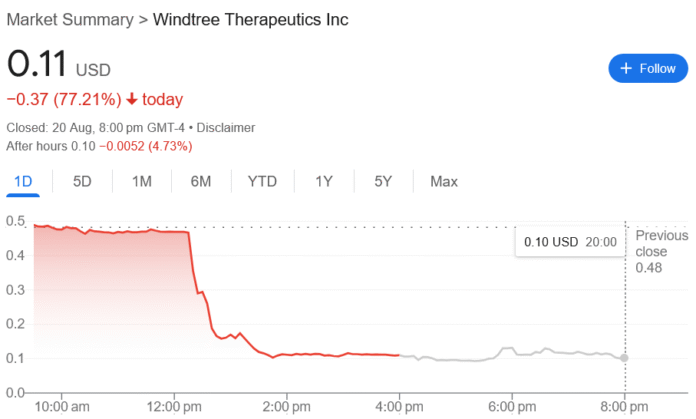

Windtree Therapeutics, a biotech company that recently established a BNB treasury strategy, experienced a significant decline in its stock price, falling 77% on Wednesday. This downturn occurred after Nasdaq triggered a delisting alert due to the company’s failure to meet the minimum bid price requirement of $1 per share, as outlined in the Nasdaq listing rule 5550(a)(2). According to a registration statement submitted to the US Securities and Exchange Commission, Windtree’s shares will cease trading on Thursday.

The company’s stock price plummeted to $0.11, with a further 4.7% decrease in after-hours trading, as reported by Google Finance. This sharp decline comes after a brief increase in the stock price following the announcement of its BNB treasury strategy on July 16. However, since reaching a high point on July 18, the stock has lost over 90% of its value.

While some companies have seen success after adopting a crypto finance strategy, others, like Windtree, have not been as fortunate. The biotech firm is part of a growing number of publicly traded companies to pursue a BNB treasury strategy, which allows investors to gain exposure to BNB without directly holding the cryptocurrency.

Windtree to Continue Financial Disclosures

Despite the delisting alert, Windtree’s CEO, Jed Latkin, stated that the company will continue to fulfill its reporting obligations. This move is similar to that of other crypto companies, such as Argo Blockchain, which was initially suspended by Nasdaq but later reinstated after meeting the necessary compliance requirements.

Windtree’s Announcements and Subsequent Decline

On July 16, Windtree announced the establishment of its BNB treasury, along with a $60 million purchase agreement with Build and Build Corp, which included options for an additional $140 million. The company’s stock price initially rose by 32.2% in the following two days but subsequently fell. A week later, Windtree signed a $500 million credit line with an unidentified investor and a separate stock pact with Build and Build Corp to purchase more BNB tokens.

However, the company has not disclosed the amount of BNB it holds or its plans for continuing the BNB treasury strategy. CoinTelegraph reached out to Windtree for comment but has not received a response.

BNB Price Increase

Despite Windtree’s decline, BNB was one of the top-performing large-cap cryptocurrencies on Wednesday, rising by 5.6% to $876.26 and reaching a new all-time high. This increase occurred as the wider crypto market rebounded from a two-week slump, according to Coingecko data.

BNB is one of the few large-cap cryptocurrencies, along with XRP and Solana, to reach a new high in this bull cycle, while other major cryptocurrencies, such as Ether, Dogecoin, Chainlink, and Cardano, remain below their 2022 highs.

For more information on this topic, please visit https://cointelegraph.com/news/bnb-treasury-firm-falls-77-percent-after-nasdaq-delisting?utm_source=rss_feed&utm_medium=rss_tag_regulation&utm_campaign=rss_partner_inbound