XRP, a cryptocurrency known for its real-time gross settlement system, has been gaining significant attention from investors and market analysts alike. The potential of XRP to rise to new all-time highs is supported by increasing institutional demand and open interest. According to recent data, the price of XRP could continue its upward trend to $3.12 and later to $4.50.

Institutional Demand and Open Interest

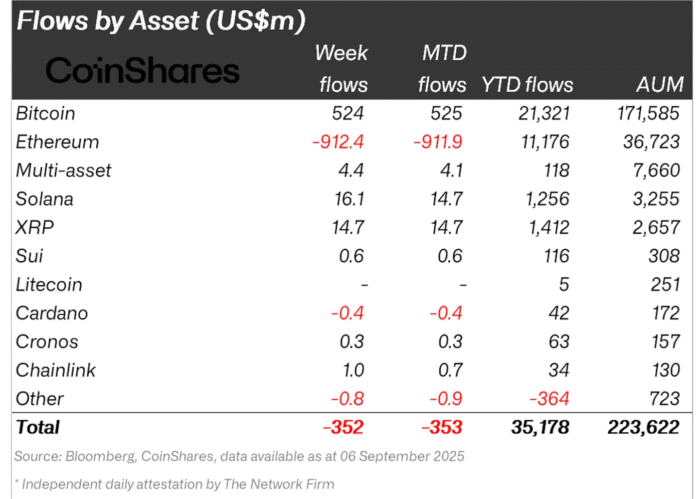

The XRP price has increased by 1.7% in the last 24 hours and by 6% in seven days, currently trading over $3. Market analysts say that this defines the old coin for further profits by several on-chain and technical factors. The institutional demand for XRP system products remains constant, with XRP Exchange Traded Products (ETPs) achieving inflows of a total of $14.7 million in the week of September 5, bringing their inflows to $1.4 billion for the year.

Crypto Funds Net Flows Data. Source: Coinhares

Other top-cap cryptocurrencies, such as Bitcoin (BTC), Solana (SOL), and SUI (SUI), recorded net inflows of $524 million, $16.1 million, and $600,000, respectively. Ether (ETH) achieved outflows of $912 million, indicating a possible rotation of funds from the largest altcoin to other cryptocurrencies, including XRP.

XRP Derivatives Data

XRP derivatives also show that traders are coming back and opening new positions, indicating an increase in speculative impulse. The open interest (OI) of XRP has increased by 11% to $8.3 billion in the past seven days, compared to $7.4 billion on September 4, signaling an increase in dealer participation. According to data from Coinglass, OI has increased by 4% in the last 24 hours alone.

XRP-Future Open interest. Source: Coinglass

The funding rate, periodic payments between long and short traders in perpetual futures contracts to reconcile prices with the spot market, has been positive since August 1. This metric has increased steadily over the past 10 days, indicating that more traders are taking long positions (betting on a price increase) compared to short positions (betting on a decline).

XRP OI-weighted funding rate. Source: Glasnode

XRP Price Targets

The XRP price has been consolidating a symmetrical triangle, with data from CoinTelegraph Markets Pro and TradingView showing a symmetrical triangle in the daily period. It broke out of consolidation on Monday with a daily close above the upper limit of the triangle at $2.95.

“XRP broke out of its multi-month consolidation, and the confirmation of the breakout occurs with the now $3 test in play,” said analyst Casitades in a Wednesday post on X.

XRP/USD Daily Chart. Source: Casitaden

According to Casitades, the most important levels are upside down as soon as the resistance at $3 has been resolved, $3.08 and $3.27. “In addition, Fibonacci extensions from the larger consolidation have not changed and still point to the $4.50 zone as a breakout destination.”

Other analysts have even more ambitious goals for XRP, saying that it is still on track to achieve $20 for the cycle based on Elliot wave analysis.

For more information, visit https://cointelegraph.com/news/xrp-price-why-the-next-logical-target-is-4-50?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound