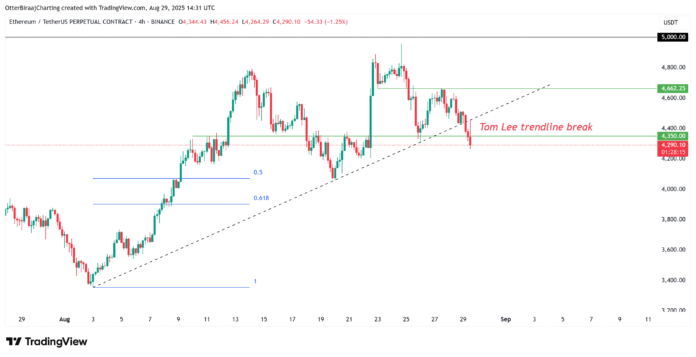

Ether Breaks Below Key Support Level: What’s Next for the Cryptocurrency?

The cryptocurrency market has witnessed a significant decline in the value of Ether (ETH) recently, with the coin breaking below the critical support level of $4,300. This move has sparked concerns among investors and analysts, who are now predicting a potential deeper correction in the coming weeks. According to data from Coinglass, the total liquidation of Ether futures positions between August 22nd and Friday amounted to $338 million, which has increased the likelihood of a further decline.

Mark Newton, an analyst at Fundstrat, had previously marked the $4,300 level as a decisive floor, citing the neutral relative strength index (RSI) and the still unused Ichimoku cloud structure as reasons for optimism. However, the current situation seems bleak, with the seasonality in September throwing a shadow over the bullish setup. Historical data shows that September has been the weakest month for Ether, with the coin achieving its worst average returns of -12.55% during this period.

Ether’s one-day chart shows the coin’s struggle to break above the resistance level of $4,700, which has resulted in a decline below the critical support level. The move has also been accompanied by a contraction in open interest, which suggests that long positions are being rinsed. According to analyst Amr Taha, the daily percentage change of the ETH Open Interest (OI) recorded a higher low compared to its last trough, but the absolute open interest fell on Binance to a lower low.

Increasing Divergence with Open Interest Trends in Ether

The divergence between the open interest and the price of Ether indicates a structural imbalance, whereby retail traders are completing long exposure instead of adding new positions. The total ETH open interest is currently around $9 billion, which is a significant decline from its previous levels. Interestingly, the last time the ETH recovered open interest, which was compressed to this brand, and recovered greatly to $4,900, which indicates that a similar relief for the excess leverage could form the foundation for restoration.

The financing rates over large stock exchanges have also returned negatively, which indicates a short dominance in eternal markets. The combination of falling open interest and negative financing rates confirms that longs are being rinsed and not initiated. However, such conditions can also precede sharp reversions, since the negative financing often signals overcrowded short positioning that has a faster than expected bullish back rash as soon as demand has been intervened.

Technical Analysis and Potential Support Levels

From a technical point of view, higher time frame charts show a weakness that comes to the monthly conclusion. Historically speaking, the highest probability of correction at the beginning of September, so that in the first week the possibility of a decline of 10% could take place compared to current prices. The immediate support for the watch is almost $4,180, although a crucial back rim of this level seems less likely, since the current collapse of a longer bullish phase follows.

Instead, market participants can position themselves mentally below the threshold of $4,000, with the zone matching $3,900 to $3,700 with a daily fair value gap (FVG) that could attract offers. If this zone fails, attention in the direction of the next FVG would shift between $3,100 and $3,300. This region could serve as a central turning point for a broader continuation of the bull market.

A breakdown below would mark a significant shift in the higher time frame structure and possibly raise questions about the sustainability of the current bull cycle of Ether. As the cryptocurrency market continues to evolve, it’s essential for investors to stay informed and adapt to the changing trends and conditions. For more information and analysis, visit https://cointelegraph.com/news/ether-breaks-below-tom-lee-trendline-is-a-10percent-incoming?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound