Introduction to Cryptocurrency Market Trends

The cryptocurrency market is known for its volatility, and understanding the trends is crucial for investors. Recently, Bitcoin (BTC) has been trying to break through the $110,000 barrier, but bears have been defending this level. The market sentiment platform Santiment reported an increase in “buy the dip” mentions on social media, which could signal a potential floor formation if widespread fear and lack of interest in buying occur.

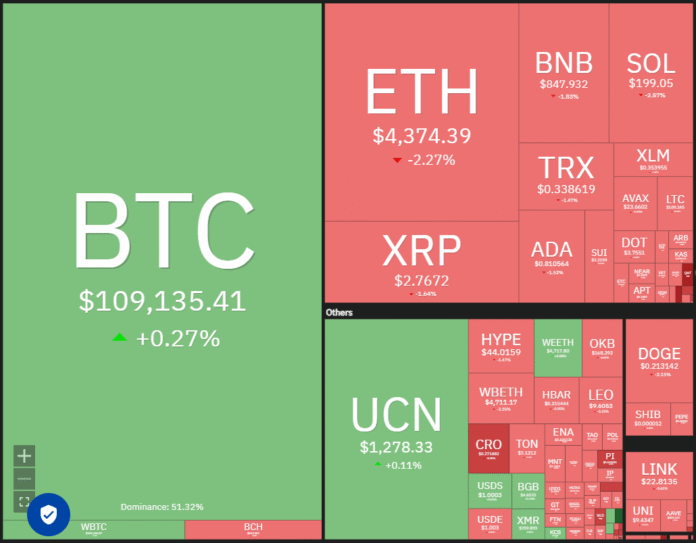

Krypto market data Daily View. Source: Coin360

Seasonal Weakness and Institutional Investment

Historically, September has been a negative month for BTC, with an average decline of 3.80% since 2013. However, institutional investors continue to show interest in digital assets, with $2.48 billion invested in the past week, according to CoinShares data. This influx of investment could potentially impact the market trends.

S&P 500 Index Price Forecast

The S&P 500 index remains in an upward trend, but the negative divergence of the relative strength index (RSI) suggests a weakening bullish momentum. The bears may attempt to pull the price below the 20-day exponential moving average (EMA), which could lead to a decline to the 50-day simple moving average (SMA) and potentially to the breakout level of 6,147.

SPX Daily diagram. Source: CoinTelegraph/Tradingview

US Dollar Index Price Forecast

The US dollar index (DXY) attempted to break above the moving averages but was unable to sustain the higher level. The index turned away and closed below the moving averages, indicating that bears are trying to gain control. The next support level is at 97.55, and if this level is broken, the index could decline to 97.10 and then to 96.37.

Dxy Daily Chart. Source: CoinTelegraph/Tradingview

Bitcoin Price Forecast

On Friday, BTC fell below the support level of $110,530, indicating that bears are trying to take control. However, bulls are unlikely to give up easily and will attempt to push the price back above the 20-day EMA. If the price is strongly rejected by the 20-day EMA, it could lead to a decline to $105,000 and then to $100,000.

BTC/USDT Daily Chart. Source: CoinTelegraph/Tradingview

Ether Price Forecast

ETH (ETH) is experiencing a tough battle between bulls and bears at the 20-day EMA. The flat 20-day EMA and the RSI near the midpoint do not give a clear advantage to either the bulls or the bears. If the price breaks below the 20-day EMA, the ETH/USDT pair could decline to $4,094, and if this level is broken, it could lead to a fall to $3,745 and then to $3,350.

ETH/USDT Daily diagram. Source: CoinTelegraph/Tradingview

XRP Price Forecast

XRP (XRP) continued its slide to the crucial support level of $2.73, where buyers are expected to step in. The 20-day EMA is likely to act as a resistance, and if the price breaks below the 20-day EMA, the XRP/USDT pair could fall to $2.33, completing a bearish descending triangle pattern.

XRP/USDT Daily diagram. Source: CoinTelegraph/Tradingview

BNB Price Forecast

BNB (BNB) is trying to hold above the 20-day EMA, but bears are unlikely to give up easily. The negative divergence of the RSI indicates that the 20-day EMA is at risk of a breakdown. If this happens, the BNB/USDT pair could decline to the 50-day SMA.

BNB/USDT Daily Chart. Source: CoinTelegraph/Tradingview

Solana Price Forecast

Solana (SOL) broke below the breakout level of $210, indicating that bears are trying to catch aggressive bulls. The SOL/USDT pair is likely to find support in the zone between the 20-day EMA and the upward trend line. If the price bounces off the upward trend line, bulls will attempt to drive the pair above $218.

Sol/USDT Daily diagram. Source: CoinTelegraph/Tradingview

Dogecoin Price Forecast

Dogecoin (DOGE) has declined to the support level of $0.21, indicating that bears are selling at small rallies. The 20-day EMA has turned down, and the RSI is just below the midpoint, which increases the risk of a breakdown. If the price breaks below $0.21, the DOGE/USDT pair could decline to $0.19.

Doge/USDT Daily diagram. Source: CoinTelegraph/Tradingview

Cardano Price Forecast

Cardano (ADA) attempted to break above the 50-day SMA but was met with selling pressure from bears. The ADA/USDT pair closed below the 50-day SMA and began its slide