Cryptocurrency Market Awaits Federal Reserve Chairman Jerome Powell’s Speech

On Friday, the annual meeting of the US Federal Reserve in Jackson Hole took place, where comments from Chairman Jerome Powell can present important signals on interest policy that may impact the Federal Market Committee meeting in September. The cryptocurrency market, particularly Bitcoin, has been closely watching the event, with investors eagerly awaiting Powell’s speech.

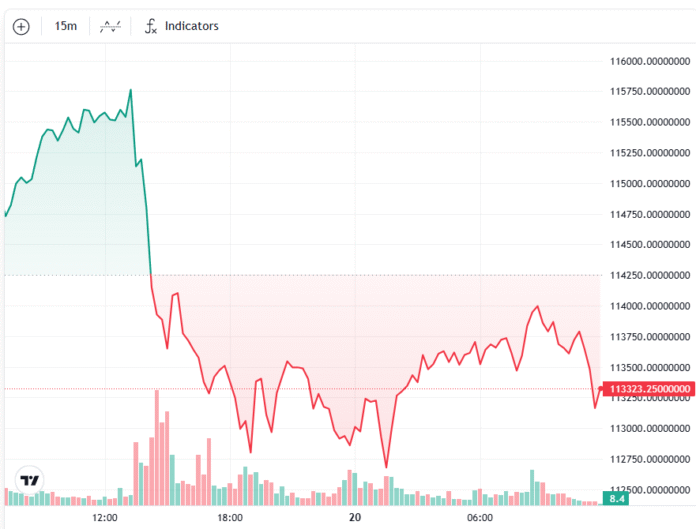

On Wednesday, Bitcoin (BTC) briefly fell to $112,565, a two-week low that was last seen on August 3, as CoinTelegraph data showed. This slump below $113,000 was a snapshot of “rising nerves on the market”, according to Ryan Lee, Chief Analyst at Bitget Exchange. Lee stated that “anxiety spikes” under the digital asset dealers, macroeconomic tensions in relation to Powell’s speech, have been causing unease among investors.

“Now it could pave the way for a back rash if the stories could calm down and pave the liquidity return,” the analyst told CoinTelegraph. The market’s reaction to Powell’s speech will be crucial in determining the direction of Bitcoin’s price. BTC/USD, one-day chart. Source: cointelegraph

Companies Continue to Accumulate Bitcoin

Despite the uncertainty in the market, companies continue to accumulate Bitcoin. At least 297 public institutions have acquired Bitcoin, including 169 public companies, 57 private companies, 44 investments and stock markets traded, and 12 governments, according to BitcoinTreasuries.net. This represents more than 17% of the total offer. Source: BitcoinTreasuries.net

The investor concerns regarding potential interest rate reduction were tightened on August 12, after the US consumer price index (CPI) rose by 2.7% compared to the previous year, which remained unchanged from June, but is far above the 2% target of the FED. After the CPI messages, expectations of an interest rate reduction decreased by over 12% to 82%, which, according to the last estimates of the Fedwatch tool of the CME group, is due to over 94% a week ago. FED-SIES-ZUNSPRESTEMEDIENTIONS. Source: Fedwatch tool of the CME Group

Interest Rate Reduction and Bitcoin Rally

The first interest rate reduction of 2025 can become a significant market catalyst that triggered the expectations of two or three total interest before the end of the year, says André Dragosch, head of European research at Crypto Asset Manager. “The moment you see further interest cuts by the Fed, the curve will become steep, which implies even more acceleration and US money supply,” Dragosch told CoinTelegraph and added that the reduction in installments may be the most important macro development to support the continuation of the Bitcoin rally “at least until the end of the year”.

For more information on the cryptocurrency market and its relation to the Federal Reserve’s interest policy, visit https://cointelegraph.com/news/bitcoin-dips-fed-powell-speech?utm_source=rss_feed&utm_medium=rss_tag_blockchain&utm_campaign=rss_partner_inbound