The world of stablecoins is heating up, with various companies vying for dominance in the market. Recently, Stripe announced its plans to issue a hyperliquid stable coin, dubbed USDH, in collaboration with other crypto companies such as MoonPay, Agora, and Rain. This move is seen as a challenge to existing stablecoin issuers like Paxos and Frax.

Introduction to USDH

In a Discord message on Friday, the Hyperliquid team announced its intention to create a “hyperliquid-first, hyperliquid-oriented, and compliant USD stablecoin”. This was followed by Native Markets submitting the first proposal in the StableCoin payment processor Bridge edition of Stripe. The Native Markets proposal promised to contribute “a sensible proportion of its reserve proceeds” to Hyperliquid’s assistant fund Ministry, with a focus on ecosystem and regulatory compliance.

However, not everyone is convinced that Stripe is the right partner for Hyperliquid. Nick van Eck, co-founder and CEO of Agora, made an alternative proposal, arguing against the Stripe alternative. “If Hyperliquid gives up its canonical stable coin on Stripe, a vertically integrated issuer with clear conflicts, what do we all do?” van Eck asked, urging caution before using Stripe (Bridge) as an issuer.

Concerns Over Stripe’s Involvement

Van Eck claimed that Bridge has inadequate financial infrastructure and product experience, and also referred to the announcement of plans for its own pace blockchain as a potential conflict of interest. “Stripe is obliged to drive activities in this ecosystem,” he said, questioning how long it would take before Stripe and Bridge begin to push users and perpetrators from other financial applications directly to their own platform instead of Hyperliquid.

MoonPay President and board member Keith Grossman announced on Sunday that the payment processing company would support Agora’s proposal for issuing USDH for Hyperliquid, utilizing “the regulated payment rails available” to operate this initiative. Like van Eck, he criticized the Native Markets proposal, stating that “USDH deserves scaling, credibility, and orientation – not the BS recording. This is this coalition, not roaming.”

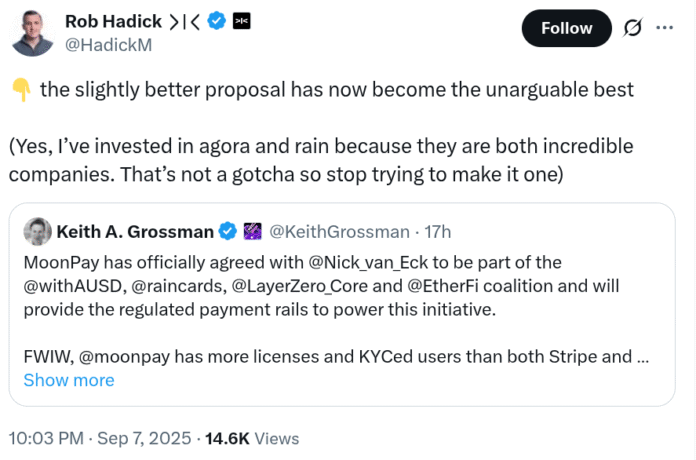

Rob Hadick, general partner of the venture capital company Dragonfly.xyz, expressed his enthusiasm for the addition of MoonPay to the coalition, calling it the “undeniable best” proposal for USDH emission. In a post on Sunday, he wrote that the coalition’s proposal made it the top choice for USDH emission.

Source: Rob Hadick

Competing Proposals

Apart from the Stripe proposal, the coalition must compete with stablecoin issuers Paxos. On Sunday, the company also made a proposal for the introduction of USDH, promising to direct a percentage of the interest earned by USDH reserves to Hyperliquid’s native token, HYPE, and to users, validators, and partner protocols.

Another competing proposal is that of the Frax Blockchain, which promises to return all income from USDH-supported by its FRXUSD to the community. “We suggest that nobody else agrees: give the community everything back,” says the proposal.

Stablecoins: An Active Battlefield

The competition highlights the growing activity in the stablecoin sector as regulatory authorities and financial institutions step in. HSBC and ICBC are reportedly preparing to apply for stablecoin licenses in Hong Kong, where a new framework came into force on August 1st.

Adoption is also moving quickly, with the financial regulatory authorities of Kazakhstan recently paying for license and monitoring fees in stable coins in US dollars. The US state of Wyoming also plans to start StableCoin’s stable coin approved by the local government. 1Money, a company that builds a Layer 1 blockchain for stable coin payments, recently announced that it has secured up to 34 US money transfer licenses in addition to a Bermuda license.

At the beginning of this month, the President of the European Central Bank, Christine Lagarde, asked the EU legislature to tackle gaps in stablecoin regulation. “[The US government’s policies] Could not only lead to further fees and data loss, but also moved to the United States in Euro deposits, ”said Piero Cipollone, board member of the ECB, in April.

For more information on the Hyperliquid USDH stablecoin and the competing proposals, visit Cointelegraph.