Most important snack:

-

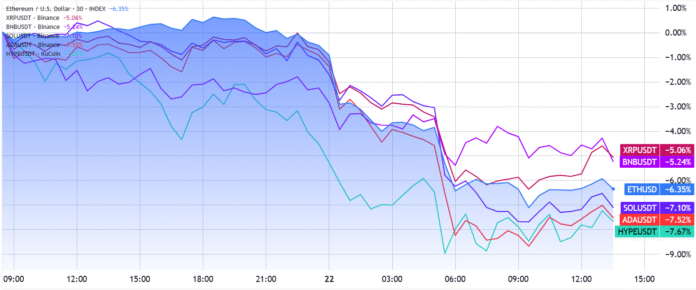

The correction of ether was aligned with wider Altcoin movements, with liquidations being compensated for by stable open interest.

-

Ether options and eternal financing data show a weaker moan demand, but not a trigger controlled by derivative for the sale.

Ether (Eth) was exposed to a correction of 9.2% in less than 12 hours after a risk change on the cryptocurrency market. Despite more than 500 million US dollars of forced liquidations from bullish lever positions, buyers entered almost $ 4,150. Traders are now discussing whether the sale was excessive and whether there is space for further corrections below $ 4,000.

ETH/USD against other important old coins, 30 minutes. Source: Tradingview / Cintelegraph

The decline of ether was almost identical to the wider Altcoin market and showed no specific concerns about the Ethereum ecosystem. Although the ETH futures recorded significantly higher 24-hour liquidations, this reflected largely increased open interest and broader use of derivatives such as options and not a signal for excessive leverage through bullish positions.

The aggregated open interest in Ether -Futures was 63.7 billion US dollars on Sunday, while Sol (Sol), XRP (XRP), BNB (BNB) and Cardano (ADA) were combined for COINGGLASS data for 32.3 billion US dollars. It is essential to note that the open interest of Ether Futures remained relatively unchanged on Monday compared to the day before at 14.2 million ETH, which indicates that the liquidation effect was compensated for by the addition of new lever positions.

Etherivates showed no signs of excessive bullity

In order to determine whether ether traders have changed their prospects for the sudden negative price swinging, it is useful to evaluate the monthly ETH -Futures premium. Under neutral conditions, these contracts usually act 5% to 10% over the spot markets in order to take into account the longer settlement time. A strong demand for short positions can bring the premium to the level.

Athe two -month futures annualized premium. Source: laevitas.ch

The annualized monthly Futures bonus of ether sank to the lowest point in three months and indicated the weak demand for Leveraged Longs. The data has been a lack of trust in bulls since Saturday when the ETH bonus slipped under the neutral threshold of 5%.

ETH perpetual contracts are a useful instrument to confirm the mood of the dealers. Under neutral conditions, the annualized financing rate should be between 6% and 12%.

ETH perpetual futures -financing rate, annualized. Source: laevitas.ch

The financing rate of Ether Perpetual Futures fell briefly -6% and later recovered -1% on Monday. The metric had already fallen under the neutral 6% -epapa level on Thursday, which questioned the idea that cascade fluids were mainly caused by excessive bullish leverage.

Institutional demand should generate an ETH rebound

It remains possible that a small group of companies will be positioned overly optimistically, but the initial trigger of the weakness of ether is unclear and seems to cause other cryptocurrency dealers to panic.

Ether options offer another way to test whether professional dealers have expected a crash. If there had been a form of the prerequisite, the demand for PUT options would have increased from PUT options compared to call contracts (purchase) contracts. As a rule, a ratio of over 150% is a strong fear of correction.

Bitmine lasts more than 2% of the ETH offer, announces $ 365 million

Put-to-call premium ratio on the derbit. Source: laevitas.ch

On the deribit, the volume of put-to-call ether options floated close to 80% from Wednesday to Sunday and was the 30-day average. Overall, ETH derivative data show the weaker demand for bullish exposure, but no indication that derivative markets were the origin of the downturn.

Instead, indications indicate that Futures liquidations were the result of the panic sale that temporarily dampened the risk. However, this should not be a long -term concern, since Ethers corresponds to a step in harmony with large old coins. The case for the recovery of the ETH re-recovery of $ 4,600 remains due to rising company reserves and the growing demand for Spot ether stock exchange fund (ETFs).

This article serves general information purposes and should not be regarded as legal or investment advice. The views, thoughts and opinions that are expressed here are solely that of the author and do not necessarily reflect the views and opinions of cointelegraph or do not necessarily represent them.

For more information on the current state of the cryptocurrency market, visit https://cointelegraph.com/news/eth-futures-turn-bearish-a-market-overreaction-or-is-3-8k-next?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound