Blackrock’s Crypto-Based ETFs Reach $260 Million in Annualized Revenue

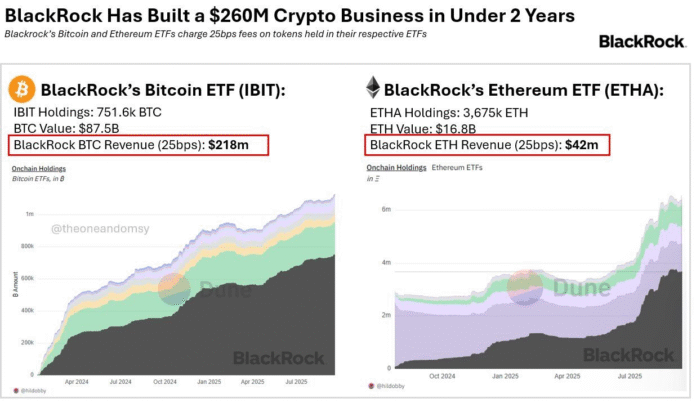

Blackrock, the world’s largest asset manager, has achieved significant success with its cryptocurrency-based stock exchange-traded funds (ETFs), generating $260 million in annualized revenue. This milestone marks a “benchmark” model for traditional investment funds seeking lucrative business models. The ETFs, which track the performance of Bitcoin (BTC) and Ether (ETH), have attracted substantial investments, with Bitcoin ETFs accounting for $218 million and Ether products accounting for $42 million.

The profitability of Blackrock’s crypto-oriented ETFs is expected to drive more investment giants from the traditional financial sector to launch regulated cryptocurrency-based trading products. According to Leon Waidmann, Blackrock’s Crypto ETFs serve as a “benchmark” for institutions and traditional pension funds. Waidmann noted, “This is no longer an experiment. The world’s largest asset manager has shown that crypto is a serious profit center. This is a quarter of a billion dollar business that was built almost overnight. Many fintech insiders do not do that in a decade.”

Waidmann compared the ETFs to Amazon, which began with books before scaling, stating that the ETFs were the “entry point to the crypto world”. The growth of Blackrock’s ETFs is seen as proof that institutions could expand the current crypto market cycle. With some analysts, the inclusion of ETFs and company treasures can continue to drive demand beyond the traditional four-year half-cycle of the industry.

Blackrock’s Bitcoin ETF Reaches $85 Billion Milestone

In a related development, Blackrock’s funds under management have approached $85 billion, making up the lion’s share or 57.5% of the market share of the entire Spot-Bitcoin ETF in the US, according to Dune. This milestone takes place less than two years after Bitcoin ETFs’ first debut on January 11, 2024. The ETF from Fidelity, the second-largest US spot-Bitcoin ETF, holds $22.8 billion, making up 15.4% of the total market share.

According to Ryan Lee, Chief Analyst at Bitget Exchange, ETF inflows into Bitcoin can see another price discovery of new all-time highs in the next few weeks. Lee stated, “Since BTC and ETH-ETFs already attract massive inflows, the macro background prefers an approach ‘Buy the DIP’, since the institutional entry in the middle of guidelines helps to determine a bullish soil for risk assets.”

Source: Leon Waidmann

Bitcoin ETFs by market share. Source: dune.com

Worldwide biggest ETFs. Source: ETF database

For more information, visit https://cointelegraph.com/news/blackrock-bitcoin-eth-etfs-260m-revenue-adoption-benchmark?utm_source=rss_feed&utm_medium=rss_tag_blockchain&utm_campaign=rss_partner_inbound