Tron Leads the StableCoin Race with a 60% Fee Reduction

The Super Representative Community from Tron has voted to reduce the network’s transaction fees by 60%, the largest fee reduction since the blockchain’s foundation. This move aims to defend Tron’s dominant position as a USDT rail, with a stable coin offer of $80.97 billion, surpassing Ethereum’s $73.8 billion. The proposal came into force on August 29, 2025, and is expected to increase transaction volume and maintain long-term sales growth.

The fee reduction is a strategic move to counteract rising transaction costs that threatened Tron’s dominance in StableCoin payments. The network processes daily USDT transfers of over $24.6 billion, almost seven times the Ethereum volume, and maintains a dominance of 98.56% in its StableCoin ecosystem. Tron’s fee structure aims to attract its user base, with 45% of users able to complete typical USDT transfers.

Strategic Fee War Intensifies Blockchain Competition

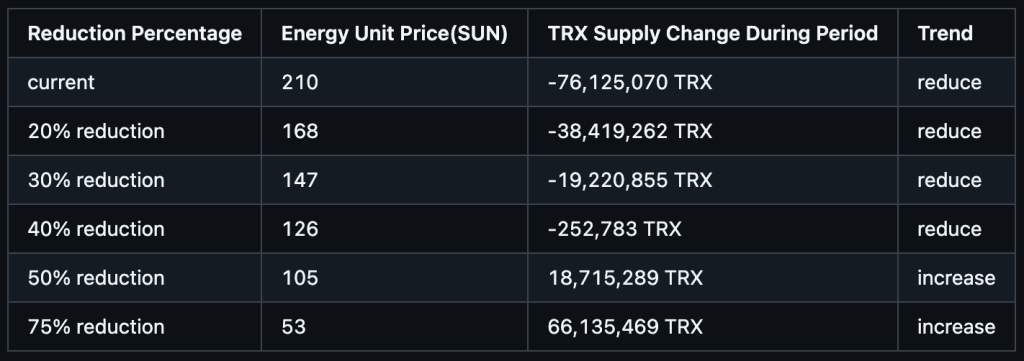

The analysis of the network shows that a 60% fee reduction could add 12 million potential transmission users and increase transaction volumes, maintaining sales despite lower individual fees. The proposal was adopted after three weeks of discussion in the community, with super representatives considering short-term income. Quarterly dynamic fees are checked against TRX price fluctuations, network activities, and growth rates to compensate for profitability with competitive positioning.

Justin Sun announced that the community proposal would affect short-term profitability but expects an increased transaction volume to achieve long-term sales growth. The network processed 273 million transactions in May, with 28.7 million active addresses and 75% gasless transaction models used. Tron achieved sales of $308 million in June, although it offers gasless functions.

USDT Dominance Faces Regulatory and Competitive Pressures

Tron organizes 51% of all circulating USDT worldwide, with an offer of $80.97 billion, compared to Tether’s total output of $157.1 billion in all blockchains. The network processes a daily volume of over $23.5 billion and consistently exceeds the billing activities of $20 billion from Ethereum. The regulatory framework, including the US Genius Act, EU Mica, and StableCoin Bill from Hong Kong, also solved their way to dominance.

However, the competition continues to increase from Ethereum Layer 2 solutions and Solana, which has started to optimize the chain for improved scalability and lower costs. In the midst of growth, the NASDAQ-listed Tron Inc. requested $1 billion in securities for TRX token purchases, reflecting the Bitcoin Treasury model from Microstrategy. For more information, visit https://cryptonews.com/news/tron-votes-to-slash-network-fees-60-to-defend-stablecoin-dominance/