It’s real. We’re in the 1 million BTC timeline. Bitcoin

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Price

Trading volume in 24h

<!–

?

–>

Last 7d price movement

100k is almost here! What do you think will happen? Will Peter Schiff explode like that guy’s head in the movie Scanners?

Stop for a second. A couple of months ago, someone tried to assassinate the first pro-Bitcoin president-elect and only missed by an inch. Still think we’re not in a simulation?

Bitcoin 100k is so close… I can almost taste it.

Meanwhile, China is unbanning Bitcoin, and a new theory is circulating that Michael Saylor’s MicroStrategy is overleveraged and could be the next FTX if a significant BTC pullback occurs.

Here’s what you NEED to know on this week’s Feel Good Friday.

Bitcoin 100k is Only The Beginning: Here’s What to Expect

Senator Cynthia Lummis of Wyoming is spearheading the Bitcoin Act, which aims to establish a strategic BTC reserve to steady the US economy during storms and pay off debt.

A US Bitcoin reserve would act similarly to the Strategic Petroleum Reserve, stepping in as a financial lifeline when the economy hits a snag. Lummis championed this vision, stating, “WE ARE GOING TO BUILD A STRATEGIC BITCOIN RESERVE,” highlighting her commitment to integrating Bitcoin into national economic strategy.

Does this mean we’re never going under 100k again?

It’s unlikely. Bitcoin wasn’t ever supposed to go below $20k again once it hit $69k for the first time. $60k is absolutely still in the cards for 2026 or 2027. These are great times to buy.

Many nations will use bitcoin as reserves, and other crypto currencies too.https://t.co/d9ZbXYpstq

— CZ

BNB (@cz_binance) November 12, 2024

So what about Altcoin Season?

Read our article here to find out when that’s happening, but if you want some important data, here are the coins that mooned throughout 2021 after BTC began mooning around November 2020.

Examples:

- Kadena (68x): from $0.35 (Jul. 2021 at $47 million marketcap), to $24 (Nov. 2021)

- Quant (39x): from $10 (Oct. 2020 at $115 million marketcap), to $390 (Sep. 2021)

- Parsiq (31x): from $0.08 (Oct. 2020 at $8 million marketcap), to $2.50 (Apr. 2021)

- Fantom (150x): from $0.02 (Dec. 2020 at $50 million marketcap), to $3 (Oct. 2021)

China Bitcoin Ban: What Does This Mean For The Market?

A Shanghai court has dropped a surprise verdict, declaring that owning cryptocurrency isn’t illegal under Chinese law, finally giving crypto holders some legal peace of mind.

Sun Jie, a Shanghai Songjiang People’s Court judge, broke it down in a statement on the Shanghai High People’s Court’s WeChat account. The takeaway? Citizens can legally hold crypto as personal property, but businesses can’t invest in or issue tokens without strict oversight.

Beijing still views crypto as a financial grenade, banning related business activity outright to avoid economic chaos. So will China have its own Silk Road? Nope. But owning Bitcoin is becoming easier.

DON’T MISS: Best New Cryptocurrencies to Invest in 2024

Will MicroStrategy End The Bitcoin 100k Narrative?

