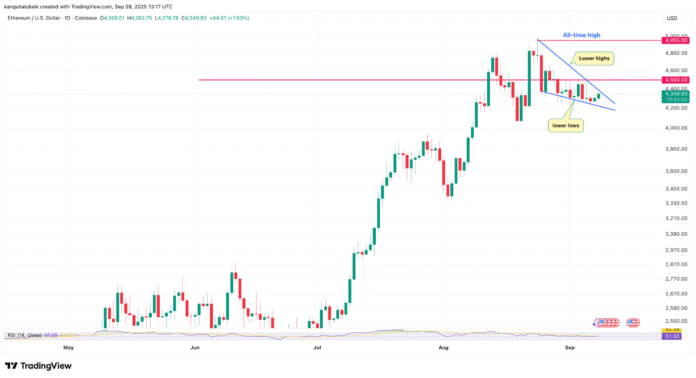

Ethereum’s (ETH) price has been struggling to break through the $4,500 resistance level, and technical indicators suggest a possible decline to $3,500. Since reaching an all-time high of $4,950 on August 14, the price has formed a series of lower highs and lower lows on the daily candle chart.

Declining Demand and Weakening Signal

The decline in purchase and spot Ethereum exchange-traded fund (ETF) demand has led to a weakening signal, with the Spot Volume Delta Metric indicating a negative net spot purchase on exchanges. This lack of demand may lead to further consolidation or a deeper withdrawal, as every attempted breakout may lack the momentum required to push ETH above key levels.

According to data from Sosovalue, Spot Ethereum ETFs have seen a decline in demand, with outflows of $446.8 million on Friday alone, bringing the total outflows to -$787.6 million for the week. This decrease in demand may be a sign of a weakening market, making it challenging for ETH to break through the $4,500 resistance level.

Reduced Leverage and Open Interest

The open interest (OI) in Ethereum futures has decreased by 18% to $58 billion, from an all-time high of $70 billion on August 23. This decline in OI suggests reduced leverage and market participation, which may signal a weaker trend. As CoinTelegraph reported, a decline in OI between August 28 and September 3 was accompanied by a 15% drop in ETH price.

Ethereum Network Activity and Revenue

According to TOKEN Terminal, Ethereum revenue has decreased, with the proportion of revenue due to token burns falling by around 44% in August. Despite the ETH price rally of 240% since April, the decline in revenue occurred on August 24, when ETH reached an all-time high of $4,957. The 30-day performance of top blockchains shows a decline in network fees from around 10% to around $43.3 million, as Nansen data shows.

Technical Analysis and Price Projections

Since mid-August, the ETH price has been forming a descending triangle pattern on the daily chart, which is considered a bearish reversal indicator. A daily candlestick below the support line of the triangle at $4,200 would confirm the continuation of the downward trend, with a measured target of $3,550. However, some analysts argue that a bounce may occur earlier, with investor and trader Ted Pillows suggesting a potential decline to $3,800-$3,900 before a reversal.

Read the full article at https://cointelegraph.com/news/why-is-ethereum-price-failing-to-break-4-5k