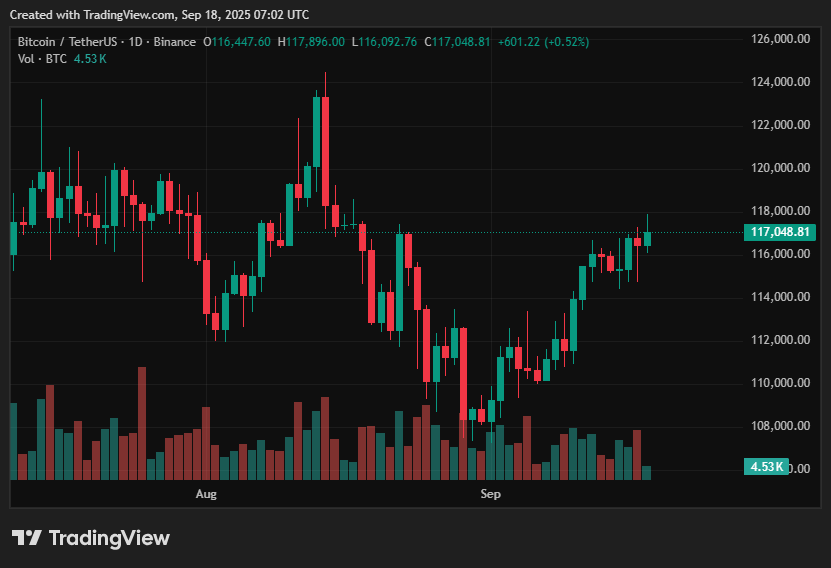

The Bitcoin price has been a topic of intense discussion among investors and analysts, particularly after the U.S. Federal Reserve’s 25-basis-point rate cut on September 17, 2025. As of September 18, 2025, Bitcoin is trading at approximately $117,000, sparking debates about its potential future movements. According to Bitcoin price prediction analysts, the key range for the immediate term is $115,000 to $120,000, with an upside scenario aiming for $125,000 to $130,000 and a downside scenario risking $110,000 to $100,000.

Current Bitcoin Price Scenario

The intraday band for Bitcoin on September 18, 2025, is between $116,000 and $118,000, with open interest in futures stronger and volumes higher. Significant exchange withdrawals are seen in on-chain flows, which reduces the amount of supply accessible. Institutional demand and spot ETF inflows are supporting the upward bias, making a breakout to $125,000-$130,000 possible. However, risks include profit-taking, September seasonality, a stronger USD/yields, and the collapse of the $115,000 support.

BTC 1d chart: Source: crypto.news

Positive Factors on Bitcoin Price

Institutional demand via spot Bitcoin ETFs and decreased exchange liquidity are currently the main bullish drivers. Bids in the $115,000-$120,000 range have been considerably supported by several days of net ETF inflows this month, as well as significant US-listed spot ETF purchases during the week surrounding the FOMC. As leveraged futures roll and momentum traders follow the move, Bitcoin may soon retest $120,000 and try a run toward $125,000-$130,000 if spot demand (ETF creations + OTC buys) holds and exchange withdrawals persist.

Negative Factors for BTC Price

Risks exist despite the bullish flows. Bitcoin might return to the low-$110,000 range or lower if it were to break out of the mid-$115,000 level, which would encourage profit-taking and cause short-term deleveraging in futures markets. Any hawkish reading of Fed instructions, seasonality (September has historically been bad), or an unexpected spike in Treasury yields / USD strength are still plausible downside catalysts. Furthermore, the previously withdrawn supply may re-enter exchanges and exert pressure on the price if the appetite for spot ETFs wanes or if new selling by major token holders occurs.

Bitcoin Price Prediction Based on Current Levels

Key range for the immediate term for BTC is $115,000-$120,000. Traders can expect two scenarios here: Scenario A, a persistent rise over $120,000, propelled by ongoing ETF inflows and low exchange liquidity, indicates that the market will reach targets in the $125,000-$130,000 range in the upcoming weeks. Scenario B, failure/pullback, if leveraged positions are liquidated, a loss of $115,000 (or a significant increase in U.S. yields) might cause a decline toward $110,000 and, in a more severe unwind, the $104,000-$100,000 range.

BTC support and resistance levels, Source: Tradingview

For more information on Bitcoin price predictions and the latest market trends, visit https://crypto.news/bitcoin-price-prediction-15k-move-imminent/