Introduction to Crypto Pension

President Donald Trump’s latest executive regulation could prove to be the largest turning point for crypto since Spot Bitcoin ETFs. On August 7, he instructed the Ministry of Labor to revise the retirement rules and enable 401(K) plans to include alternative assets such as crypto, real estate, and private equity. This move has the potential to significantly impact the crypto market and the broader financial landscape.

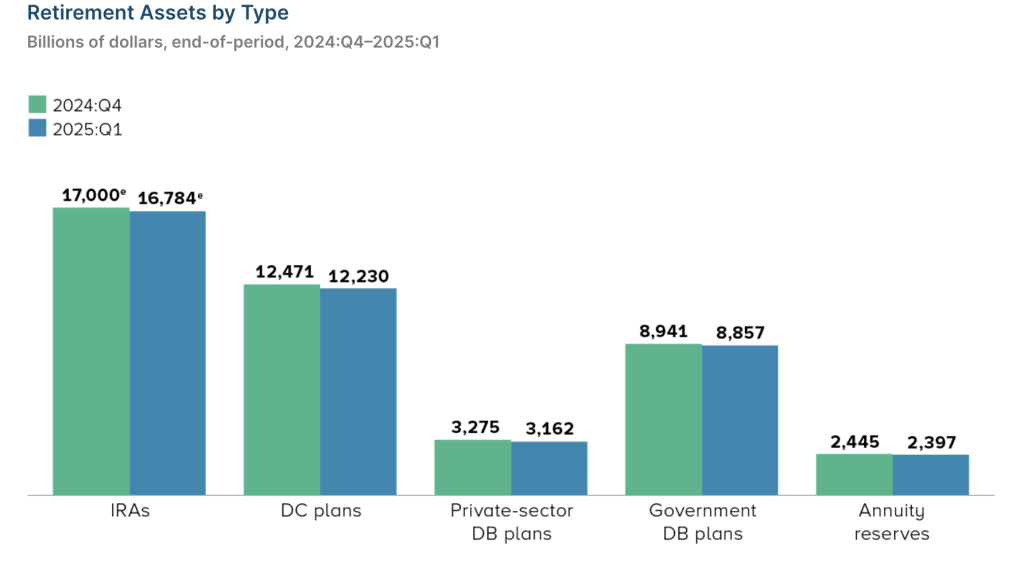

The operations are enormous, with $8.7 trillion dollars in 401(K) accounts, which form the backbone of the American pension system. The opening of a fraction of this capital to digital assets could not only change markets but also the political and regulatory landscape surrounding crypto.

Why 401(K) Plans Are Different

The US pension system is based on three pillars: social security, plans sponsored by employers such as 401(K) plans, and individual pension accounts (IRAs). Under these, 401(K) plans prove to be a unique middle ground – widespread, automatically financed, and professionally managed, but still shaped by individual selection options from a preset menu.

According to the Investment Company Institute, 401(K) plans make up almost 30% of all individually directed pension assets. The credit grows with age, and the average is almost $300,000 for pensioners over 65 years. This is not speculative capital – it is the savings of Central America.

Source: Investment Company Institute

Three Shifts Ahead

The effects of this step are not just financial inflows. It could unleash three structural shifts – the behavior of user behavior, institutional capital flows, and political dynamics.

1. Mainstream Breakthrough

The toughest barrier for crypto was trust among older, conservative investors. In addition to an S&P 500 index fund, a 55-year-old worker opens a “Digital Assets Fund”, which lists a “digital assets find”, a psychological shift. What was once seen as speculative gambling becomes a pension scheme sanctioned by the government and the employer.

This confirmation is powerful: it is recovering crypto as part of the financial life of mainstream.

2. A Steady Capital Pipeline

ETFs opened the door for institutions, but the rivers remain mood-driven. 401(K) assignments work differently – they are directly bound to the wage and salary billing. On each payment day, millions of dollars would automatically be inserted into selected funds, creating a stable and composed inflow current.

This predictability will arrange for asset managers such as Fidelity and Vanguard to build diversified crypto products – Bitcoin, Ethereum, and possibly blue-chip DeFi tokens or hybrid portfolios that mix digital assets with stocks and bonds. The result: deeper liquidity and a more sophisticated asset management ecosystem.

3. A Political Moat

The most important thing may be that the crypto guideline could insulate from partisan fluctuations. For a long time, US administrations have weakened between openness and hostility to digital assets, discouraging capital in the long term. By linking crypto with retirement savings, the calculation changes: every future government that limits crypto would be at risk of being regarded as “going into my pension”.

These binding financial interests in political survival could force both parties to achieve greater political consistency in what can be determined by America’s long-term financial agenda.

Optimism with Caveats

The advantage is clear. Even if only 5% of 401(K) assets shift into crypto, this is about $400 billion – an order of magnitude larger than the latest ETF inflows. In combination with regulatory clarity and mainstream acceptance, it could catalyze a reassessment of the entire wealth class.

But challenges remain:

- Assumption: More than 60% of 401(K) arguments sit in conventional investment funds. To convince savers to move towards the fleeting assets will take time.

- Risk: Retirement money is sensitive to market fluctuations. Supervisory authorities and managers must define guardrails and disclosure rules to protect the participants.

- Design: Do the offers concentrate closely on Bitcoin and Ethereum or extend to a wider universe? How much volatility will plans allow, and how will the funds be smoothed?

The Starting Gun

Trump’s command is less a conclusion than a start. By combining the future of crypto with the most conservative capital of America – pensions – it accelerates the shift of the sector from the speculative border to the structural financial column.

The upcoming seas are extensive: trillions of potential inflows, new product classes, and political realignment. They are also uncertain: adoption hurdles, regulatory details, and volatility risk remain.

But the symbolism is already clear. When pension accounts treat crypto as a serious wealth class, the door to a new financial era is no longer hypothetical. It swings up.

For more information, visit https://cryptonews.com/exclusives/trumps-8-7-trillion-pension-gambit-could-be-cryptos-next-big-break/