Dogecoin Price Plummets: Whales Unload, Indicating Risk Aversion

Dogecoin (DOGE) has experienced a significant price decline, dropping over 24% after reaching a multi-high of $0.28 on July 21. This downturn has led to the largest owners of the meme coin unloading their holdings, signaling a lack of confidence in a potential price rebound in the coming weeks. On-chain metrics and derivative data also point to a decrease in investor interest, further contributing to the bearish outlook.

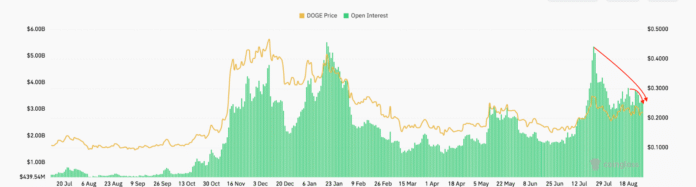

The decline in open interest and daily active addresses is a clear indication of reduced demand for DOGE. According to Coinglass, the Futures Open Interest (OI) for Dogecoin has decreased by 8% to $3.24 billion, down from $5.35 billion. This reduction in speculative positioning and the number of traders betting on short-term price increases is a concerning sign for the cryptocurrency’s prospects. Doge OI (USD). Source: Coinglass

On-Chain Metrics Indicate Further Losses

Santiment data reveals that the number of addresses holding $10 to $100 million in DOGE has dropped by 6% since the end of July. This decrease in large holder activity is often a precursor to further price declines. Dogecoin supply distribution. Source: Santiment

A recent transaction reported by Whale Alert, in which 900 million DOGE worth over $200 million was transferred to Binance by an unknown whale, has raised concerns about short-term selling pressure. When large owners distribute an asset during a price decline, it typically signals that they expect further losses. The number of daily active addresses in the Dogecoin network has also significantly decreased to 58,000, compared to a high of 1.65 million in the fourth quarter of 2024 and 674,500. Doge Daily Active addresses. Source: Glasnode

Rising Wedge Pattern Signals Bearish Reversal

From a technical analysis perspective, the sales pressure on DOGE could gain significant downward momentum if it breaks below an ascending wedge pattern. The Dogecoin price is currently testing support from the lower trend line of the wedge at $0.218. A break below this level will likely trigger a deeper price drop, with a technical target of $0.12, representing a decline of 45% from current prices. Doge/USD Daily chart. Source: CoinTelegraph/Tradingview

The relative strength index (RSI) also shows a weakening trend, falling from 85 on July 20 to 49, indicating overbought conditions are being unwound. To avoid further losses, the DOGE price must break above the $0.19 to $0.20 zone or the 100-day and 200-day moving averages at $0.20.

This article does not contain investment advice or recommendations. Every investment and trade movement involves risk, and readers should conduct their own research before making a decision. For more information, visit https://cointelegraph.com/news/dogecoin-whales-de-risk-doge-price-dropping-45-percent?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound