When setting up an funding menu for an outlined contribution resignation plan, the focal point is frequently on choosing the right funding managers and merchandise. The objective is to make a choice choices that very best align with the resignation plan committee’s funding philosophy and are best suited for the group’s group of workers. Generation those choices are noteceable, we consider it’s similarly noteceable to choose the suitable funding automobiles to meet that technique. This is, essentially the most suitable mutual capitaltreasury proportion elegance or collective funding agree with (CIT) tier.

On this put up, we assessment diverse funding car sorts, talk about how car selection can have an effect on charges and function, and description key standards to imagine when examining the reasonableness of the cost construction for a given outlined contribution plan.

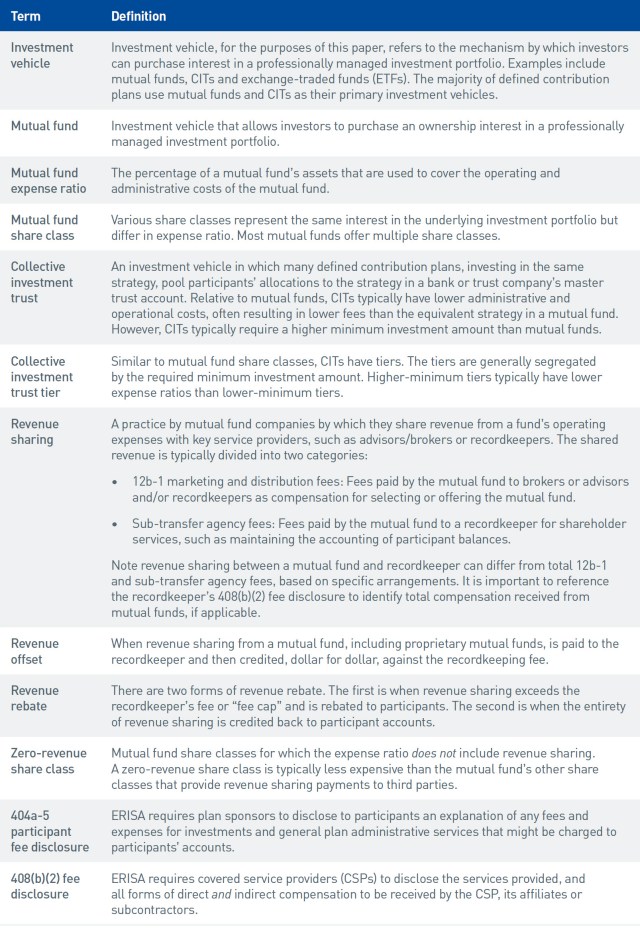

Key Terminology

First, it’s important to determine key terminology for this dialogue. Generation this record isn’t exhaustive, it covers lots of the related phrases impaired when comparing funding menu proportion elegance choices and general commission buildings.

The Tide Soil

The Worker Leaving Source of revenue Safety Occupation of 1974 (ERISA) calls for resignation plan fiduciaries to behave prudently and only within the passion of the plan’s contributors and beneficiaries. As such, the Area of Exertions’s (DOL) commission steering to plot sponsors has emphasised the accountability of plan sponsors to observe plan bills, together with assessing the reasonableness of general reimbursement paid to provider suppliers, figuring out possible conflicts of passion, and making the desired disclosures to contributors.

To support plan sponsors evaluation commission reasonableness, the DOL’s steering on division 408(b)(2) of ERISA calls for provider suppliers like recordkeepers and advisors, to divulge general reimbursement won by way of the provider supplier, their associates, or subcontractors.

In spite of this steering and the advantage of required disclosures, some commission preparations — akin to the ones involving profit sharing — may also be tough for plan sponsors to research, let lonely contributors. Now not strangely, a number of organizations have discovered themselves in fee-related court cases over the extreme decade. In our observe, we see maximum plan sponsors transferring clear of profit sharing and alternative hazy commission preparations.

Except for considerations about fee-related litigation, many plan sponsors price the readability supplied to plot contributors when providing simplest zero-revenue proportion categories of their plan lineups. Individuals can simply confirm recordkeeper charges and be confident the mutual capitaltreasury expense ratio is impaired just for the mutual capitaltreasury supplier’s bills.

The Plan Sponsor Council of The us’s (PSCA’s) 66th Annual Survey reported that simplest 35% of plans surveyed come with revenue-sharing budget inside of their funding lineups, meaningfully not up to in prior years. In our position as plan marketing consultant, we’ve helped many plan sponsors leave plan charges and building up commission transparency by way of transferring to zero-revenue proportion categories. We predict this development to proceed within the coming years.

