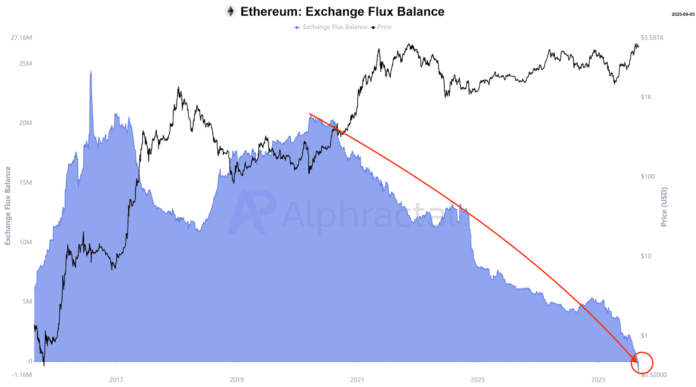

Ethereum (ETH) is showing signs of a potential bull run, with its exchange flow balance turning negative for the first time in history. This significant milestone could mark a shift in investor behavior, with more ETH tokens leaving exchanges than being deposited. According to Joao Wedson, founder and CEO of data analysis platform Alphractal, this negative balance indicates accumulation and long-term holding behavior, which could lead to higher prices in the long run.

ETH Exchange Flow Balance Turns Negative

The exchange flow balance is a metric that tracks the cumulative net flow of ETH across all exchanges over time. A positive value indicates more inflows than outflows, which can lead to potential selling pressure. On the other hand, a negative balance suggests that more ETH tokens are leaving exchanges than being deposited, which is a sign of accumulation and long-term holding behavior. As Wedson noted in an X post, “Billions of dollars in ETH flow out of the exchanges!” This historical milestone could mark a big change in ETH investor behavior.

ETH exchange flow balance. Source: Alphractal

In recent weeks, the exchange flow balance has increased, reflecting significant accumulation and reducing the supply of ETH. This reduction in supply could lead to a lack of liquidity and higher prices in the long run. As reported by CoinTelegraph, the overall balance of ETH balance sheets has generally been lowest for nine years, with the exchange balance at 15.72 million ETH after Friday, according to Glassnode data.

ETH exchange network flows. Source: Alpractal

ETH Price Must Break $4,500 to Secure Bull Run

For the ETH price to secure a bull run, it must break the $4,500 resistance level. This level has limited the price since ETH dropped to $4,300 on August 29. Crypto trader Jelle noted that a decisive close above $4,500 would “leave very little in the way” of a higher move to price discovery. Analyst Donald Dean also pointed out that a daily candlestick close above the upper trend line of the pennant at $4,500 would confirm the breakout.

ETH/USD four-hour chart. Source: Jelle

Based on Fibonacci Retracement Levels, Dean determined the targets for the bull run at $5,766, $6,658, and $9,547. These targets are set based on the ETH/BTC relationship, with $5,766 at the 50% retracement, $6,658 at the 618 FIB level, and $9,547 for 100% withdrawal.

Several bullish signs indicate that ETH is well-positioned to break above $5,000 in the coming days or weeks. However, it’s essential to note that every investment and trade movement carries risk, and readers should conduct their own research before making any decisions. For more information, visit https://cointelegraph.com/news/ethereum-bull-run-eth-exchange-flux-turns-negative-for-the-first-time?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound