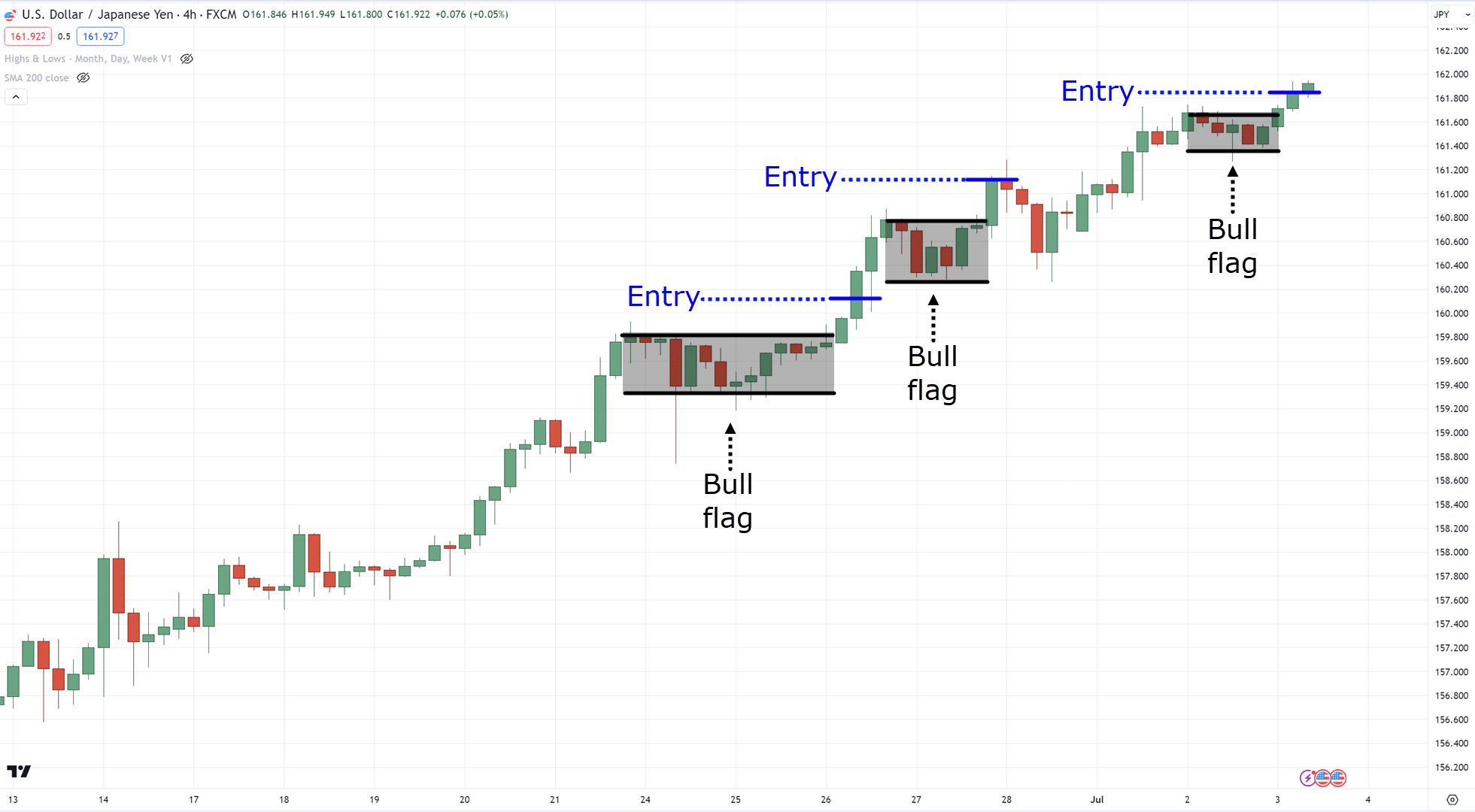

Simply because the representation presentations you…

This setup is a 3-step procedure.

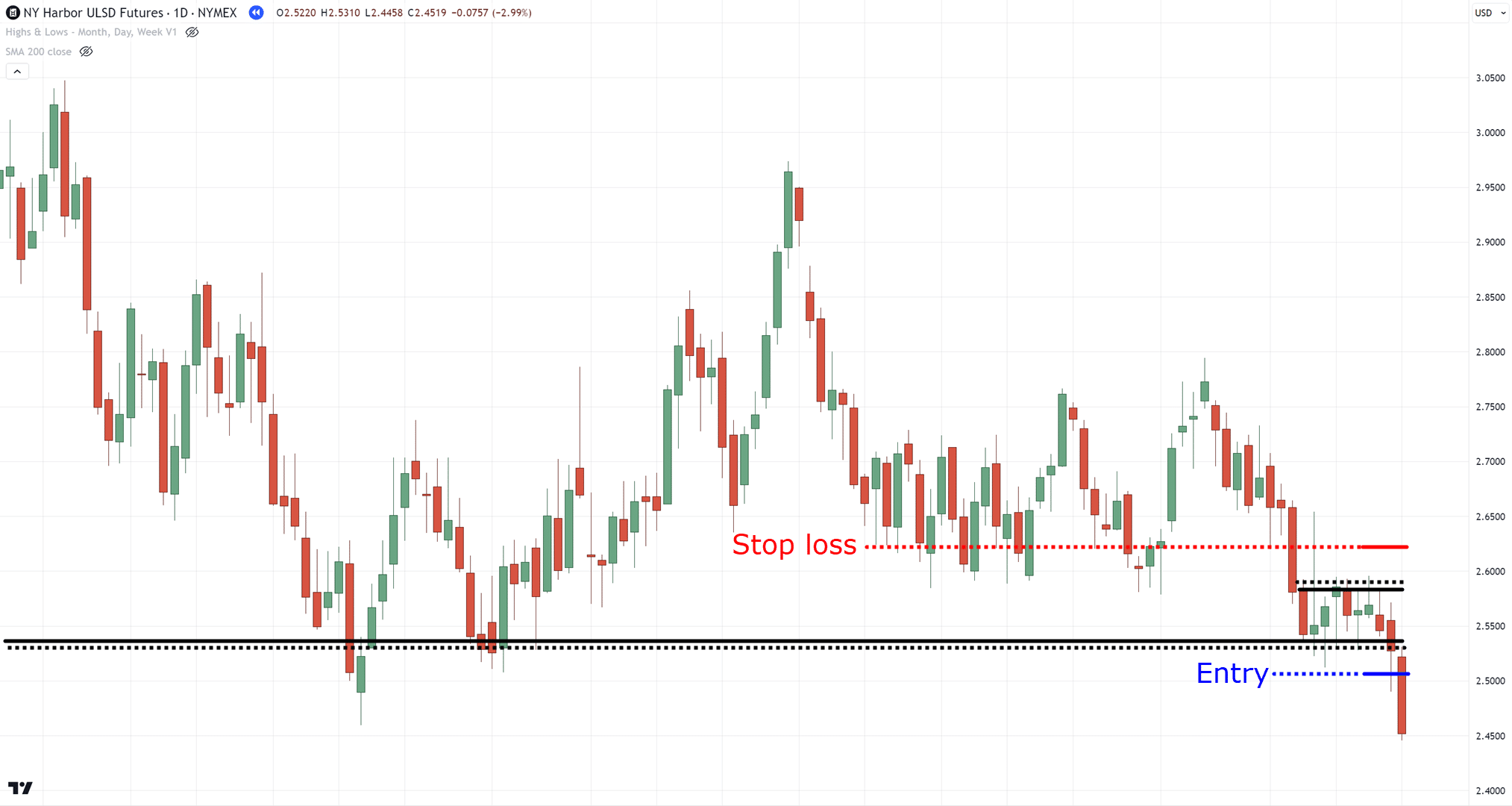

First, the cost should fracture above a pattern layout department of price…

2nd, the cost should build a flag trend or a consolidation…

(Construct certain you at all times take into account that the second one step is essentially the most a very powerful to this setup!)

3rd, the cost should fracture out from that flag trend…

It’s right here that our entries lie, as you must stay up for the candle to similar past the flag trend ahead of getting into the business.

Now, you could be pondering…

“Why this setup?”

Excellent query!

And the solution is extra easy than you’d assume.

This setup now not simplest detects marketplace reversals but in addition will provide you with the chance to experience that reversal with out “chasing” the marketplace.

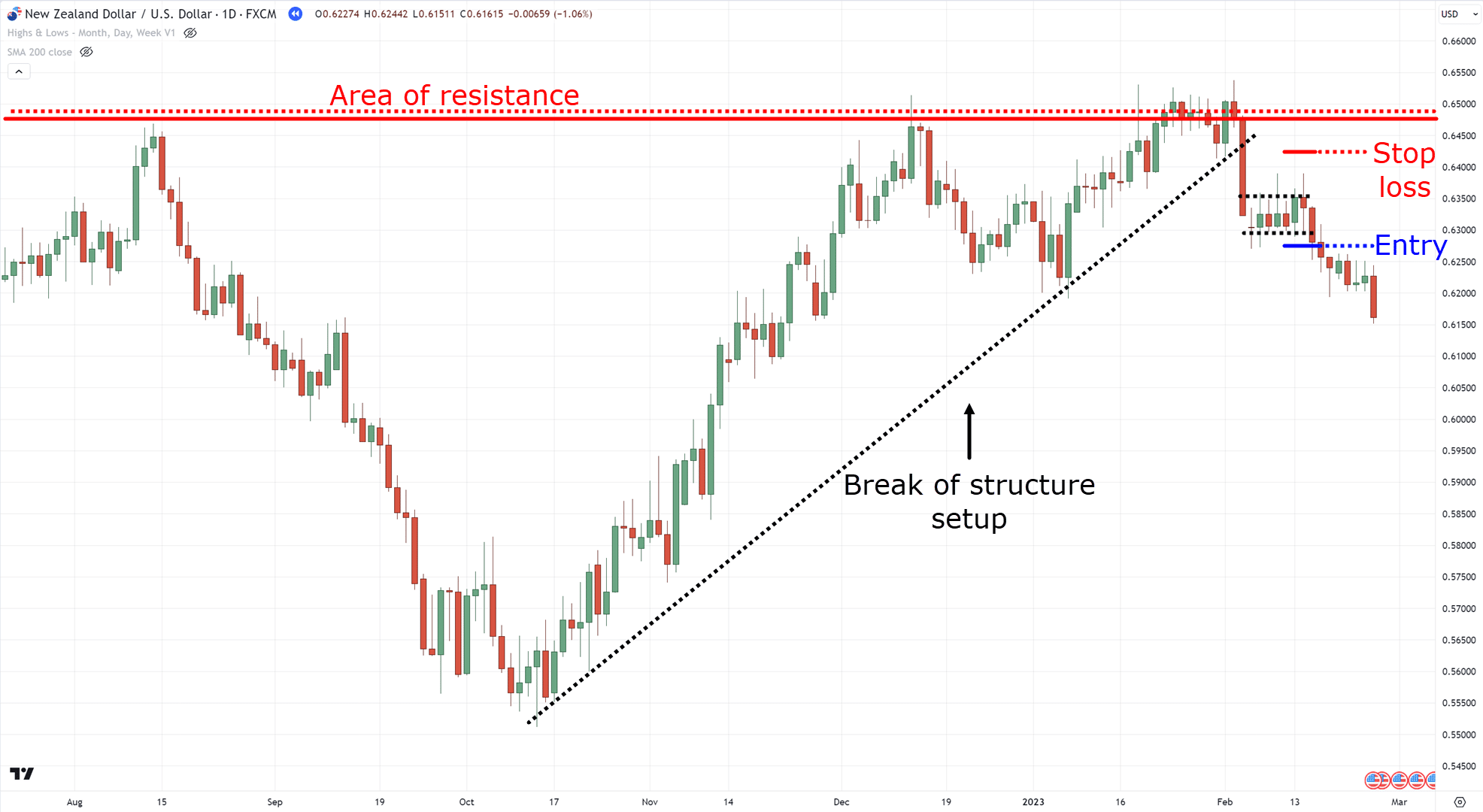

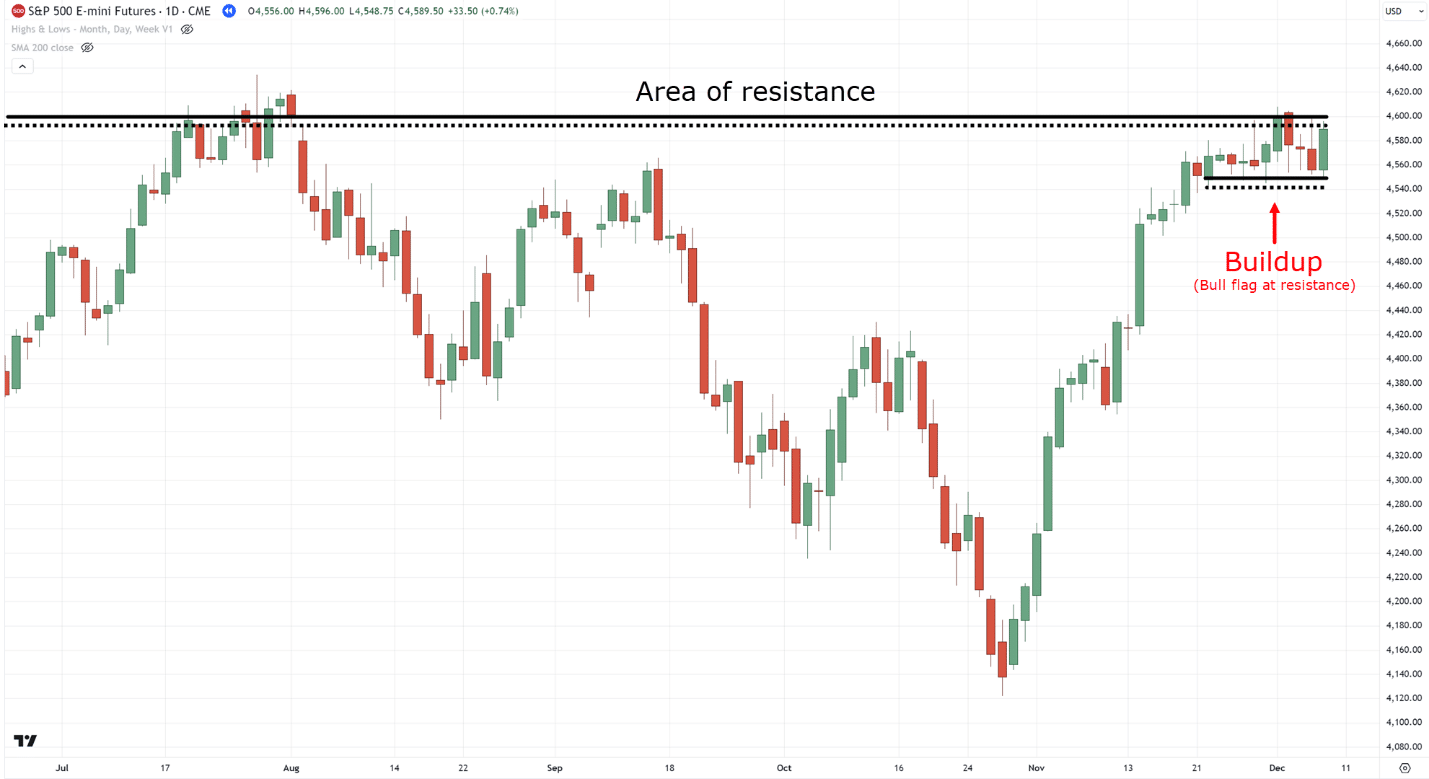

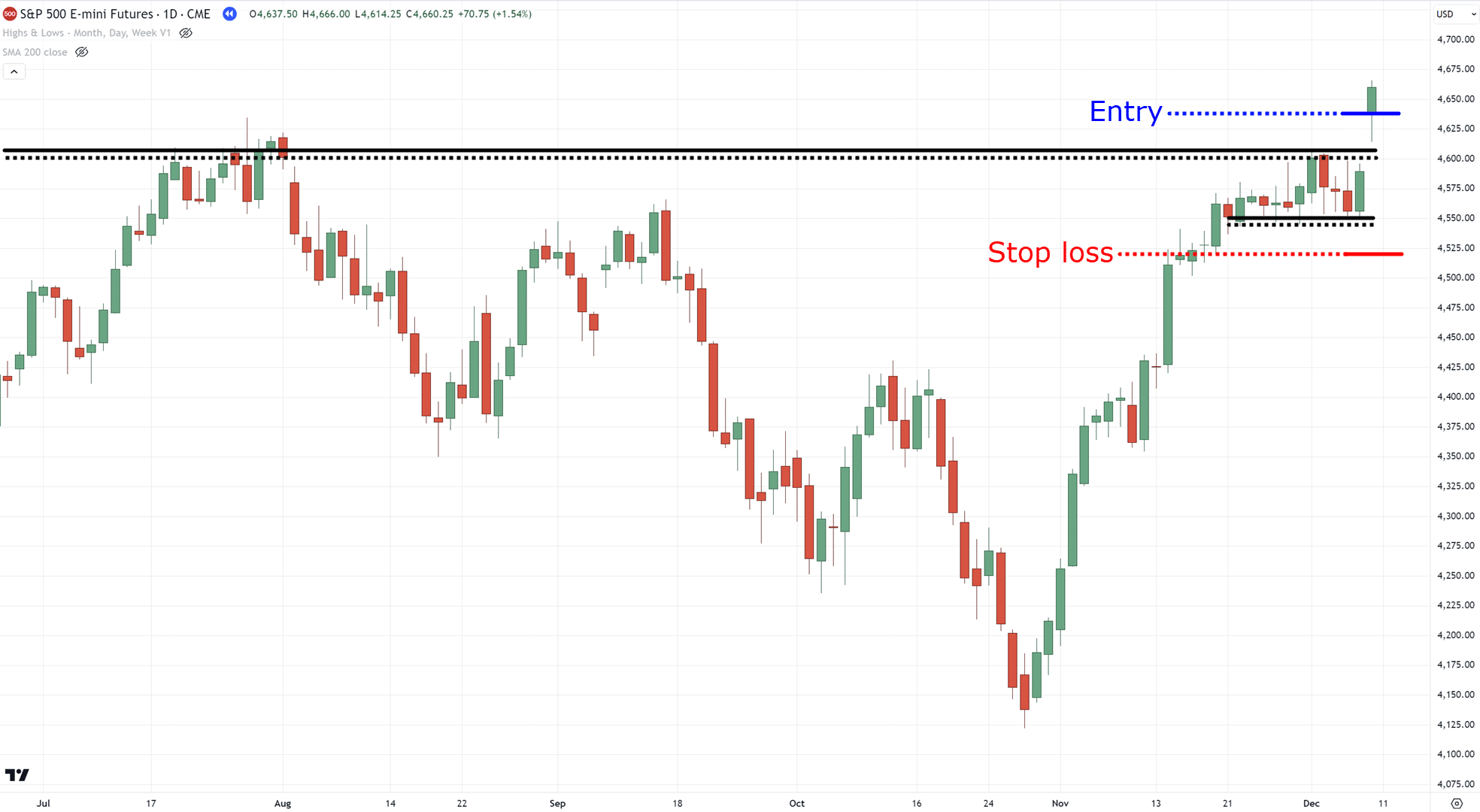

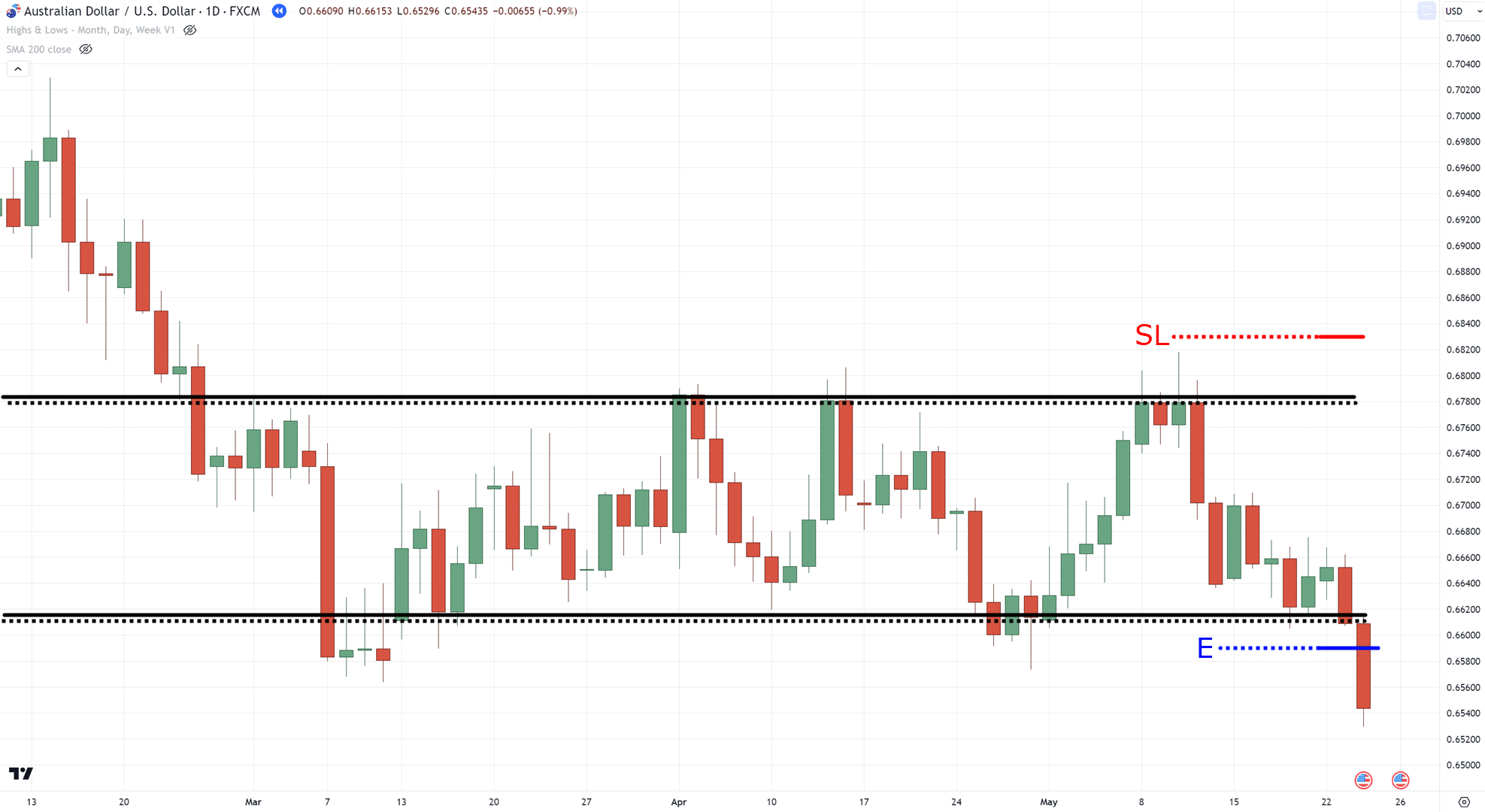

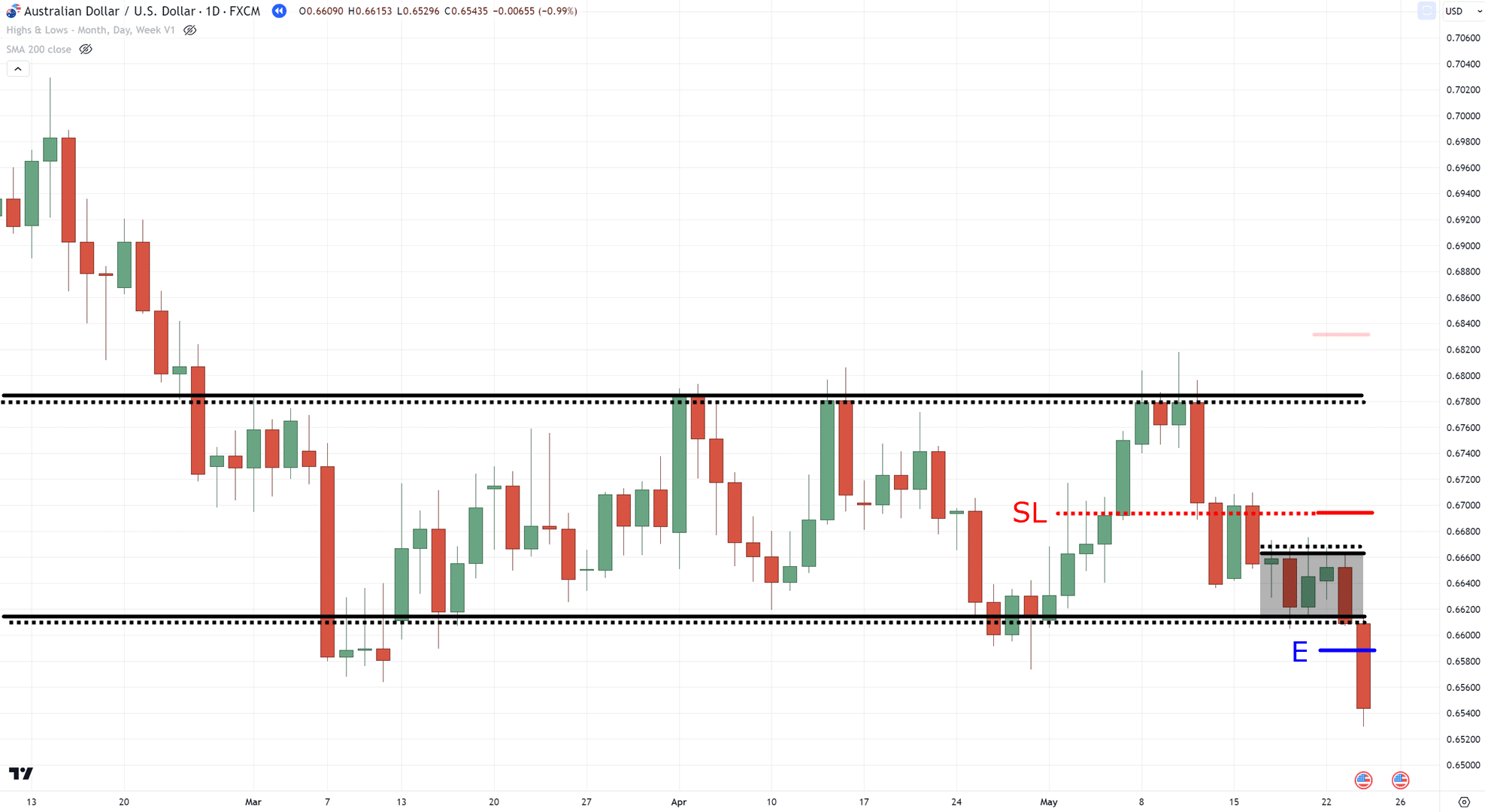

Take a look at this situation of the cost coming near a big department of resistance…

Are you able to see it?

Now, the second one setup is one thing it’s possible you’ll already be ordinary with…

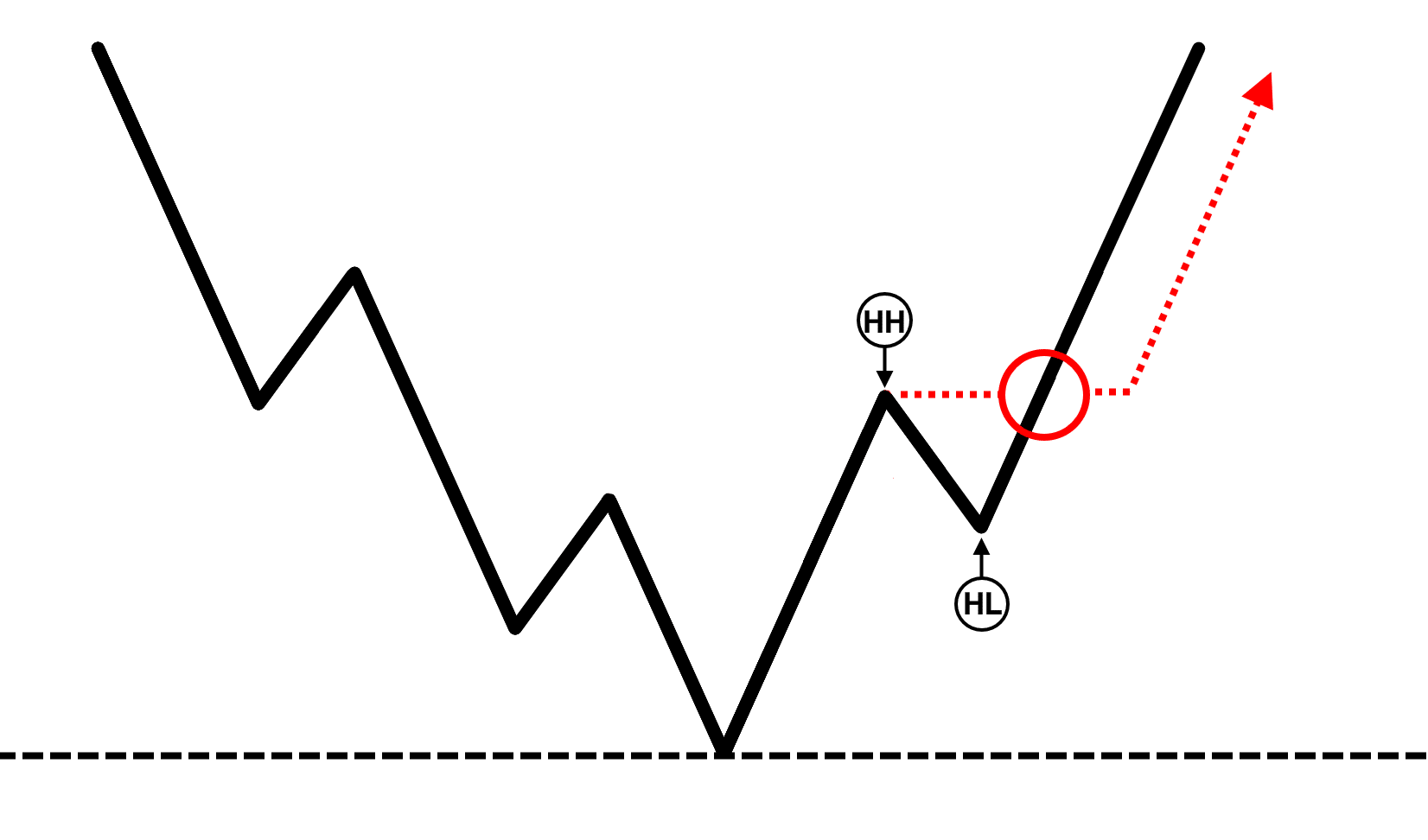

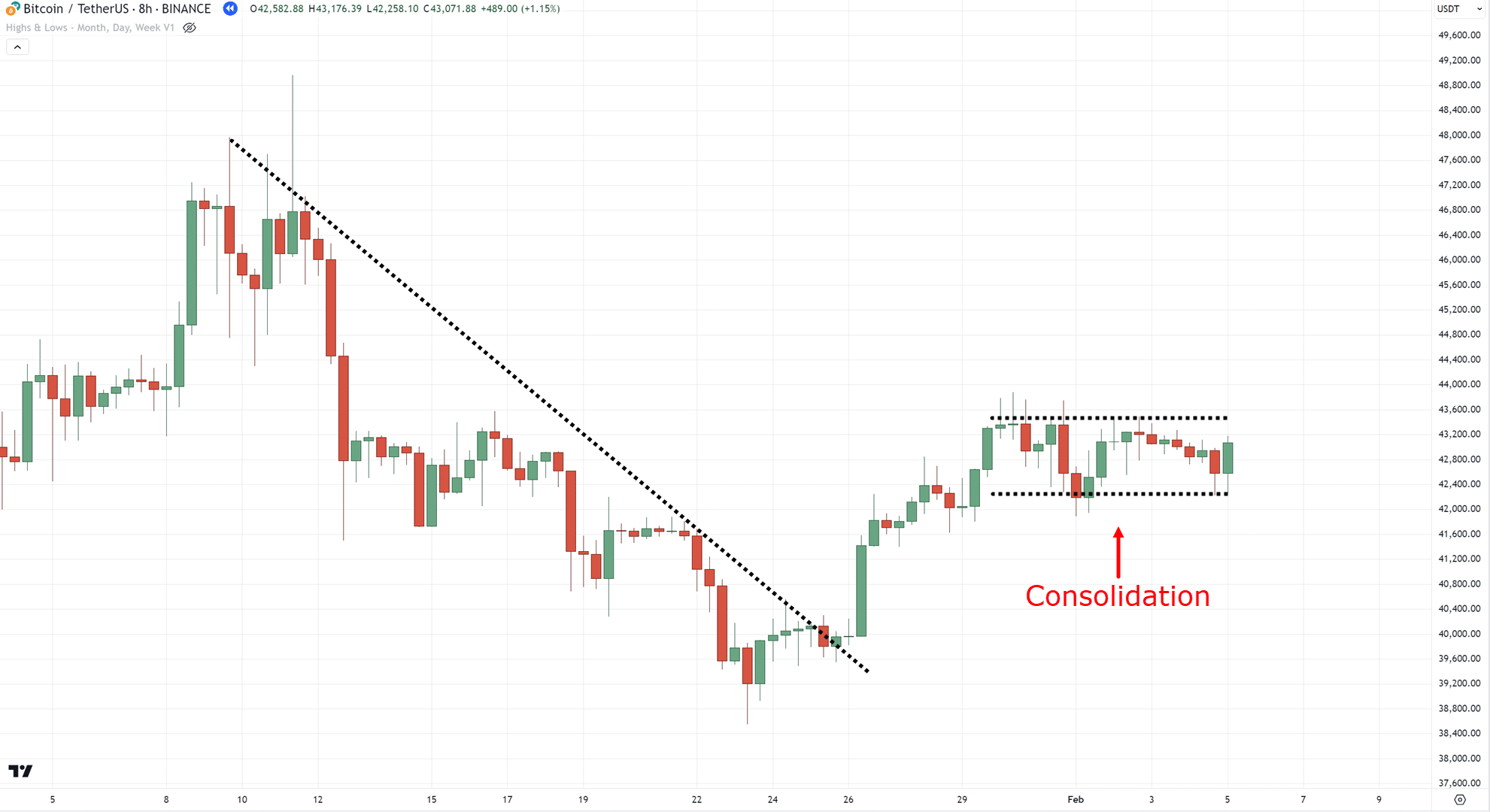

Buildups

What does this cruel?

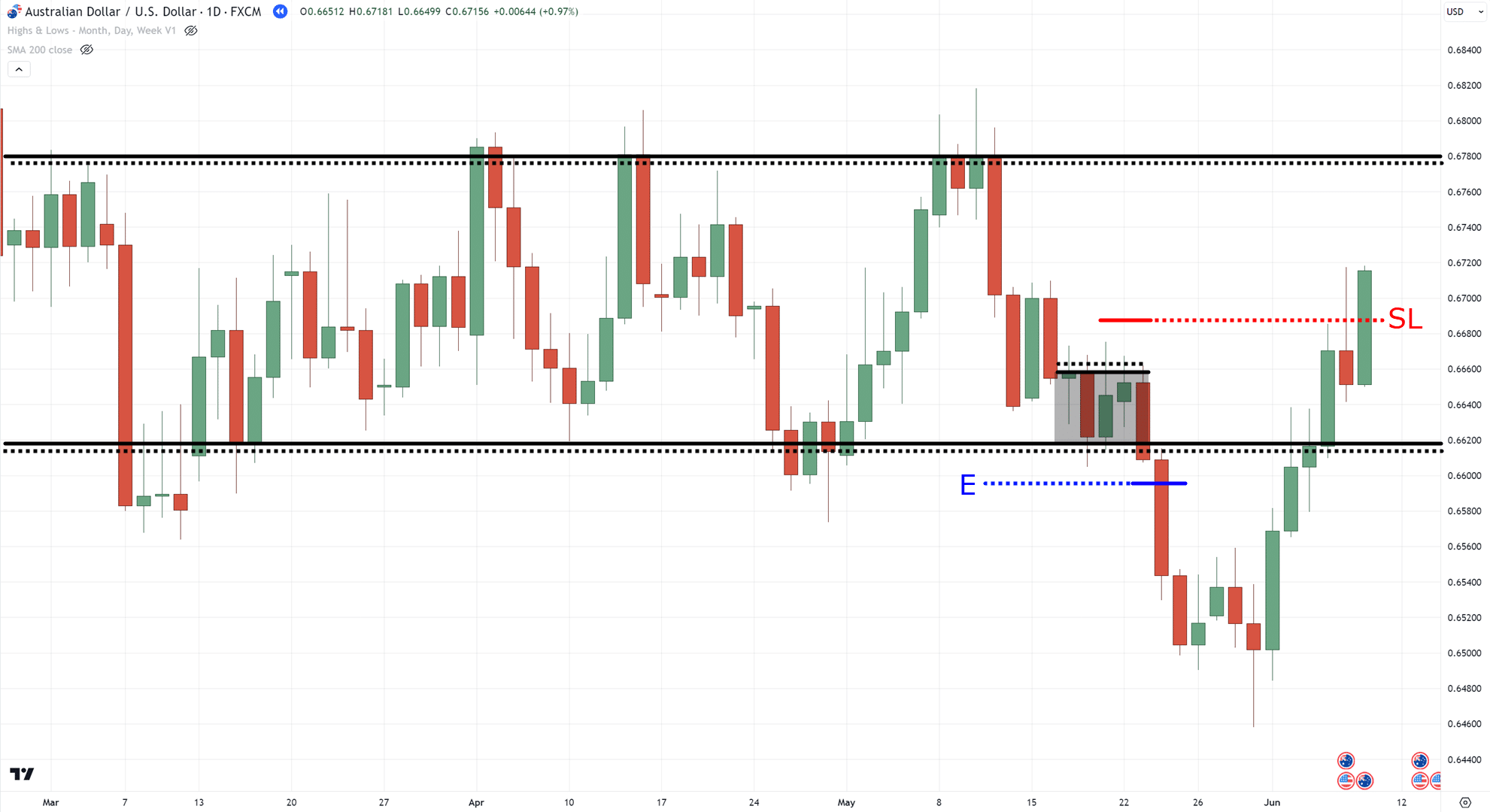

Smartly, it’s about looking ahead to a flag trend at an department of price.

Are you able to see a flag trend soaring at resistance?…

Excellent, as it presentations that the consumers are already on the gates – about to fracture them evident!…

A really bullish setup!

It’s in fact the similar as looking ahead to a “buildup” on the department of aid, simply in the wrong way…

Construct sense?

Alright, next why this setup?

The primary explanation why is that through looking ahead to a buildup, you keep away from being “prey” to fake breakouts many of the date, as you let the marketplace play games its hand first through appearing a buildup!

Were given it?

Finally, we have now…

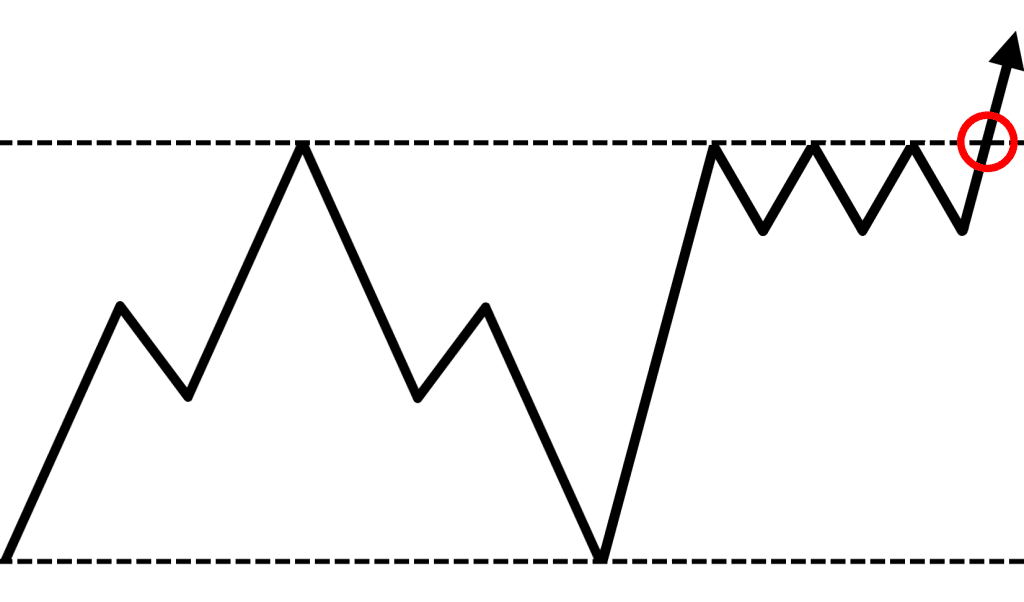

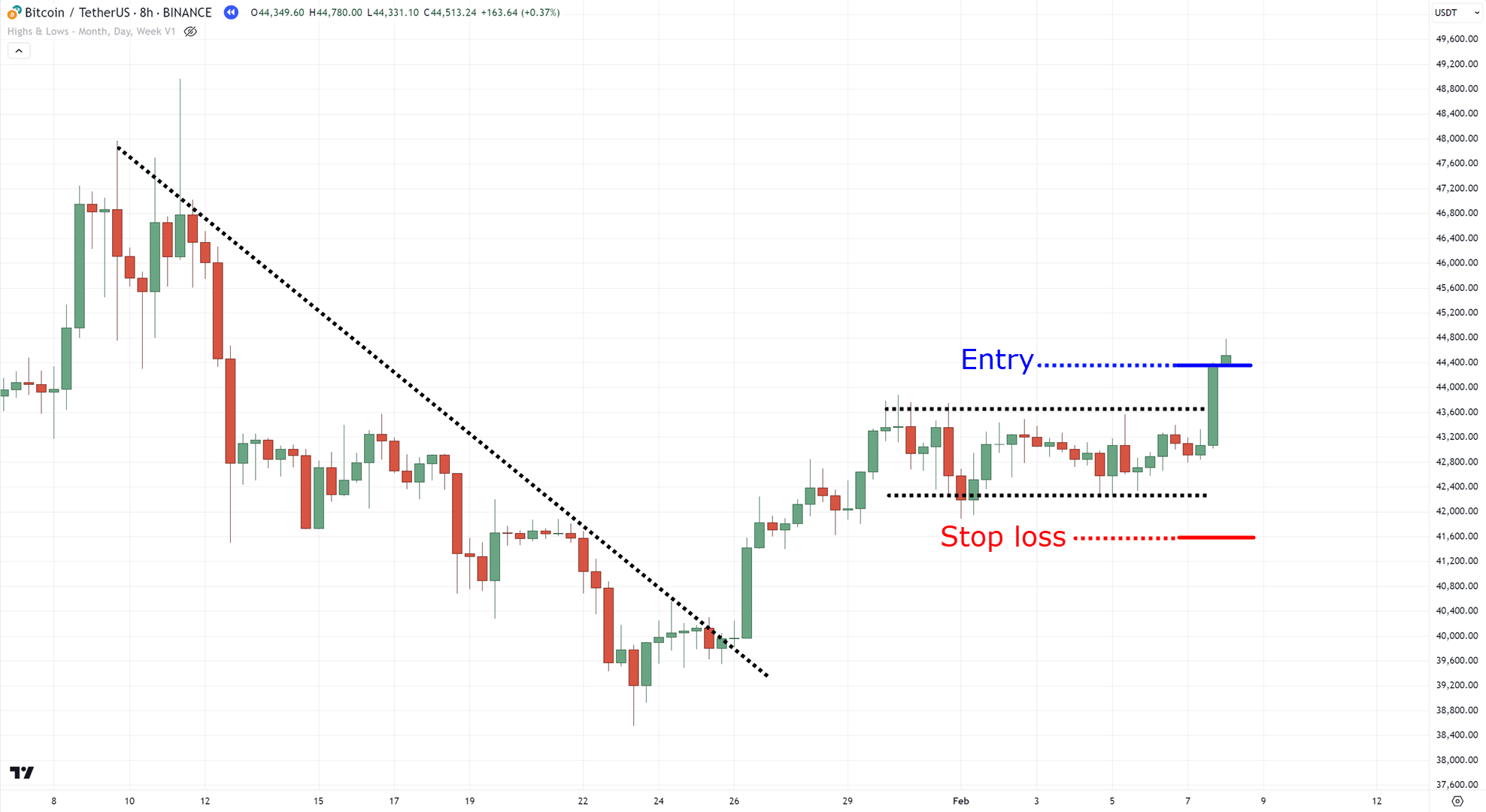

Pattern Continuation

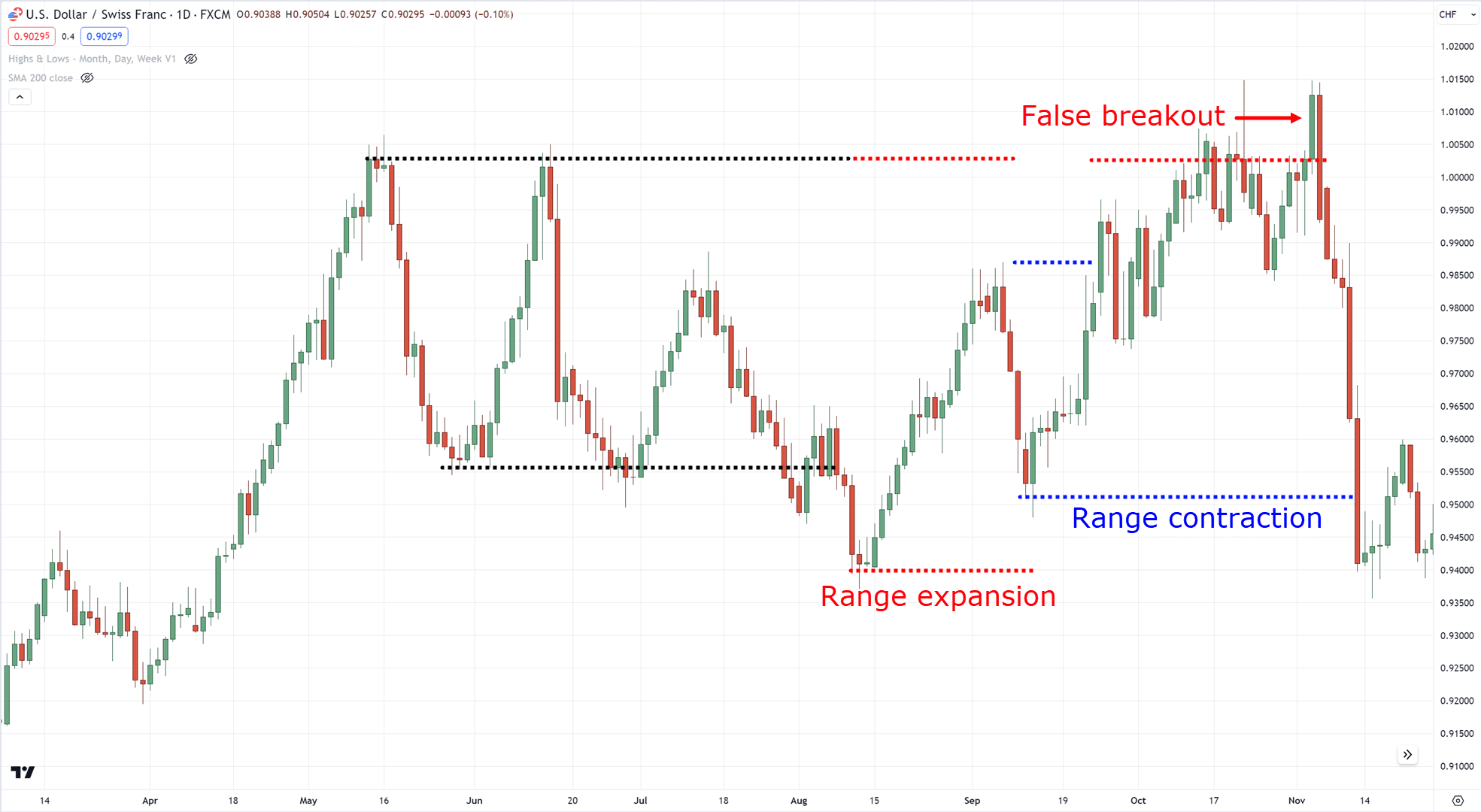

On every occasion there’s a undergo marketplace or a uneven marketplace, buying and selling the markets turns into tough, proper?

Heaps of fake alerts!

A whole lot of “market manipulation!”…

However as soon as there’s a pattern in play games?…

The whole lot turns out so easy!

It’s those marketplace statuses which might be essentially the most ideally suited to business.

Then again, regardless of how some distance the rage is going, you at all times should input objectively, reminiscent of through looking ahead to a flag trend…

Easy pattern, easy setups!

At this level, I’m certain you understand that we’re buying and selling a host of flag patterns.

And also you’re proper!

So simple as they’re, flag patterns trade in you essentially the most function method to go into the markets.

However maximum of all, they assist you to have a greater risk-to-reward ratio.

In lieu of hanging your stops above resistance on breakout…

Looking forward to a flag trend would provide you with a greater reference level on the place to playground a tighter cancel loss…

Nice-looking tough stuff, proper?

The flag trend lets you have a greater risk-to-reward ratio, however on the identical date, it additionally temporarily indicators you in case your buying and selling thought has been invalidated…

Something, although.

It’s usefulness remembering that “there’s no such thing as a guarantee” unquestionably applies right here!

The flag trend can fail as neatly, similar to all setups in the market.

However now that you’ve got a setup that may business traits, reversals, and breakouts…

I’ll percentage with you why integrating the day by day time frame into your 1 future buying and selling is remarkable (and what you must be searching for)

Why you want to have a look at the day by day time frame for the best way to business worth motion within the 1 future time frame

One promise…

Marketplace variety.

Every now and then, it’s possible you’ll listen buyers ask:

“Out of all the thousands of stocks out there, how do you choose which ones to trade?”

A conserve clear out, in fact!

“How do you choose which forex pairs to trade?”

On this case, a forex power meter!

“How about crypto?”

You’ll make a selection to business crypto in response to marketplace capitalization!

There may also be some ways to choose markets to business, however the principle takeaway is that this:

You’ll’t simply make a selection which markets to business in response to alternative community’s evaluations or research.

You should have a marketplace variety rule…

…a constant method to choose markets to business!

So, how do you select which markets to business at the 1 future date body?

Have a look at the day by day time frame

The decrease the time frame, the extra a very powerful it’s to hunt affirmation in a better time frame!

After all, some would argue that you’ll simply keep on with one time frame.

Then again…

Taking a look on the day by day time frame now not simplest will provide you with a constant solution to business worth motion within the 1 future time frame, but in addition will increase the anticipation of a hit trades.

And also you could be pondering…

“Alright, what exactly do we look for on the daily timeframe?”

Right here’s the trade in:

I will be able to provide you with two forms that experience labored for me in addition to for lots of scholars and coaches.

However ahead of buying and selling it live to tell the tale the markets…

You should do your personal again checking out first, as you must by no means pluck the entirety at face price.

With that indubitably, let’s get began!

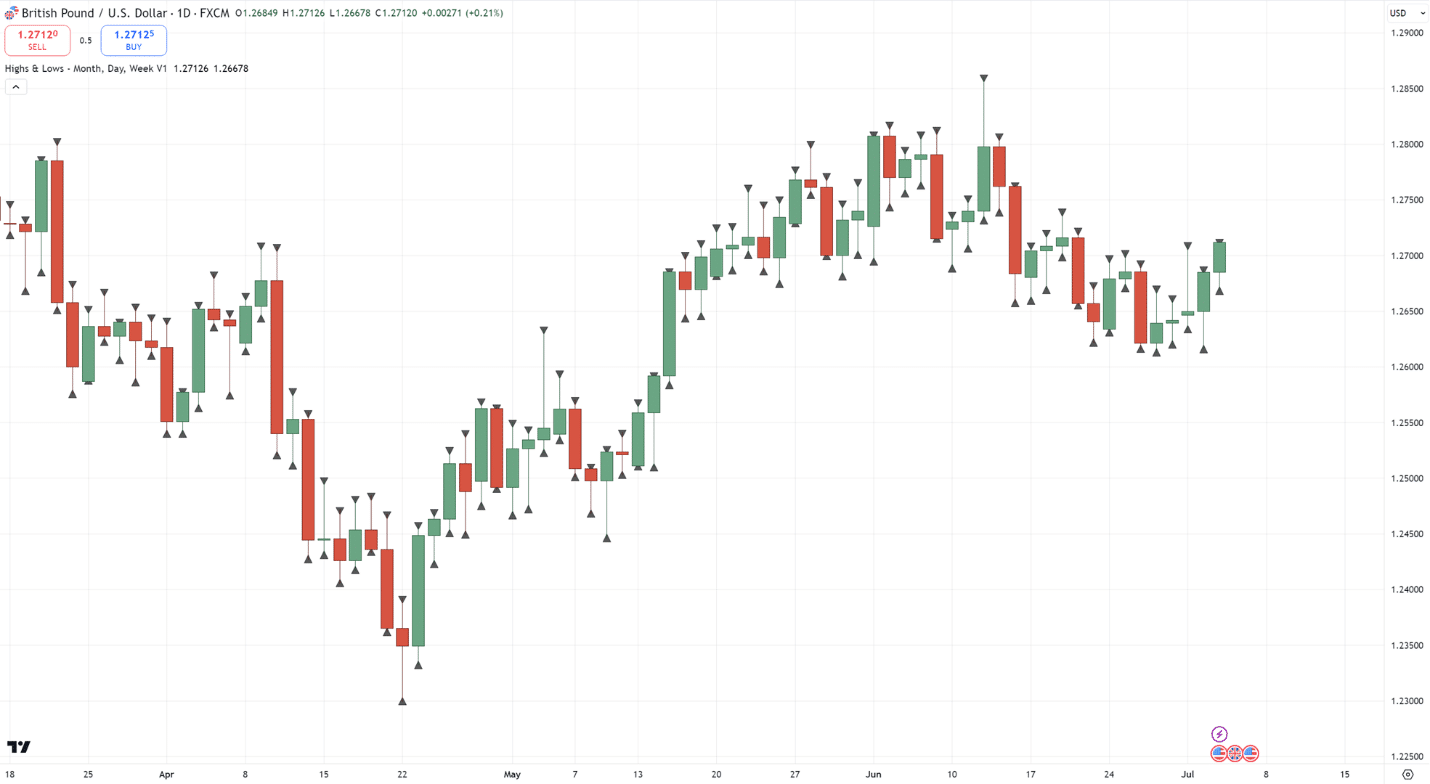

Earlier pace highs and lows

Of the 2 forms I’ll percentage with you, this one is the most straightforward.

That’s as a result of you’ll explode it even with out a trademark (although having one will backup).

The concept that is inconspicuous – simply pluck the highs and lows of the day by day time frame…

And next merely travel ill the 1 future time frame…

Mainly, the former day by day highs and lows work as an department of price in your chart…

Take into accout that we don’t imagine the “current” day by day highs and lows as you’d wish to reference the former day by day highs and lows!

So, the best way to business worth motion within the 1 future time frame the use of this form?

Smartly – stay up for reversals by way of fracture of construction!…

That is in particular helpful, as you don’t essentially want to have a look at the day by day time frame.

Then again, the indicator (which is named the Highs & Lows through UnknownUnicorn on TradingView) presentations the information from the day by day time frame.

However there’s one caveat to this form…

Right through trending markets, the cost will generally tend to fracture its earlier pace’s top or low.

On this case, you utility the accumulation setup across the earlier day by day highs…

Mainly, stay up for a bull flag trend starting across the earlier pace’s top or a undergo flag trend at the earlier pace’s low.

Were given it?

For taking earnings, you’ll at all times imagine hanging your objectives ahead of the former day by day top (if lengthy)…

However for trending markets, imagine trailing your cancel loss the use of a temporary transferring reasonable such because the 20 MA…

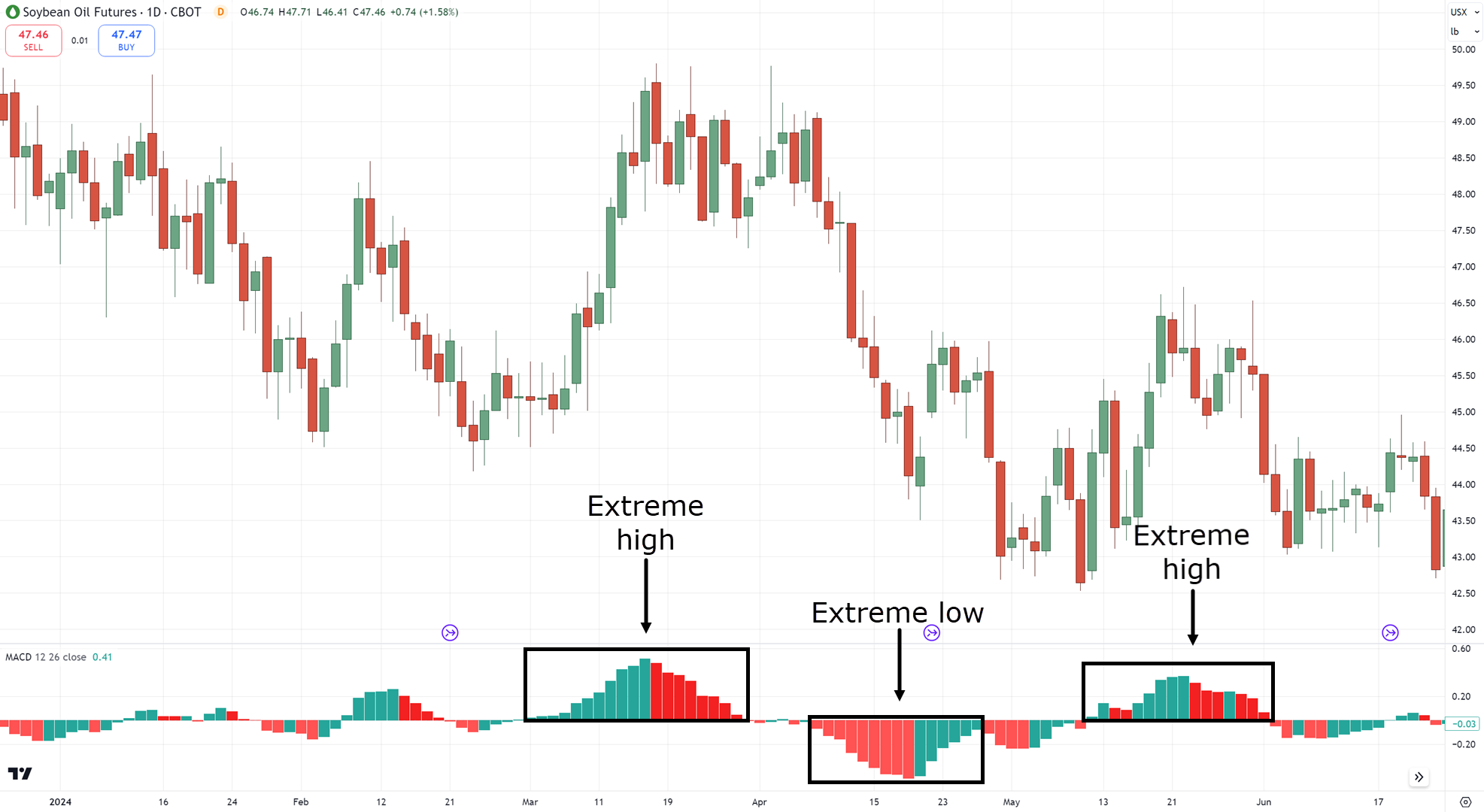

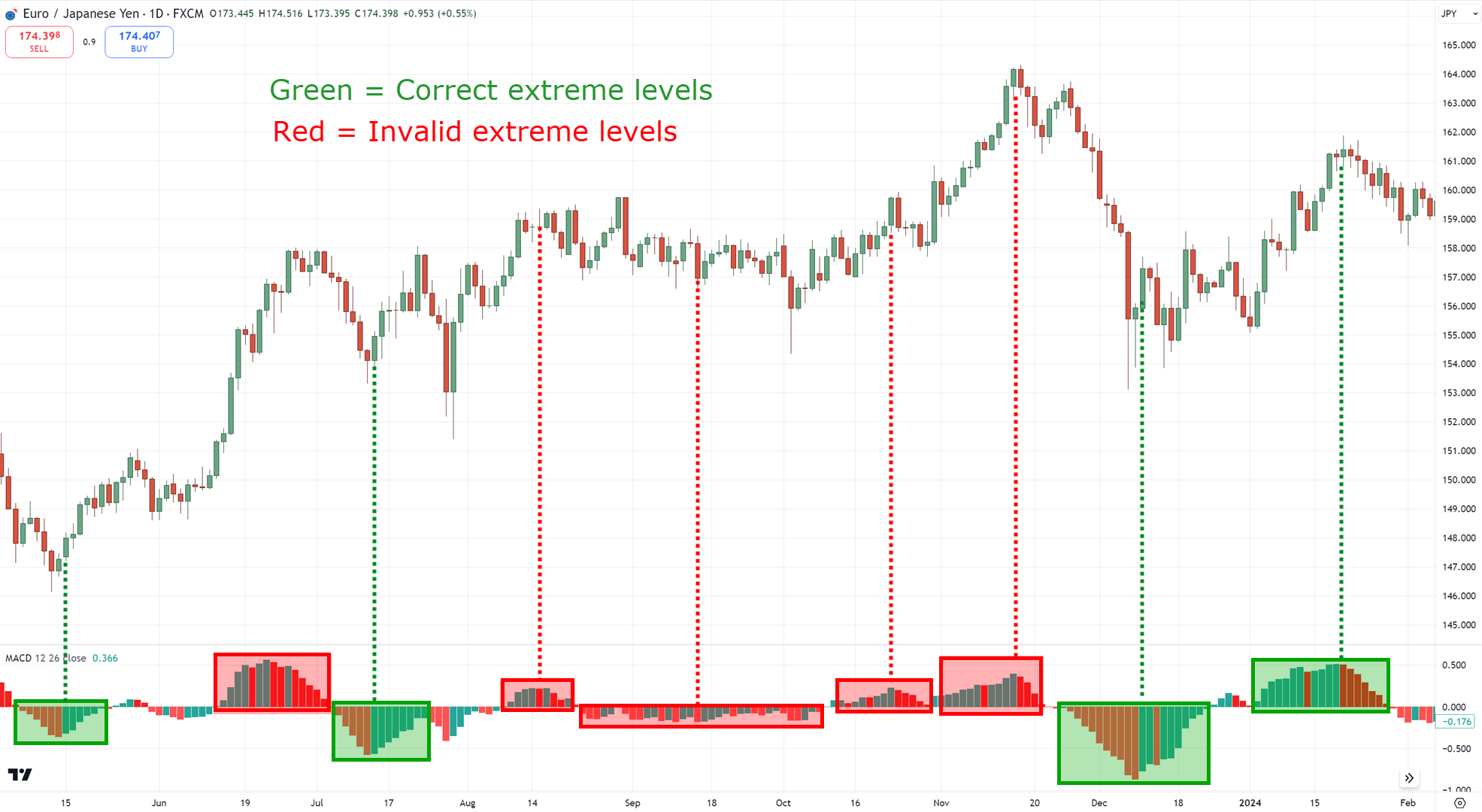

Last MACD ranges

I’ve to confess.

I discovered this form from Darek Dargo which you’ll take a look at in his interview with Rayner right here:

The the Forex market Dealer With 86% Profitable Fee (With Darek Dargo)

So, it’s simplest honest to offer him credit score for this form!

However mainly…

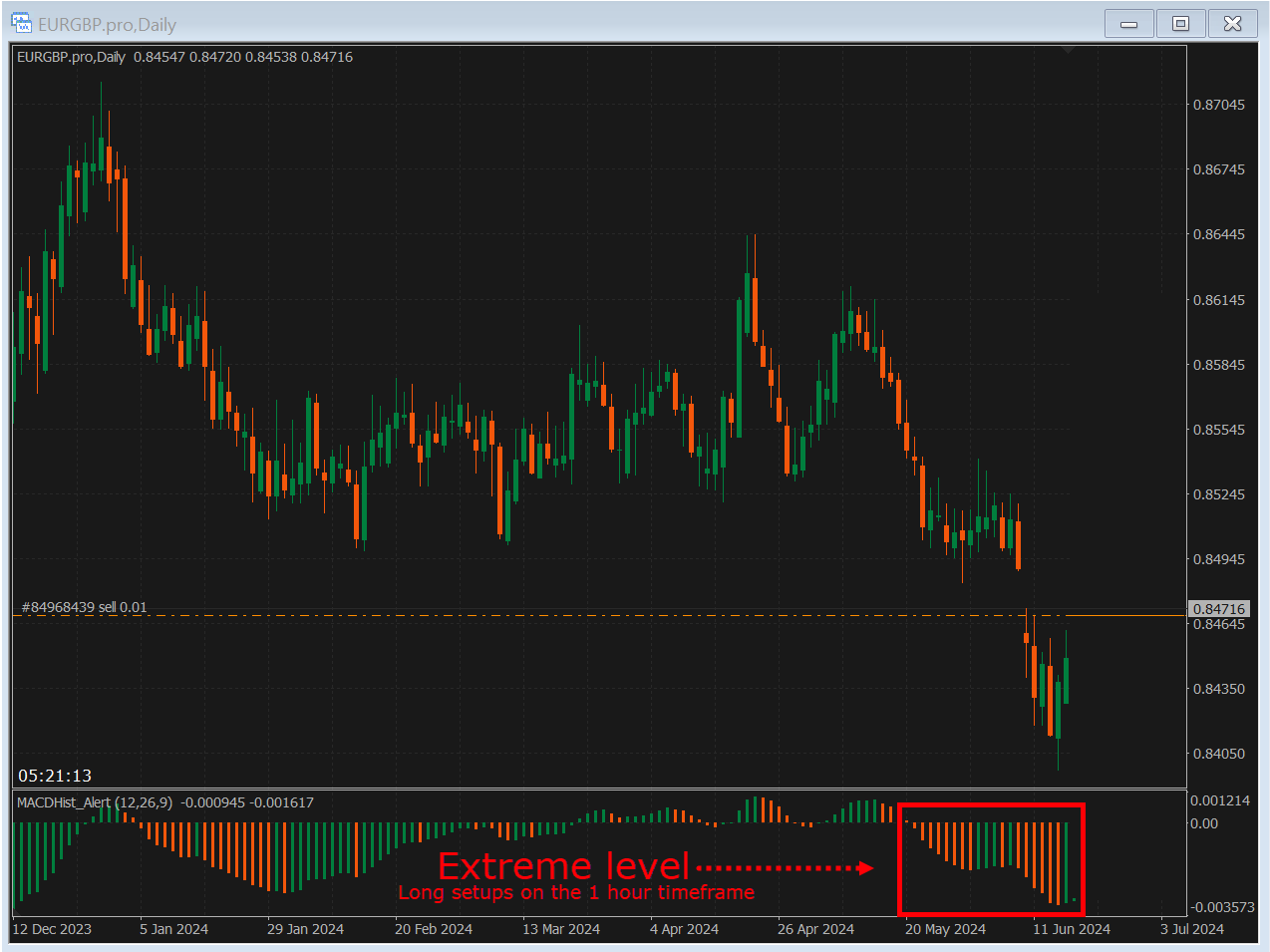

You wish to have to have a look at the “extremes” at the MACD histogram (default values) on the day by day time frame…

Recognizing those extremes at the day by day time frame will pluck apply!

You want to be informed what’s an ultimate stage and what isn’t…

However if you spot one…

It’s just a topic of date ahead of the marketplace snaps again, like an overstretched rubber band!

Now, how are you able to utility this to business the 1 future time frame?

First, spot an ultimate stage at the MACD histogram at the day by day time frame this is forming to opposite…

While you see it, travel all the way down to the decrease time frame and business worth motion within the path of the prospective reversal…

This form is especially helpful because it doesn’t simply assist you to simply spot doable reversals out there and is helping you see setups in your watchlist, which I’ll percentage with you nearest.

Now, as for taking earnings…

Darek ceaselessly makes use of a 1:1 risk-to-reward ratio to retain this win charge top…

However you’re additionally independent to compromise through having a bias pluck benefit and next taking whole earnings on the upcoming department of price…

Construct sense?

Superior!

At this level, you’ve discovered a couple of worth motion setups to business at the 1 future time frame.

Now not simplest that!

You’ve additionally discovered how to choose markets to business.

Then again, there’s one explicit subject that buyers don’t ceaselessly discuss, if in any respect…

And that’s the buying and selling regimen.

Let me percentage extra with you within the later division…

The way to business worth motion within the 1 future time frame: When must you test your charts?

This subject is ceaselessly essentially the most overpassed but essentially the most remarkable.

Why?

As a result of you need to regard buying and selling as a trade rather of a pastime!

You want a constant buying and selling regimen on when and when to not test your charts.

As a result of let’s face it…

On markets reminiscent of foreign exchange and crypto, you’ll’t be conscious all of the date!

So, going again to the query – when must you test your charts?

Smartly, a buying and selling regimen all the way through a pace may also be segregated into 3 portions:

- Watchlist construction (early morning)

- Execution (intermission checking all the way through the pace)

- Journaling (each and every weekend)

Let me give an explanation for…

Watchlist construction (early morning)

That is the place you are taking a similar have a look at your watchlist to peer doable trades for the residue of the pace.

I counsel you do that within the morning.

While you’ve analyzed each and every marketplace in your watchlist…

You’ll hone it to a couple of markets that you’re going to observe or explode throughout the pace.

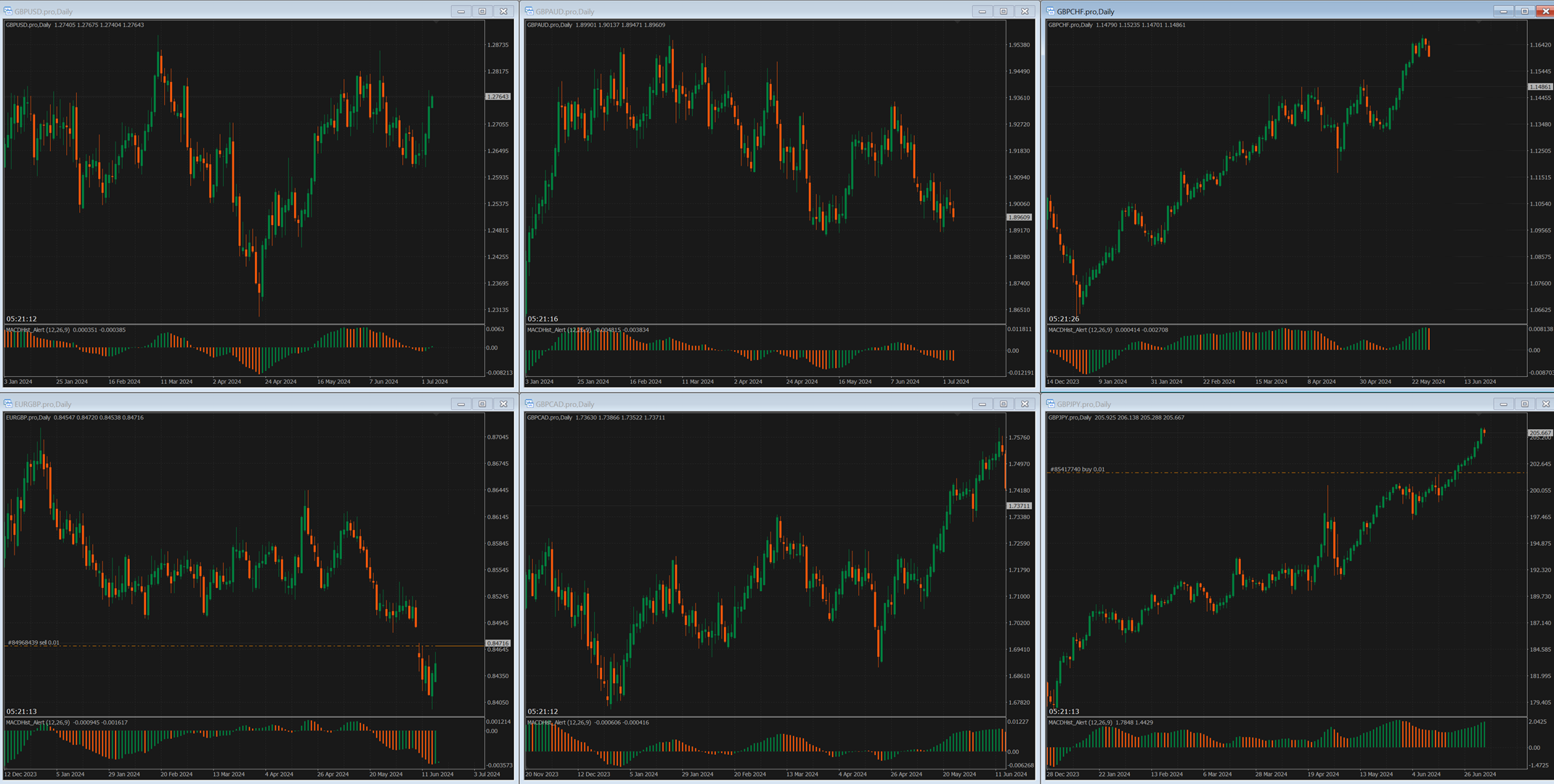

Let’s pluck foreign exchange an illustration.