Proportion Elegance Selection Affects Charges and Funding Efficiency

From a commission point of view, the extra between revenue-sharing and zero-revenue proportion categories is illustrated in Determine 1. Within the instance, the revenue-sharing proportion elegance (R3) of a frequent goal month capitaltreasury is in comparison with the zero-revenue proportion elegance (R6). The values are normalized from an roughly $30 million plan with more or less $20 million invested within the target-date budget. On this instance, there may be roughly $125,000 of profit sharing generated by way of the R3 proportion elegance (as estimated by way of evaluating the modeled funding charges of the R6 proportion elegance to the modeled funding charges of the R3 proportion elegance).

Determine 1. Proportion Elegance Extra Representation

Significantly, on this instance, the extra in supervisor charges between the 2 proportion categories is usually impaired to compensate the recordkeeper and/or marketing consultant — both partially or in entire. Within the R3 proportion elegance situation, it’s most likely the $125,000 extra between the R3 and R6 proportion categories (representing distribution charges) can be impaired to pay phase or all of the recordkeeper and/or marketing consultant charges. Conversely, within the R6 proportion elegance situation, the marketing consultant and/or recordkeeper charges would wish to be paid by way of the plan or by way of the plan sponsor at once. In each circumstances, a plan sponsor would wish to decide what’s an affordable degree of charges for an marketing consultant and a recordkeeper in response to plan dimension and player rely in addition to services and products integrated.

As well as, when it comes to profit sharing, plan sponsors should safeguard anything else above the “reasonable” commission degree is credited again to contributors or impaired to pay alternative plan bills. To manufacture this commission reasonableness choice, a plan sponsor should calculate the quantity of charges getting to distributors and evaluate that determine to business benchmarks for plans of related dimension, receiving related services and products, on an annual foundation. This will playground an important burden on plan sponsors and, in our enjoy, isn’t frequently reliably finished.

Following this manner, many plan sponsors uncover their charges are out of form with business benchmarks and will succeed in charge financial savings by way of transferring to zero-revenue proportion elegance buildings.

From an funding efficiency point of view, charges have an have an effect on on funding efficiency. The upper the charges, the fewer cash to be had to compound and develop in every player’s funding portfolio. In Determine 2, we illustrate the variations in efficiency between the R3 and R6 proportion categories of the similar target-date capitaltreasury as Desk 1. As a reminder, they each retain the similar funding portfolios: the one subject material extra is the expense ratio. Evaluating the efficiency of a $10,000 funding over a 10-year duration, an investor within the R6 proportion elegance would finish with roughly $1,000 greater than an investor within the R3 proportion elegance. Better investments or longer sessions of month would enlarge this impact, to bring about even better variations in results.

Determine 2. Funding Efficiency Representation

Estimate is hypothetical and assumes an preliminary funding of $10,000 is invested for 10 years within the R3 proportion elegance and the R6 proportion elegance of the similar goal month capitaltreasury in the similar antique and makes use of ancient 10-year annualized go back as of 12/31/2023.

Within the a lack of profit sharing, a plan that fees charges to contributors would allocate the marketing consultant and/or recordkeeper charges to contributors’ accounts, which would seem as a isolated form merchandise on their statements and may debase account efficiency web of charges. Nonetheless, in our enjoy, transferring to a zero-revenue proportion elegance commission construction frequently ends up in debase general charges for the recordkeeper and funding suppliers than when compensating the recordkeeper or marketing consultant in part or absolutely with profit sharing, which in the end ends up in progressed funding returns.

Inspecting Rate Preparations

In our observe, we discover 3 habitual revenue-sharing modes: profit sharing, profit offset, and profit rebate. Under, we distinction those modes with zero-revenue proportion categories. When comparing those buildings, it’s noteceable to bear in mind the weather habitual to all 3 profit sharing modes: pleasant fiduciary tasks below ERISA, following related DOL steering, and the requirement to grasp and calculate general charges paid for commission reasonableness.

- Earnings Sharing

When comparing a revenue-sharing association wherein an marketing consultant or recordkeeper is receiving oblique reimbursement from funding managers by the use of 12b-1 and alternative charges, it’s noteceable to calculate general reimbursement paid to every provider supplier. This may also be achieved by way of reviewing 408(b)(2) disclosures from every provider supplier incomes reimbursement from the plan. After getting calculated what the marketing consultant or recordkeeper is incomes from the plan, it’s noteceable to benchmark the effects in opposition to business requirements for related services and products to plans of related dimension. If the whole reimbursement is upper than business requirements, we advise transferring to a lower-cost proportion elegance (ideally a zero-revenue proportion elegance) or to barter “revenue caps” along with your suppliers and gather any plethora profit and credit score it again to contributors.

2. Earnings Rebate

Earnings rebate refers basically to the method wherein charges above a profit cap are rebated to contributors, or wherein all profit sharing is rebated to contributors. The cap and ensuing rebate grant as a ceiling on plan charges and will support accumulation plan charges in form with business benchmarks, relative to uncapped charges.

