XRP Price Surge: Can it Reach $3.60 Amid ETF Approval Hopes?

The cryptocurrency market has been abuzz with speculation about the potential approval of a Ripple Exchange-Traded Fund (ETF) in the United States. According to Bloomberg analysts, there is a 95% chance of winning for an XRP ETF, with a Securities and Exchange Commission (SEC) decision expected in October. This news has led to a surge in the price of XRP (XRP), which reached $3.04 on Tuesday after being rejected from its highest level. The move was fueled by speculation about the potential approval and increased institutional participation in XRP derivatives, which has raised expectations about whether XRP could visit the $3.60 level in July.

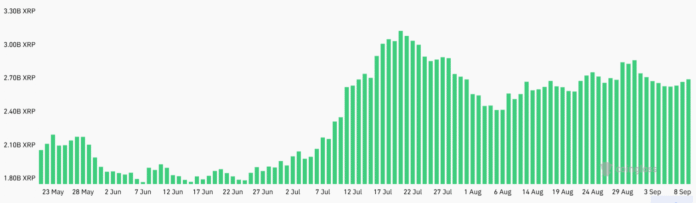

The demand for XRP Futures has risen significantly, with aggregate open interest reaching $7.91 billion at prevailing prices, compared to the previous month. The number of outstanding XRP futures contracts listed at the Chicago Mercantile Exchange (CME) has increased by 74% in the same 30-day period, reaching 386 million XRP. This increase shows greater participation from professional fund managers and market makers.

XRP Futures aggregate open interest, XRP. Source: Coinglass

XRP Futures Premium and Market Sentiment

While higher futures activity in general interest shows long and short positions, monthly futures contracts can provide signals from leverage. Under neutral market conditions, XRP Futures usually trade 5% to 10% above spot markets to account for the longer settlement time. The monthly XRP Futures are currently trading with a premium of 7%, which indicates that the leverage question is balanced, corresponding to the pattern of the last month.

XRP 3 months Futures Annualized Premium. Source: laevitas.ch

One reason for the subdued view is the underperformance of XRP compared to the wider Altcoin market capitalization. XRP has remained flat since August, while the Altcoin market has risen by 14% in the same period. This rally was supported by gains of 32% in Hyperliquid (HYPE), 28% in Solana’s SOL, 19% in Cardano’s ADA, and 18% in Ether (ETH).

Total altcoin capitalization (red) against XRP/USD (blue). Source: Tradingview / Cointelegraph

XRP Rally Depends on Upcoming ETF Decision

The expectation of an XRP ETF approval in the USA has been central to the recent price performance of XRP. Bloomberg analysts lay the chances of winning at 90% or higher, although the final decision from the SEC is only expected at the end of October. Rex-Footry products that combine ETF and ETN structures could arrive earlier, following a model similar to Solana’s SSP, for which no direct approval from the SEC is required.

Stablecoin ranking, USD. Source: Defillama

The StableCoin Rlusd from Ripple has also crossed the $700 million mark for assets. While the milestone seems impressive, almost 90% of the offering was issued on the Ethereum network, which creates little to no direct demand for the XRP main book. In addition, the StableCoin market remains dominated by established issuers with deeper liquidity, including Circle’s USDC and World Liberty’s USD Liberty, which presents impressive competition.

Some investors expect XRPL to develop into a primary intermediary of international payments, effectively replacing the current fast infrastructure or expanding its role in tokenization. However, data from rwa.xyz shows that XRPL only makes up 2% of outstanding real assets, and smaller blockchains such as Avalanche, Star, and Aptos are being utilized.

The progress of XRP to $3.60 cannot be excluded, but given the modest $100 million total value locked (TVL), the likelihood of such a dynamic seems limited. For more information, visit https://cointelegraph.com/news/xrp-aims-for-dollar3-amid-etf-approval-hopes?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound