Introduction to Know Your Token (KYT)

The concept of Know Your Customer (KYC) has been a cornerstone of compliance in the crypto industry for years. However, it has become increasingly apparent that KYC alone is not enough to ensure the integrity of crypto transactions. This is where Know Your Token (KYT) comes in – a crucial step in verifying the provenance and legitimacy of crypto assets. In this article, we will explore the importance of KYT and how it can help build trust in the crypto industry.

The Limitations of KYC

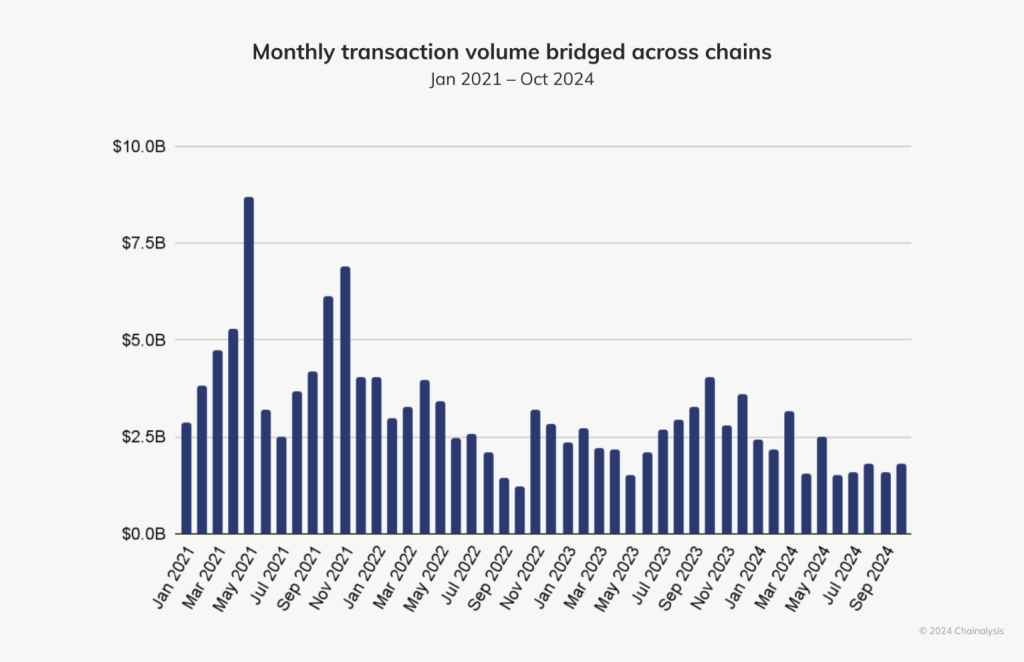

While KYC is effective in verifying the identity of customers, it does not provide any information about the assets themselves. In 2024, cross-chain bridge volumes reached over $125 billion, with each transaction leaving a visible trail on the blockchain. However, this transparency is often underutilized, and the lack of KYT can lead to unnoticed exposure to risky assets.

Source: Chainalysis

Source: Chainalysis

Reading the Chain: The Importance of KYT

KYT involves assessing the provenance of a token directly from the blockchain. This process can help identify potential risks and ensure that assets are legitimate. By using KYT, companies can meet or exceed regulatory expectations and gain a competitive edge in the industry.

A proven approach to KYT involves conducting six key tests: reputation checks on the team, technical reviews of code and governance, financial health assessments, legal status evaluations, cybersecurity attitude assessments, and testability evaluations. These checks create a framework for evaluating a token’s risk profile before it is listed or accepted.

Standardizing KYT: The Future of Crypto Compliance

Regulatory bodies are increasingly recognizing the importance of KYT. In Europe, the MiCA regulation is already in effect, and stablecoin rules began to apply in June 2024. In Asia, the SFC has expanded its licensing process for Virtual Asset Trading Platforms (VATPs), and the UAE has introduced new regulations requiring VASPs to conduct due diligence and integrate KYT into their operations.

Companies are now publishing token-risk methods as part of their AML programs, and some are even refusing to do business with counterparties that cannot provide original data. The integration of KYT dashboards into governance, product, and risk reviews is becoming increasingly common.

Conclusion: Building Trust in Crypto with KYT

In conclusion, KYT is a crucial step in building trust in the crypto industry. By verifying the provenance and legitimacy of crypto assets, companies can ensure that they are not exposing themselves to unnecessary risks. As regulatory bodies continue to recognize the importance of KYT, it is likely to become a standard practice in the industry. Companies that adapt early and integrate KYT into their operations will strengthen their positions and maintain control over their assets.

For more information on the importance of KYT and its role in building trust in the crypto industry, visit https://cryptonews.com/exclusives/want-trust-back-in-crypto-start-with-the-tokens-not-the-people/