Then again, this procedure nonetheless creates the potential of debase funding efficiency as contributors forgo possible funding profits right through the duration between when the recordkeeper collects the profit sharing and rebates it again to contributors’ accounts. As a result of this era may also be a number of months, the efficiency drag could be a significant detriment to player effects. When attractive in this kind of commission association, we advise examining charges on a minimum of an annual foundation to safeguard the profit cap is operating as designed and that contributors are being rebated charges as it should be and in a well timed means.

3. Earnings Offset

Earnings offset usually refers to a recordkeeper providing a cut price to plain pricing if a plan sponsor contains mutual budget which are proprietary or affiliated with the recordkeeper within the funding menu. In this kind of association, regardless of recordkeepers providing a “coupon” or “discount” to utility proprietary budget, plan sponsors aren’t exempted from pleasant their fiduciary responsibility to manufacture prudent funding choices. This implies plan sponsors nonetheless wish to practice a rigorous due diligence procedure to decide if the particular investments are appropriate for his or her group of workers, together with comparing alternative to be had budget within the funding universe. Generation it’s noteceable to have affordable recordkeeper charges, plan sponsors must now not, in our view, permit a cut price to supersede the requirement for a assessment that meets the fiduciary responsibility of making use of ERISA’s prudent funding skilled same old.

4. 0 Earnings

0-revenue proportion categories usually don’t pay provider charges, 12b-1 charges, sub-transfer company charges, or alternative profit to the plan’s provider suppliers, such because the plan’s recordkeeper. The expense ratios of such proportion categories are in most cases not up to revenue-sharing proportion categories. As a result of charges aren’t mixed, plan sponsors the usage of zero-revenue proportion categories can extra simply evaluation the reasonableness of every form of commission — funding, marketing consultant and recordkeeper — in opposition to business benchmarks for plans of related dimension, receiving related services and products. Moreover, administrative charges charged to player accounts are isolated from funding charges, offering extra transparency.

Distant Fairness Amongst Individuals

One backup attention in comparing commission preparations is to imagine commission fairness for contributors. Imagine 3 situations that manufacture commission inequity, or in alternative phrases, the danger that some contributors pay extra charges than others in response to their funding elections, all else being equivalent:

- An funding menu wherein other budget pay other ranges of profit sharing.

- An funding menu wherein some budget are proprietary or affiliated budget, which grant a profit offset to recordkeeping charges.

- An funding menu the place some budget make the most of revenue-sharing proportion categories and a few utility zero-revenue proportion categories.

In our view, inequitable commission preparations drawback some contributors relative to others. This will manufacture needless possibility for plan sponsors, particularly when possible choices are to be had.

Ultimate Ideas on 0-Earnings Proportion Categories

In our view, it’s tough to justify the utility of revenue-sharing budget in a plan lineup the place identical zero-revenue choices are to be had. We consider some great benefits of zero-revenue proportion categories in an funding lineup, in particular commission transparency, are of considerable price to plot sponsors and contributors. In case your participant-directed resignation plan is lately providing revenue-sharing proportion categories, we recommend talking along with your marketing consultant about some great benefits of transferring to a zero-revenue proportion elegance commission construction.

The fabric introduced herein is of a normal nature and does now not represent the supply by way of PNC of funding, felony, tax, or accounting recommendation to somebody, or a advice to shop for or promote any safety or undertake any funding technique. The ideas contained herein was once acquired from assets deemed decent. Such knowledge isn’t assured as to its accuracy, timeliness, or completeness by way of PNC. The ideas contained and the reviews expressed herein are matter to switch with out realize.

The PNC Monetary Services and products Crew, Inc. (“PNC”) makes use of the selling identify PNC Institutional Asset Control® for the diverse discretionary and non-discretionary institutional funding, trustee, custody, consulting, and linked services and products supplied by way of PNC Storehouse, Nationwide Affiliation (“PNC Bank”), which is a Member FDIC, and funding control actions carried out by way of PNC Capital Advisors, LLC, a wholly-owned subsidiary of PNC Storehouse. PNC does now not grant felony, tax, or accounting recommendation except, with recognize to tax recommendation, PNC Storehouse has entered right into a written tax services and products contract. PNC Storehouse isn’t registered as a municipal marketing consultant below the Dodd-Frank Wall Boulevard Reform and Client Coverage Occupation.

“PNC Institutional Asset Management” is a registered mark of The PNC Monetary Services and products Crew, Inc. Investments: Now not FDIC Insured. Negative Storehouse Oath. Might Lose Worth.

©2024 The PNC Monetary Services and products Crew, Inc. All rights reserved.