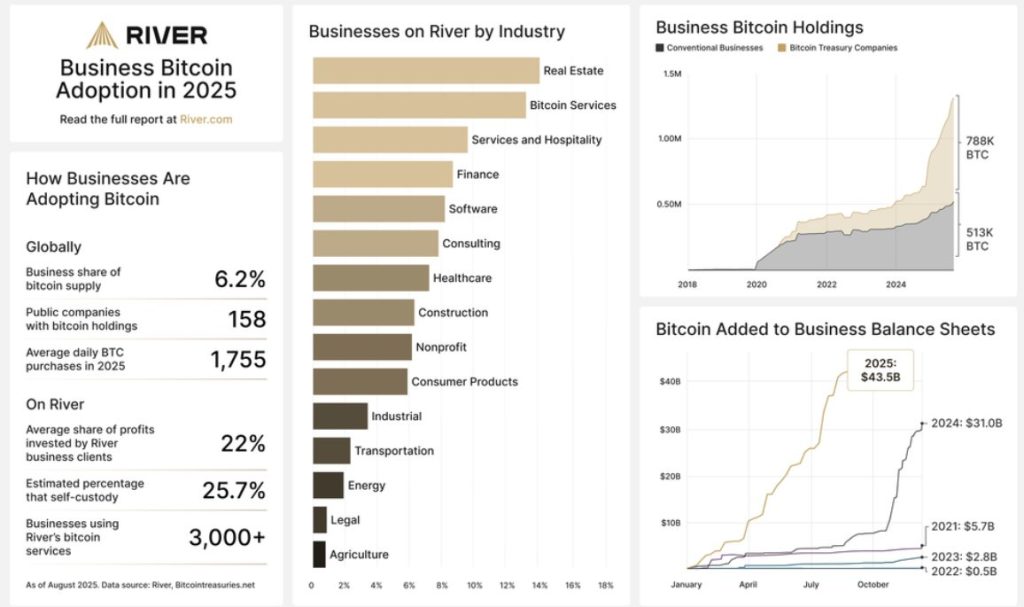

Businesses Invest Heavily in Bitcoin, Purchasing 1,755 Coins Daily

According to recent research, businesses across various industries have been investing heavily in Bitcoin, purchasing an average of 1,755 coins daily. This significant investment has contributed to a substantial increase in Bitcoin’s market capitalization, with over $1.3 trillion added in the past 20 months. Market analysts believe that if this steady investment flow continues, Bitcoin’s price could potentially reach $125,000, making it a lucrative investment opportunity.

The study, conducted by River, found that institutional Bitcoin acquisition has driven corporate reserves from 510,000 BTC to 1.3 million BTC between January 2024 and August 2025. Additionally, the number of publicly traded companies owning Bitcoin has expanded from 39 to 158 entities during this period. This significant growth in business adoption has led to businesses now controlling more than 6% of Bitcoin’s circulating supply, representing a twenty-one-fold expansion since January 2020.

Bitcoin Treasury Companies have driven much of this growth in business adoption, accounting for 76% of all business purchases since January 2024 and 60% of publicly reported business holdings. These companies focus on amassing substantial Bitcoin reserves, providing shareholders with equity-based exposure to Bitcoin’s price movements.

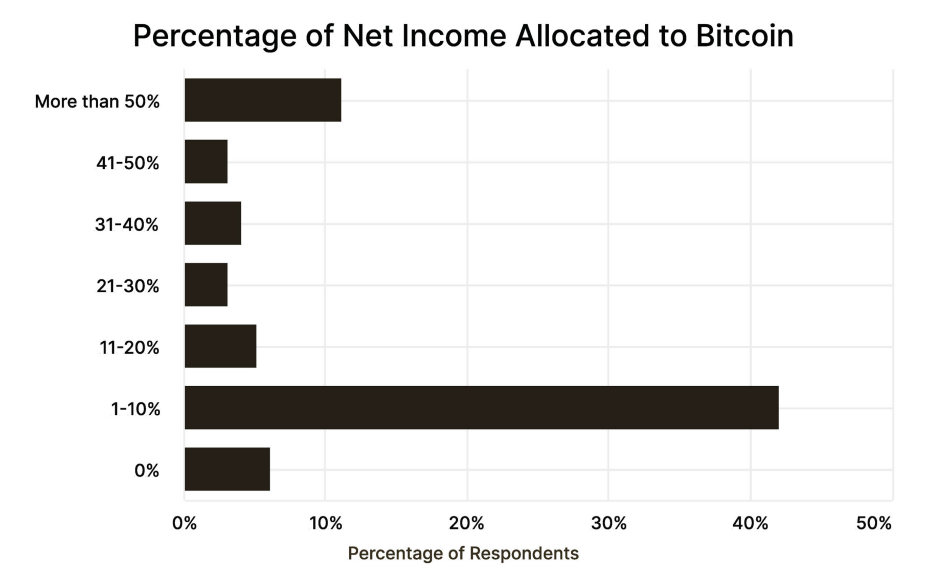

22% Net Income Allocation: Businesses Go All-In on Bitcoin Strategy

According to River’s research, businesses are now allocating a significant portion of their net income towards Bitcoin investments. The current corporate allocations average 22% of net income toward Bitcoin investments, based on July 2025 survey data, while the median allocation reaches 10%. This significant investment in Bitcoin demonstrates the growing confidence of businesses in the cryptocurrency’s potential for long-term growth.

Among these companies, 63.6% treat Bitcoin as a permanent investment vehicle, continuously accumulating positions without immediate selling or portfolio rebalancing intentions. This long-term approach demonstrates the confidence of businesses in Bitcoin’s potential for growth and their willingness to hold onto their investments despite market fluctuations.

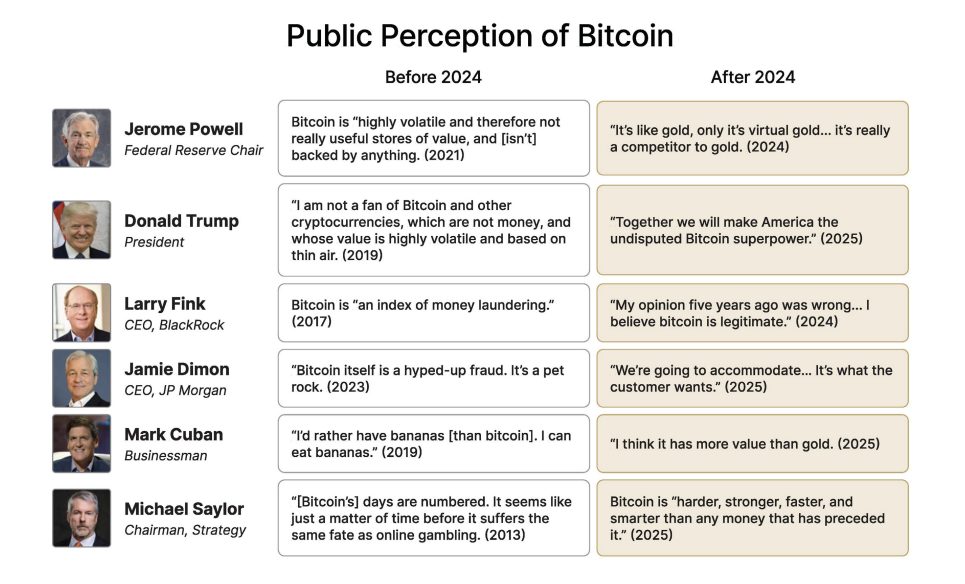

BTC Above $125K Within Reach as Volatility Drops to Gold Levels

Bitcoin’s climb above $125,000 now seems increasingly attainable, with previous adoption barriers, such as government “ban” fears or corporate ownership restrictions, having mostly vanished. Multiple sovereign nations now maintain official Bitcoin investments, and the United States has launched its Strategic Bitcoin Reserve program. Bitcoin’s volatility has also decreased, reaching levels comparable to gold, making it a more attractive investment option for businesses and individuals.

Analyst Zynweb3 observes that Bitcoin historically reaches lows at the 0.382 Fibonacci retracement, occurring in Q3 2024 and Q2 2025, with potential repetition ahead. This suggests that Bitcoin’s price could potentially drop to around $100,000 before experiencing a significant rally above $150,000.

Bitcoin Technical Analysis: $114K Resistance Break Could Trigger BTC Above $125K Breakout

Technically, the Bitcoin 4-hour chart shows the price has bounced strongly from the correction zone around $108,000, forming a bullish engulfing structure that signals renewed buying momentum. The current move suggests a push toward immediate resistance near $114,000, which will be the first test for bulls to confirm strength. If Bitcoin manages to break and sustain above this level, the chart projects an extended move toward key resistance at $120,000, marking the upper boundary of the current bullish structure.

For more information on this topic, please visit the original source: https://cryptonews.com/news/businesses-buy-1755-bitcoin-daily-adding-1-3-trillion-in-20-months-btc-above-125k-next/