Australia’s $2.8 Trillion Pension Pool: A New Frontier for Crypto Adoption

Since the signing of the 401(k) Act in the U.S., crypto exchanges worldwide have been eyeing retirement savings as a major on-ramp for digital assets. According to a Bloomberg report, Australia’s $2.8 trillion pension pool, known locally as superannuation, has emerged as one of the largest targets, with Coinbase and OKX rolling out products aimed at steering retirement funds into crypto.

Superannuation, Australia’s mandatory retirement savings scheme, totaled $2.7 trillion as of September 2024, up from $1.2 trillion a decade earlier, with an average annual growth rate of 8.2%. This dwarfs the A$2.5 trillion market cap of all companies listed on the Australian Stock Exchange.

Deloitte projects the sector will expand further, reaching $11.2 trillion by 2043 in nominal terms (about $7 trillion in today’s value). The massive size of this pool indicates why global exchanges view superannuation as a critical entry point. Coincidentally, the push into pensions also comes at a time when the super system is both seeking yield and grappling with its scale.

Cath Bowtell, chair of IFM Investors, which manages $230 billion in assets worldwide, described the sheer magnitude in a report, stating that $3.2 billion flows into the system weekly, requiring constant investment opportunities.

Super funds already span infrastructure ranging from U.S. toll roads to Canadian ports, but liquidity challenges and global risks mean funds are increasingly looking abroad for diversification.

Coinbase and OKX: Pioneering Crypto Adoption in Australian Pensions

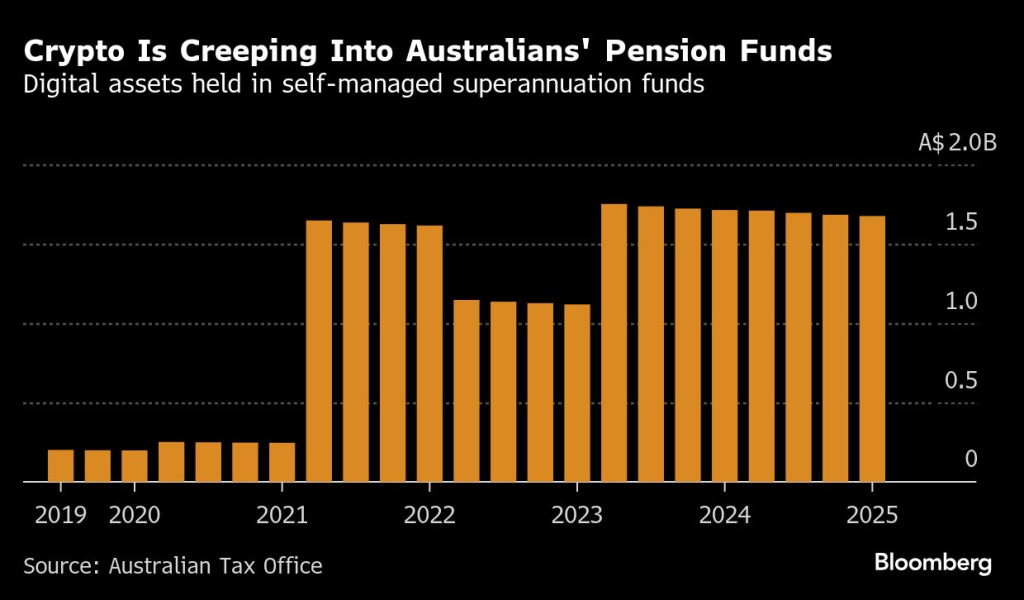

Coinbase and OKX are focusing their pension-linked crypto strategies on self-managed superannuation funds (SMSFs), which are seen as more receptive to alternative assets than traditional funds.

“It does make sense that we’re probably seeing a bit more interest in crypto in the self-managed super fund space first,” said Fabian Bussoletti of the SMSF Association in the Bloomberg report, noting that larger funds may eventually follow.

Coinbase is preparing to launch a dedicated SMSF service with more than 500 investors already on its waiting list. According to Asia-Pacific managing director John O’Loghlen, 80% of these potential users intend to establish a new SMSF, and 77% plan to invest up to A$100,000 in digital assets.

OKX, which launched a similar product in June, has already seen demand exceed expectations, according to Australian CEO Kate Cooper. Both exchanges plan to streamline SMSF creation by linking investors to accountants and legal advisors.

Regulatory Challenges and the Future of Crypto in Australian Pensions

Despite growing momentum, Australia’s experiment could hinge on whether crypto can overcome persistent regulatory skepticism. The country’s regulators—including ASIC, AUSTRAC, the tax office, and the central bank—have consistently urged caution.

“These are highly volatile products, and overexposure can lead to substantial losses,” ASIC warned in an emailed statement, urging Australians considering crypto within SMSFs to seek professional financial advice.

AUSTRAC has itself escalated its oversight through a nationwide campaign targeting non-compliant exchanges and money laundering risks. In December, it established a task force to investigate suspicious activity associated with crypto ATMs, scams, and fraud.

For more information on this topic, please visit the original source: https://cryptonews.com/news/coinbase-okx-unlock-australias-2-8-trillion-pension-pot-for-crypto-bloomberg/