Cardone Capital Expands Bitcoin Holdings with Latest Real Estate Deal

Cardone Capital, a real estate private equity firm, has added 130 Bitcoin to its balance sheet as part of a refinancing deal for its Miami River property. This move marks the fourth transaction in which the company has integrated Bitcoin into its investment portfolio. According to Grant Cardone, Chief Executive of Cardone Capital, eight more deals with a similar structure are currently underway, indicating a broader plan to combine digital assets with traditional real estate finance.

The company opted to raise equity to pay down debt instead of purchasing interest rate caps, securing a Fannie Mae debt at 4.89%. This strategy has been accompanied by the launch of the 10X Miami River Bitcoin Fund, a dual-asset vehicle backed by a 346-unit property on the Miami River and $15 million in Bitcoin. Cardone has framed this initiative as a hedge against inflation and an alternative to traditional treasury management, arguing that Bitcoin offers a unique store of value when paired with income-generating real estate.

Global Bitcoin Treasuries on the Rise

The corporate Bitcoin treasury race is accelerating, with companies like Metaplanet and MicroStrategy leading the charge. Metaplanet, a Japan-based company, has added 775 BTC to its reserves, lifting its total holdings to 18,888 BTC, worth around $2.18 billion. MicroStrategy, on the other hand, has disclosed a fresh buy of 430 BTC for $51.4 million, bringing its total stash to 629,376 BTC, worth nearly $72 billion.

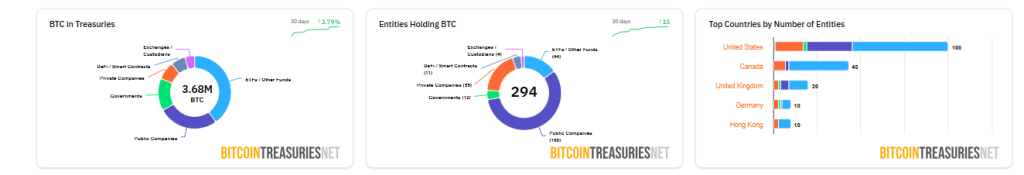

According to BitcoinTreasuries.net, 294 entities now hold 3.68 million BTC collectively, about 18% of the circulating supply. Public companies and ETFs dominate, but governments and custodians are emerging as major players, showing Bitcoin’s growing role as a strategic reserve asset worldwide. The U.S. Treasury Secretary has announced plans to build a “Strategic Bitcoin Reserve” from confiscated assets, estimating current holdings at $15-20 billion.

Bitcoin’s Growing Role in Real Estate Finance

Cardone Capital’s pivot into Bitcoin has been accompanied by a growing trend of companies integrating digital assets into their real estate investments. The company’s strategy has drawn attention from across the crypto and business sectors, with MicroStrategy’s Michael Saylor publicly congratulating Cardone on bringing the digital asset into the real estate space. As the corporate Bitcoin treasury race continues to accelerate, it will be interesting to see how this trend evolves and whether other companies follow suit.

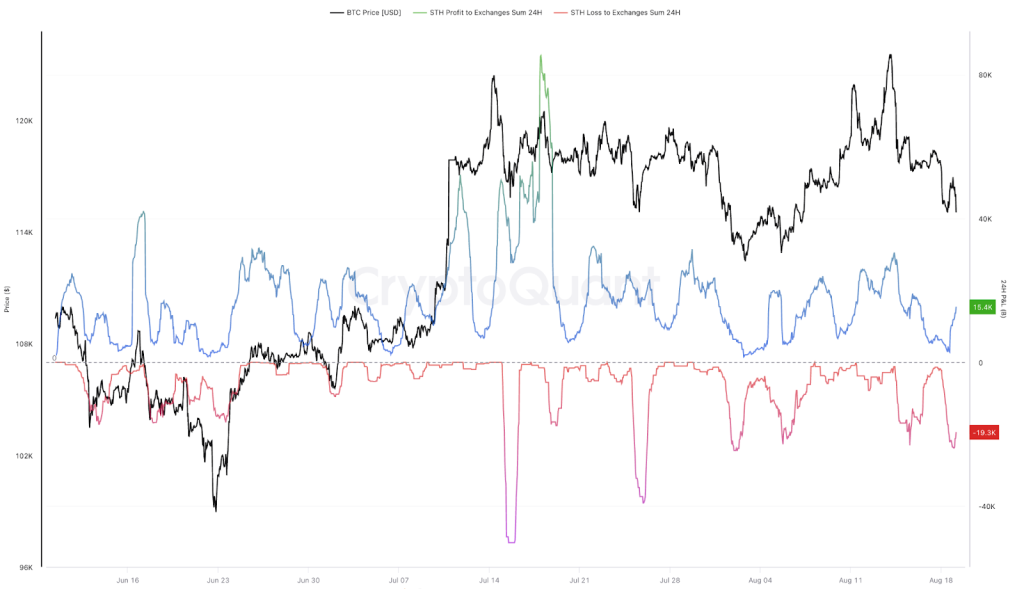

Bitcoin itself has cooled from record highs, slipping below $116,000 after last week’s $124,500 peak. On-chain data shows short-term holders have been offloading coins at a loss, echoing past correction patterns that either precede deeper drawdowns or clear the way for renewed rallies. Despite this, the growing adoption of Bitcoin as a strategic reserve asset is a testament to its increasing legitimacy and potential for long-term growth.