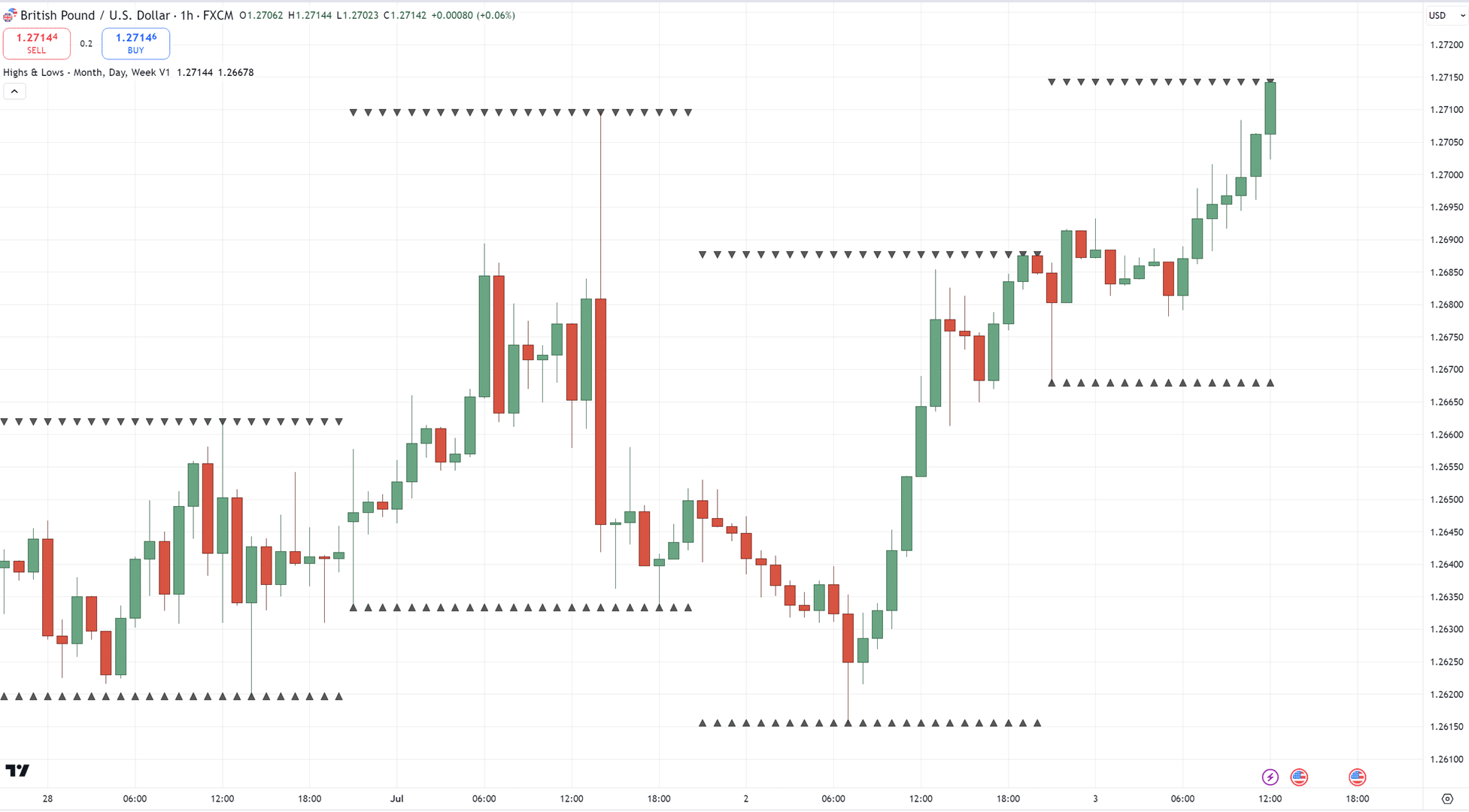

As you’ll see beneath, that is my watchlist for the GBP crosses…

If we pluck Darek’s ultimate MACD form an illustration…

Which of the markets are recently at their extremes?

That’s proper! You could have EURGBP and GBPCHF…

Now, what this implies is that for the residue of the pace, you’ll carefully have a look at the ones pairs completely and in finding setups within the 1 future time frame!

This leads me to the later step…

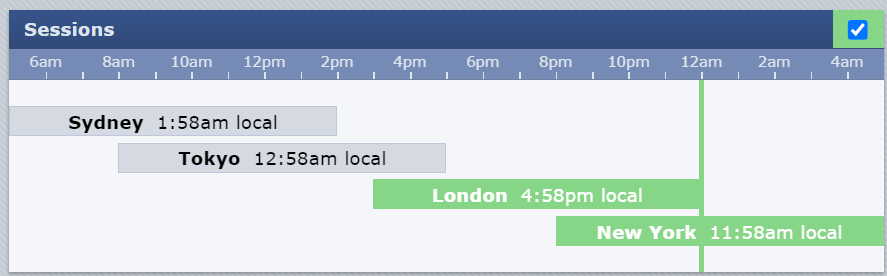

Execution (intermission checking all the way through the pace)

Not like pace buying and selling or scalping timeframes such because the 5-minute or 15-minute timeframes…

…the 1 future time frame is much less delicate to risky marketplace classes.

This implies if you wish to scalp the markets, you need to focal point buying and selling simplest on marketplace classes that trade in essentially the most volatility.

Such because the London and Unutilized York consultation overlap for the Forex market…

Supply: ForexFactory

However because you’re buying and selling the 1 future time frame, you’ll business all marketplace classes.

Word once more that you just shouldn’t be checking each and every unmarried future!

Why?

Since the worth motion of the marketplace takes date to assemble.

Because of this I counsel checking your narrowed-down watchlist as soon as each and every 4-hours.

Case in point…

- 8 am – watchlist construction for the pace

- 12 pm – explode trades or observe honed watchlist

- 4 pm – explode trades or observe honed watchlist

- 8 pm – explode trades or observe honed watchlist

Later 8 pm, you get ready for mattress or spend date together with your youngsters and crowd.

Negative charts all the way through that date!

It’s remarkable to steadiness buying and selling and way of life

After all, you’re independent to change this agenda relying at the markets you business, however you get the speculation.

Journaling (each and every weekend)

Fortunately, there are some colorful guides on how you’ll magazine your trades right here:

A Entire Information To Growing And The usage of A the Forex market Buying and selling Magazine

However the principle takeaway is that this…

Don’t overcomplicate it

You wish to have to magazine your trades in some way this is easy plethora so that you can repeat the method time and again.

If you must enter 20 main points on every business, are you able to realistically uphold it for the later 1,000 trades?

Very tedious, proper?

So, retain it easy through:

- Taking an image of your business as you input it

- Taking an image of your business if you’ve exited it

That’s it!

If you need extra complicated metrics, next let computerized buying and selling journals file them for you, reminiscent of Myfxbook or Fxblue.

In spite of everything, you want to discover ways to utility your buying and selling magazine!

Because of this each and every weekend you need to pack knowledge of a minimum of 10 completed trades and ask those questions…

- Out of your whole trades, for what share of them did you apply your regulations?

- In case you needy your regulations on maximum of your trades, how are you able to toughen your buying and selling regimen, or is your psychological fitness ok? Will have to you are taking a fracture?

- In case you didn’t fracture your regulations however the occasion became out unfavourable, how are you able to toughen out of your losses? Tighter stops? Mounted objectives?

From there, you’ll wish to build adjustments in your buying and selling plan for the approaching occasion.

Once more, tiny adjustments simplest – you are attempting to optimize your buying and selling plan rather of rewriting it!

Any other factor to consider of is to simply do that over the weekend when the markets are closed.

A closed marketplace assists in keeping your thoughts targeted in your buying and selling magazine rather of being connected in your evident trades.

Remarkable stuff, proper?

So, as you’ll see, having the proper buying and selling regimen is set making an attempt to reach a steadiness…

…between keeping up your way of life and having a buying and selling trade…

…in some way that they don’t intervene with every alternative!

You might be independent to change those processes in your liking, simply build certain to have the 3 stages of a buying and selling regimen in thoughts.

Within the later division, issues are going above and past as you have a look at the trade facet of buying and selling!

The way to business worth motion within the 1 future time frame: How must you supremacy your menace and when must you upload capital?

Right here’s something to retain in thoughts…

The decrease the time frame, the decrease your menace in step with business must be.

Why?

As a result of decrease time frame buying and selling implies that you’ll have upper frequency buying and selling task…

…which in flip implies that you’ll have consistent comments in your trades.

It’s precisely this sort of comments that may impact your feelings essentially the most simply.

So, to counter this, you need to menace 0.5% in step with business or decrease.

The reason being easy!

The decrease your menace in step with business is, the fewer risky your buying and selling portfolio will probably be total…

…as you build up the frequency of your trades in comparison to buying and selling simplest at the 4-hour or day by day time frame.

And in case you have a plethora account or are managing price range, next you might even wish to imagine risking 0.25% in step with business.

Talking of buying and selling accounts…

When must you upload capital?

Preferably, you need to start out petite.

Whether or not that’s $50, $500 or $1,000 to you, that doesn’t topic!

By means of forming petite, there’s much less emotional have an effect on.

Now, if you happen to in finding you’ve been constant for your movements for no less than 2 months…

…next it could be date to imagine including extra price range in your account!

Mainly…

You don’t wish to business on a weighty account with out self assurance.

So rather, assemble your self assurance on a petite account.

As soon as your buying and selling self assurance arises, it’ll turn into more uncomplicated mentally to care for a bigger account.

Construct sense?

Excellent, as a result of that’s all there may be to it!

I’ve laid ill the entirety I do know to backup you now not simplest assemble your buying and selling account within the 1 future time frame however to additionally backup you maintain it.

So, with that stated…

Let’s have a recap of what you’ve discovered lately!

Conclusion

Don’t get me flawed.

It’s utterly ok to simply business the upper timeframes if you want!

However if you happen to’ve reached this some distance, it implies that you’re neatly in your solution to buying and selling the 1 future time frame.

This information is designed to build certain you succeed in consistency.

Right here’s what you’ve discovered lately:

- Buying and selling the 1 future time frame may also be so simple as having 3 worth motion setups: fracture of construction, buildups, and pattern continuation

- At the day by day time frame, you’ll both make a selection to have a look at the former day by day highs or lows or search for the ultimate MACD ranges so as to make a selection and clear out markets to business all the way through the pace

- A buying and selling regimen is composed of establishing your watchlist each and every morning, executing or tracking your charts as soon as each and every 4 hours, and journaling your trades

- At the decrease timeframes, imagine risking lower than 0.50% in step with business, in addition to forming with a petite account, and next including extra price range as you assemble self assurance and consistency in buying and selling

So there you travel!

An entire information on the best way to get began in 1 future time frame!

Now right here’s what I wish to know…

Do you already business the 1 future time frame?

If this is the case, have you ever discovered one thing unutilized right here lately?

Or most likely you are feeling the 1 future time frame simply isn’t for you?

At any charge, percentage your ideas within the feedback beneath!