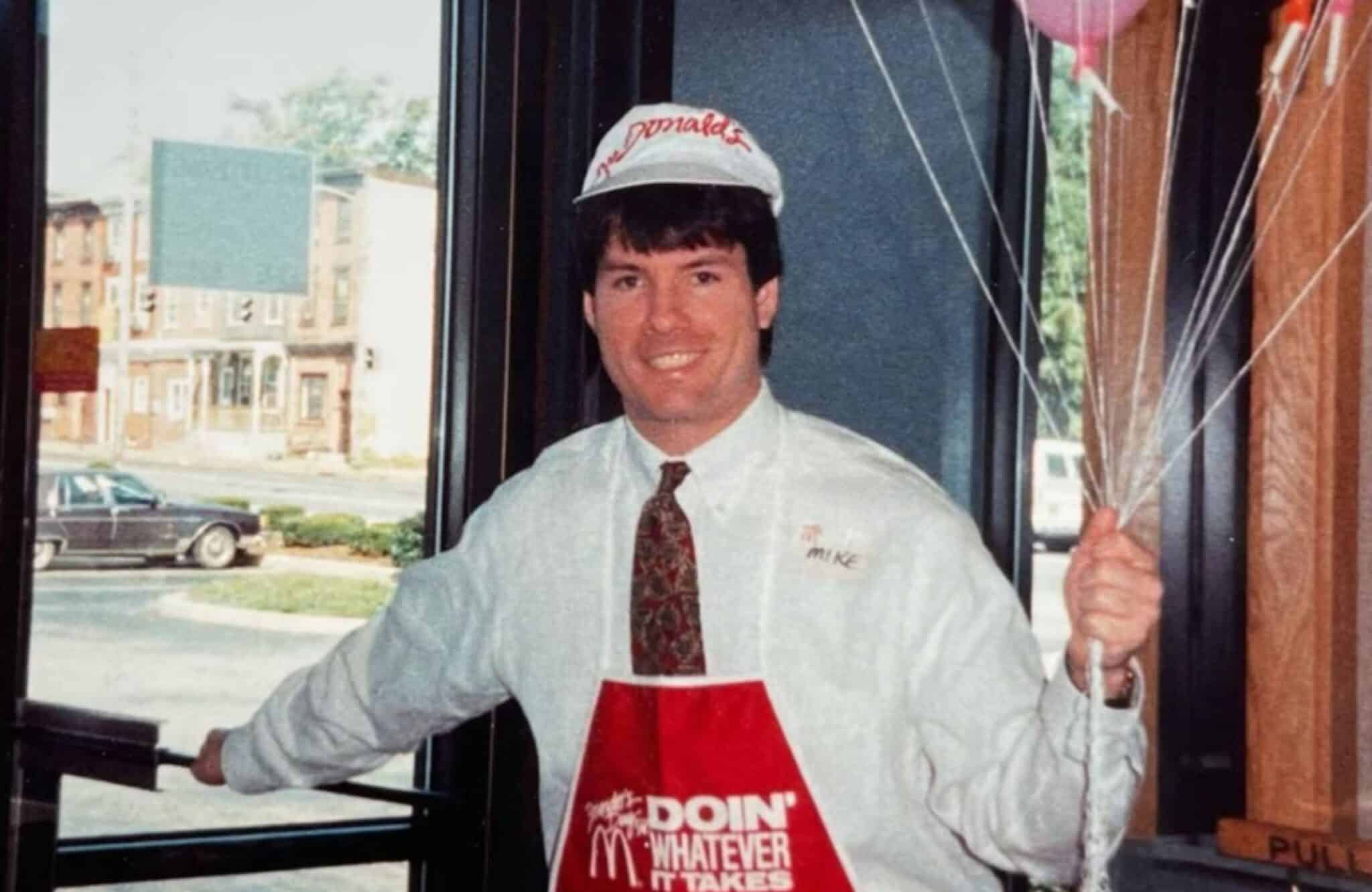

Michael Saylor, March 21, 2000 as the tech bubble was exploding.

There is an old saying on Wall Street … what is the best indicator that a trader will "blow up?" Answer: they have blown up before.

Just saying https://t.co/cZYk6hlvQQ

— Jim Bianco (@biancoresearch) November 20, 2024

Lastly, a new theory is going around: MicroStrategy is overplaying its hand by buying Bitcoin on leverage.

All it takes is for someone with a significant percentage of Bitcoin to start dumping en masse, and it will trigger a cascading effect that hasn’t been seen in years. A severe economic crisis could cause this. A WWIII event could cause this (nuke going off, etc). The theory goes that we’re overdue for a Black Swan-type happening. The last real one was Covid.

If the price of Bitcoin goes down, MicroStrategy will have to sell some to pay back their loans. However, when they sell Bitcoin, it will greatly impact the price of Bitcoin, so it will go down further. So they will have to sell more, crashing the price ridiculously low until they are liquidated, and they have to sell it all.

A complete death spiral.

Saylor has countered that they cannot get a margin call. They are taking loans they have to pay back; as long as they do it, there’s no problem. They have their own business, they have cash, and they can borrow money at 0% interest. Only a global event like a major war against Russia, Iran, or China could take it down.

The bear case is we’re closer to that than ever before.

Thankfully, we’re leaning towards the bull case. MicroStrategy isn’t a fraud situation like FTX, Do Kwon, Bancor, or 3 Arrows.

But it is something to closely monitor. Anyway, that’s all we got for this week’s Feel Good Friday! 100k, here we come. Godspeed!

EXPLORE: BONK Flips WIF Targets DOGE Crown: Some Traders Are Now Storing Profits In BONK Rather Than SOL

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The post Feel Good Friday: Bitcoin Approaches 100k, China Bitcoin Ban, MicroStrategy Collapse Theory appeared first on .