Bitcoin’s Record-Breaking Hash Rate and Network Difficulty: A Bullish Sign for Investors

Bitcoin’s hash rate, a measure of the network’s computational power, has reached an all-time high of 1.12 billion TH/s, according to data from Bitinfocharts. This significant milestone is a testament to the growing confidence of miners in the Bitcoin network. The increasing hash rate indicates that more miners are joining the network, which in turn, increases the security and stability of the blockchain.

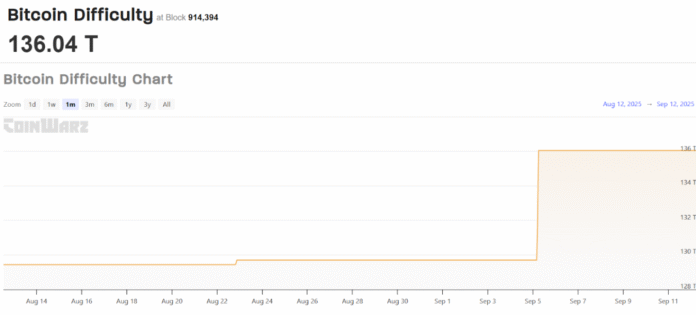

The network difficulty, which measures the computational complexity required to mine new blocks, is also on track to reach a record peak of 136.04T. This surge in difficulty is a direct result of the increased hash rate, as more miners compete to solve complex mathematical equations and validate transactions on the blockchain. According to CoinWarz, the upcoming difficulty adjustment is projected to occur on September 18, 2025, with current estimates indicating a 6.38% increase to 136.04T.

Market analysts believe that the record-breaking hash rate and network difficulty could trigger a breakout above $117,000. The Federal Reserve’s highly anticipated rate decision, scheduled for September 17, is expected to have a significant impact on the market. A 25-basis-point rate cut is anticipated, which could lead to a risk-on market and boost investor sentiment.

Bitcoin Technical Analysis: A Bullish Outlook

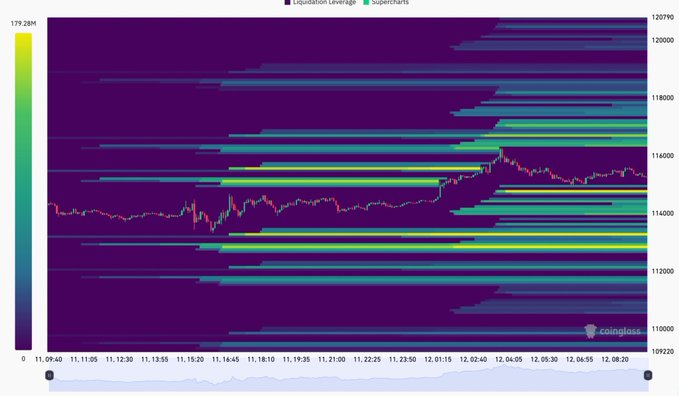

Bitcoin analysts have identified $117,200 as the key resistance level for the price to overcome. Should BTC decisively reclaim this threshold, pathways toward new all-time highs above $124,000 would emerge. The current price of around $115,400 is near the range’s upper limit, where resistance has historically prompted corrections. With support established around $107,700, the chart indicates a probable rejection at current levels, favoring a decline toward the range’s lower boundary unless buyers achieve a convincing breakout above $119,000.

The FOMC meeting approaches next week, with a 25-basis-point rate cut anticipated. Market direction will hinge on Powell’s commentary and the Fed’s perspective on inflation and employment metrics. If Powell emphasizes inflation concerns, BTC might decline to test the $112,000 liquidity zone. However, if the Fed adopts a more dovish tone, Bitcoin could break out above $117,000 and reach new heights.

Miner Reserves and Network Resilience

Crypto analyst Avocado Onchain identifies a fundamental shift in mining behavior and Bitcoin network resilience. The Miners’ Position Index (MPI) shows that miners are maintaining their holdings rather than liquidating, suggesting a long-term accumulation strategy. The present cycle shows a contrasting pattern, although some pre-halving distribution is obvious, as the intense late-cycle liquidations remain notably absent.

For more information on Bitcoin’s hash rate and network difficulty, please visit the original source: https://cryptonews.com/news/bitcoin-hash-rate-hits-record-1-12b-th-s-as-network-difficulty-surges-will-btc-break-117k/