Unveiling the Largest Ether Owners in 2025

The Ethereum network has witnessed significant growth and adoption in recent years, with a substantial increase in the number of users and investors. As of August 2025, the top 10 ether addresses hold approximately 83.9 million ETH, accounting for around 70% of the total circulating supply. But who are the largest ether owners in 2025, and what does this mean for the future of the Ethereum network?

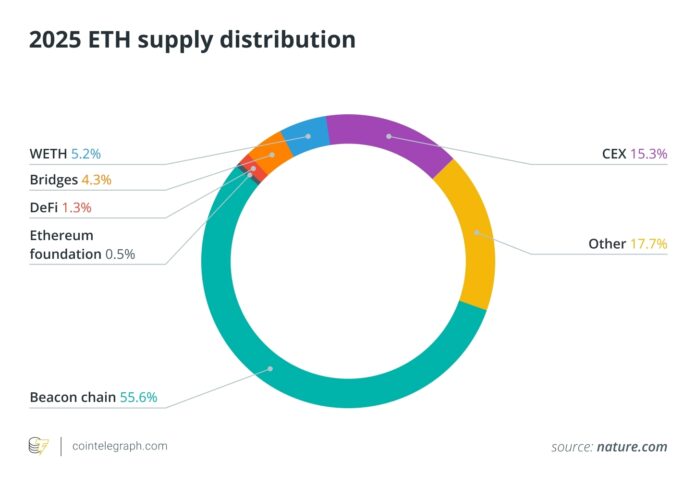

A closer examination of the data reveals that the majority of ether is held by intelligent contracts, larger exchanges, Exchange-Traded Funds (ETFs), and even public companies at the protocol level. The Beacon deposit contract, which promotes Ethereum’s proof-of-stake system, holds around 65.88 million ETH, equivalent to approximately 54.58% of the total circulating supply. This makes the Beacon contract the largest ETH owner, surpassing individual whales and institutional investors.

Breakdown of the Top Ether Addresses

The top 10 ether addresses hold a significant portion of the total circulating supply, with the largest addresses belonging to intelligent contracts, exchanges, and institutional investors. As of August 4, 2025, the top 10 ether addresses hold approximately 83.9 million ETH, while the 200 most important wallets make up over 52% of the total supply, maintaining more than 62.76 million ETH. These investments are largely tied to the deduction of contracts, exchange liquidity, token bridges, or depot funds.

Institutional investors, such as Blackrock, Fidelity, and listed companies, now hold millions of ETH, transforming ether into a serious asset. The Ethereum network has evolved from its early days, with the majority of ether now held by platforms and services built on top of it. This shift in ownership structure has significant implications for the future of the Ethereum network and its potential for growth and adoption.

The Role of Intelligent Contracts and Exchanges

Intelligent contracts play a crucial role in the Ethereum ecosystem, with the Beacon deposit contract being the largest ETH owner. The contract holds around 65.88 million ETH, which is used to secure the network and promote the proof-of-stake system. Exchanges, such as Coinbase, Binance, and Bitfinex, also hold significant amounts of ETH, with these addresses representing an active infrastructure layer that supports liquidity, derivatives, and bridging between chains.

The wrapped ether (WETH) contract is another significant ETH owner, holding over 2.26 million ETH, equivalent to around 1.87% of the circulating supply. These contracts and exchanges are essential components of the Ethereum ecosystem, providing liquidity, security, and functionality to the network.

Institutional Investors and Corporate Treasuries

Institutional investors, such as Blackrock and Fidelity, have entered the Ethereum market, holding millions of ETH. The Blackrock Ishares Ethereum Trust (Etha) has driven significant growth in institutional ETH ownership, with over 3 million ETH held as of August 2025. Grayscale’s ETHE and Fidelity’s Ethereum Fund (FETH) are also notable players in the institutional ETH market, with these funds representing a new class of regulated, ETF-based, and confident investors.

Corporate treasuries, such as Bitmine Immersion Technologies and Sharplink Gaming, have also started to accumulate ETH, with these companies citing the programmability of Ethereum, the stablecoin ecosystem, and regulatory clarity as the basis for their ETH strategies. This growing trend of institutional and corporate investment in ETH is likely to have a significant impact on the future of the Ethereum network.

The ETH Billionaire List

While intelligent contracts and institutions dominate the Ethereum rich list in 2025, some individuals are still notable ETH owners. Vitalik Buterin, co-founder of Ethereum, is estimated to hold between 250,000 and 280,000 ETH, mainly in non-custodial wallets. Other notable individuals, such as Rain Lõhmus, Cameron and Tyler Winklevoss, and Joseph Lubin, also hold significant amounts of ETH.

However, it’s essential to note that the identification of the top ether owners in 2025 is based on tools such as Nansen’s token-God mode, Dune Analytics, and Ethercan, which categorize wallets based on behavior and connect them to exchanges, funds, intelligent contracts, or individuals. While these sources provide valuable insights, limits remain, and the data should be interpreted with caution.

Tracking the Distribution of Ethereum Ownership

To pursue the distribution of Ethereum ownership, it’s essential to utilize tools such as Nansen’s token-God mode, Dune Analytics, and Ethercan. These platforms provide valuable insights into the Ethereum ecosystem, allowing users to track the largest ETH owners, identify trends, and make informed decisions. However, it’s crucial to remember that the data is not always accurate and may be subject to limitations, such as address reuse, cold wallets, and data protection techniques.

In conclusion, the largest ether owners in 2025 are a mix of intelligent contracts, institutions, and individual investors. As the Ethereum network continues to evolve, it’s essential to track the distribution of ownership and understand the implications for the future of the network. For more information, visit https://cointelegraph.com/news/who-owns-the-most-ether-in-2025?utm_source=rss_feed&utm_medium=rss_category_analysis&utm_campaign=rss_partner_inbound.