Bitcoin miners have been selling their holdings at an unprecedented rate, with $485 million worth of BTC sold over a 12-day period ending on August 23. This trend has sparked concerns among investors, who are worried about the potential impact on the cryptocurrency’s price. However, despite the sale, the Bitcoin network and its fundamentals remain strong.

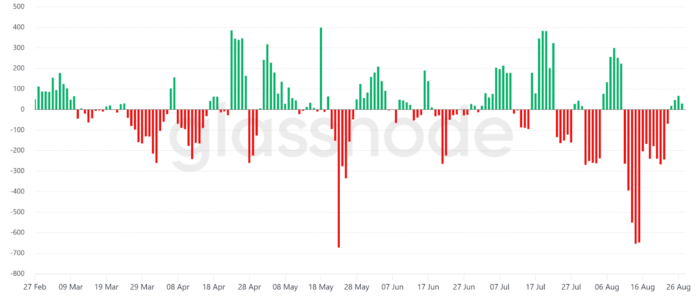

According to data from Glasnode, Miner Wallets have been consistently reducing their holdings between August 11 and 23, with the last section of consistent withdrawals of over 500 BTC per day occurring on December 28, 2024. This has led to a total outflow of $485 million in BTC, which is the largest sale by miners in nine months. The Miner Balance is now at 63,736 BTC, worth over $7.1 billion.

Despite the significant sale, the Bitcoin network remains resilient, with its Hashrate approaching an all-time high of 960 million TH/s. This increase in Hashrate has been driven by the growing number of miners and the increasing efficiency of mining equipment. The Bitcoin-Hashprice index, which measures the profitability of mining, has also improved dramatically compared to its level in March, according to data from Hashrateindex.

Impact on Bitcoin Price

The sale of BTC by miners has had a limited impact on the cryptocurrency’s price, which has increased by 18% over the past nine months. However, the profitability of mining has dropped by 10% over the same period, according to Hashrateindex. This decline in profitability has been driven by the increasing difficulty of mining and weaker demand for on-chain transactions.

Despite the challenges facing miners, the Bitcoin network remains strong, with its average block interval remaining at 10 minutes. The network’s resilience is a testament to the strength of its fundamentals and the commitment of its miners. However, the growing trend of miners pivoting to artificial intelligence (AI) infrastructure has raised concerns among investors, who are worried about the potential impact on the cryptocurrency’s price.

Miners Pivot to AI Infrastructure

Several miners, including Terawulf and Iris Energy, have announced plans to pivot to AI infrastructure, citing the growing demand for AI computing power. Terawulf has signed a $3.2 billion contract with Google to provide AI infrastructure, while Iris Energy has accelerated its acquisition of Nvidia GPUs and is building a liquid AI data center in Texas. Hive, previously known as Hive Blockchain, has also committed $30 million to expand its GPU operations in Quebec.

Despite the growing trend of miners pivoting to AI infrastructure, the Bitcoin network remains solid, with its Hashrate approaching an all-time high. The network’s strength is a testament to the commitment of its miners and the resilience of its fundamentals. However, investors remain cautious, citing the potential impact of the miners’ sale on the cryptocurrency’s price.

This article serves general information purposes and should not be regarded as legal or investment advice. The views, thoughts, and opinions expressed here are solely those of the author and do not necessarily reflect the views and opinions of Cointelegraph or its affiliates. For more information, visit https://cointelegraph.com/news/bitcoin-miners-cash-out-dollar485m-in-btc-here-s-why?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound