BNB, the native token of the Binance ecosystem, has been making waves in the cryptocurrency market with its recent price surge. Despite the overall crypto market experiencing a lull over the weekend, BNB managed to climb over 10% and exceed $1,083.50, leaving many to wonder if it can press even higher.

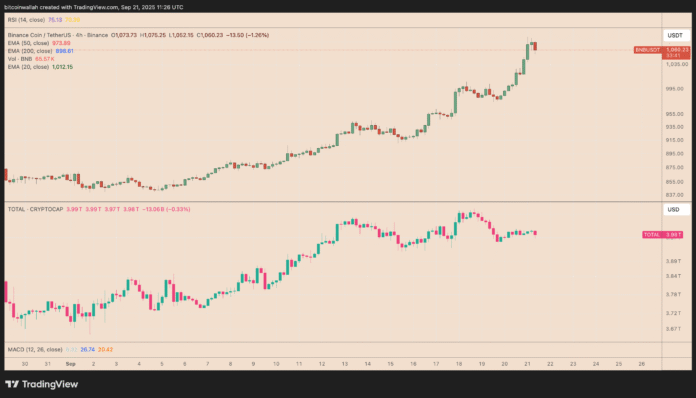

According to the four-hour price chart, BNB’s relative strength index (RSI) has entered the overbought area, increasing the risk of a short-term withdrawal. The token has gained 2.89% compared to its record high, and a correction in the direction of the 20-4-hour exponential moving average (20-4h EMA) near $1,012 is increasingly likely in the coming days.

Short-term correction risks and potential targets

The decline of BNB could extend to the 50-4h EMA by $974, a level that offers reliable trend support if the sales pressure deepens into next week. However, analyst Gael Gallot believes that BNB holding over $970 is a sign of healthy consolidation, citing the continued increasing trading volume and long overweight positions on the derivative market.

Gallot noted that the trading volume reached 3.28 billion during the move, and the impulse remains strong with a long short ratio of 17.71, showing a bullish position. The price of $970 also serves as a lower trend line of the wider rising channel pattern of BNB, which has triggered 20-35% rebounds in the direction of the channel since June.

Annual goal and potential breakout

BNB is still looking to create a potential end-of-year breakout, heated by the outbreak of a long-term cup and handle formation. The price has deleted the 1.618 Fibonacci extension near $1,037 and turned it over to support, creating upward trend targets at $1,250, measured from the cup and handle, and the 2.618-FIB line around $1,565 if the impulse applies.

This setup reflects the 2,650% rally from BNB after its rising triangular breakout in 2020-2021. Furthermore, the Netto-Netto-Netto-Metric (net unrealized profit/loss) has returned to the optimism-fear zone, indicating that owners are optimistic, often a sign of the strength of the central cycle.

On-chain data and market analysis

According to on-chain data, BNB’s technical and fundamental data look strong, suggesting that it can enter its bullet phase of the cycle, even if short-term corrections occur. The current feeling indicates that owners are optimistic, and the breakout patterns and on-chain optimism indicate an upward trend of $1,250 to $1,565 until the end of the year.

This article does not contain investment advice or recommendations. Every investment and trade movement is the risk, and readers should carry out their own research results if they make a decision.

For more information on BNB’s price movement and market analysis, visit https://cointelegraph.com/news/bnb-quietly-climbs-despite-weekend-lull-how-high-can-price-go?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound.