Bitcoin and Ethereum Spot ETFs See Unprecedented Institutional Demand

In a remarkable display of institutional investment appetite, Bitcoin and Ethereum spot ETFs collectively recorded a staggering $1.048 billion in net inflows on September 12. This surge marks one of the most substantial single-day influxes of institutional capital since the inception of these financial products.

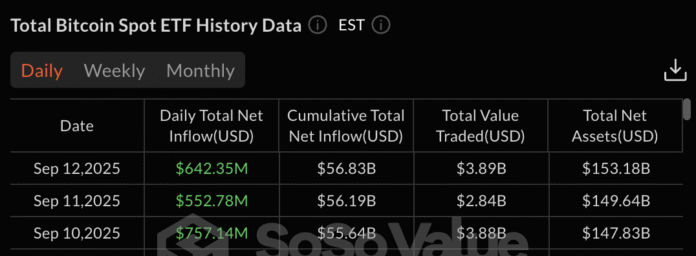

The breakdown of these inflows reveals that Bitcoin ETFs led the charge, with $642.35 million in daily inflows, thereby pushing the cumulative net inflows to an impressive $56.83 billion. Conversely, Ethereum ETFs contributed $405.55 million, bringing their total net inflows to $13.36 billion. These figures underscore the growing institutional interest in cryptocurrency, particularly in the two largest digital assets by market capitalization.

Ethereum ETFs Exhibit Strong Recovery Pattern

Ethereum ETFs have demonstrated a significant turnaround in investor sentiment over the week ending September 12. Following a substantial outflow of $787.74 million the previous week, these funds managed to attract $637.69 million in weekly inflows. This dramatic shift from outflows to significant inflows within a single week highlights the volatile yet ultimately positive institutional sentiment towards Ethereum.

The $405.55 million single-day inflow on September 12 stands as one of the strongest daily performances since the launch of Ethereum ETFs. This rebound is particularly noteworthy, as it suggests that institutional investors are regaining confidence in Ethereum’s potential for growth.

Bitcoin ETF flow data

Bitcoin ETF flow data

Weekly data further reinforces the notion of building institutional buying momentum. Bitcoin ETFs saw $2.34 billion in net inflows for the week ending September 12, with the total value traded reaching $16.65 billion. This represents a strong recovery from the previous week’s more modest $246.42 million in inflows, indicating a sustained interest in Bitcoin among institutional investors.

Technical Indicators Suggest Further Upside

The influx of institutional capital into Bitcoin and Ethereum ETFs aligns with bullish technical developments across both assets. According to analyst Ted, Ethereum’s reclaim of the $4,700 level sets up a test of the $4,880 resistance, with the potential for new all-time highs if this level is breached. Ted noted, “$ETH has now reclaimed the $4,700 level. The next major resistance for Ethereum before ATH is around $4,880. If ETH reclaims that too, a new ATH will happen soon. A failure to reclaim the top level could result in a market correction.”

Another analyst, BitBull, highlighted Bitcoin’s reclaim of its eight-year trendline, describing it as a strong technical signal. The analyst pointed out that Bitcoin lost this level last month but has now closed a strong candle above it, suggesting that momentum is building for a new all-time high within the next two to three weeks.

In conclusion, the significant inflows into Bitcoin and Ethereum spot ETFs on September 12 signal a profound institutional interest in these digital assets. As technical indicators point towards further upside potential, it will be intriguing to observe how these markets evolve in the coming weeks. For more detailed insights and the latest news on cryptocurrency markets, visit https://crypto.news/bitcoin-and-ethereum-etfs-rake-in-1-billion/