Introduction to Bitcoin Mining in 2025

The Bitcoin mining market has undergone a significant transformation in 2025. With Bitcoin developing into a US National Reserve Asset and surpassing $100 billion in ETF holdings, it has become a foundation of institutional portfolios. However, the industry faces challenges such as increased US tariffs on mining devices, reduced miner rewards due to the 2024 halving, and a surge in network hash rates. Despite these challenges, the competition for mining has reached unprecedented heights.

The next chapter of mining is being shaped by three global technological and economic trends. Firstly, the performance of Application-Specific Integrated Circuits (ASICs) is reaching its physical limits, making it insufficient to rely solely on the most powerful rigs. Secondly, the energy requirements of the AI industry are being factored into the energy supply of mining, forcing miners to adapt to the competition. Lastly, institutional investors are showing increasing interest in Bitcoin mining, which serves to generate BTC rewards.

Are Chips Not Enough Anymore?

For over a decade, Bitcoin mining has been defined by hardware advancements. Each new generation of ASICs has brought significant efficiency gains, promoting explosive hash rate growth. However, the law of Moore is slowing down, and reducing chip size is reaching physical and economic limits. As a result, silicon efficiency alone is approaching a plateau.

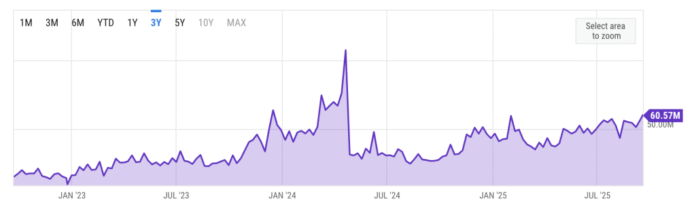

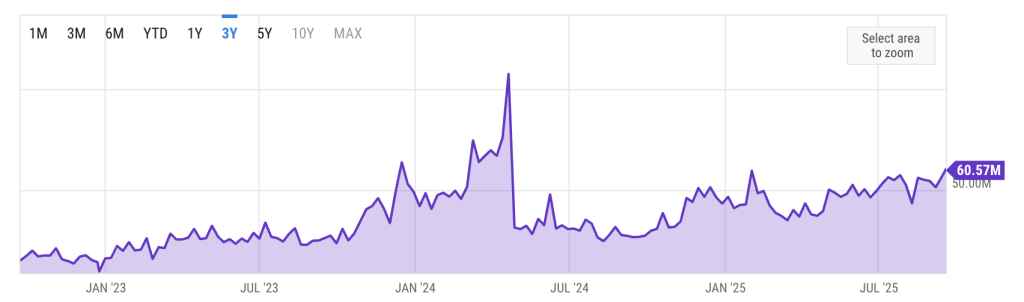

The revenue and margins of miners in 2024 have been affected, with miners needing to find efficiency gains beyond silicon to survive.  Bitcoin Miners Revenue a day. Source: Ycharts

Bitcoin Miners Revenue a day. Source: Ycharts

Every aspect of the facility, not just the ASIC, is crucial today. Cooling, air flow, power distribution, software orchestration, and even real estate layouts now decide who remains profitable. The winners will be miners who maximize output from existing hardware, cut waste in every layer, and build infrastructure that is robust enough to adapt.

Watts Can Serve Both

Another economic challenge comes from the increasing energy consumption of AI and high-performance computing (HPC) companies. The competition between mining and AI/HPC companies for accessing networks is rising. In the United States, AI/HPC players are expanding their domestic operations and securing large-scale electricity capacity (50 MW or more). Some are acquiring large mining companies and replacing ASIC-Bitcoin mining rigs with AI-serving GPUs.

However, the competition with AI does not necessarily have to be a disadvantage for miners. In fact, it could work to their advantage. AI and HPC do not have to replace mining; they can converge. Both industries have similar needs, requiring massive electricity, advanced cooling systems, and real estate optimized for computation.

Some mining companies have already adapted, fitting their capacity to AI requirements and bringing back GPUs alongside ASICs. CoreWeave expanded its partnership with Galaxy Digital and committed to an additional 260 MW for AI and HPC operations. In Texas, riot held back its planned 600-MW Bitcoin mining expansion and pivoted into the AI cloud business, with its GPU-as-a-service arm achieving $25 million in annual sales.

Why Will Wall Street Mine Bitcoin?

Institutional investors have similar reasons to engage in Bitcoin mining. Hedge funds and institutional investors realize that mining offers more than just Bitcoin rewards. It is now a financial layer in the energy infrastructure that helps manage the network, utilize waste assets, and open new revenue channels.

Mining provides programmable load that can be provided as a tool. For instance, FlareGas can rise in oil fields, cut off during peak law stress, or stabilize prices in deregulated markets. When energy becomes money, miners become valuable partners for supply companies, independent electricity generators, and even governments.

Mining also proves to be a strategic asset for the adoption of renewable energies. Miners can absorb excess sunlight at noon or excess wind at night and then scale back when the network is tight. This load flexibility reduces waste and makes renewable systems more reliable.

Mining’s Next Race Begins

In 2025 and beyond, the survival of mining companies means thinking beyond traditional profitability indicators. This implies setting up full-stack and adapting technology for wider applications. Mining companies of the future will combine scalable systems, AI-capable infrastructure, and a willingness to work with institutional investors entering the field.

Bitcoin mining has become a foundational layer of energy and digital assets. The companies that win will not only pursue hash rates but master efficiency, pivot with AI, and work with institutions. The ASIC arms race is slowing down, but the race for professionalization, monetization, and embedding in the global infrastructure has just begun.

For more information on Bitcoin mining and its future, visit https://cryptonews.com/exclusives/bitcoin-mining-in-2025-2026-beyond-the-asic-arms-race/