The Bitcoin options market is set to witness a significant event on Friday, with a total of $22.6 billion in Bitcoin (BTC) options expiring. This expiry could have a decisive impact on the price of Bitcoin, especially after the strong rejection at $117,000. Currently, bullish strategies seem to be favored, provided that the BTC price holds the support level of $110,000.

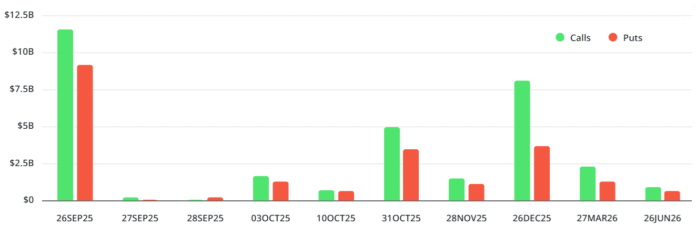

Bitcoin options aggregate open interest after expiry, USD. Source: laevitas.ch

Market Dynamics and Open Interest

Deribit continues to dominate the market with open interest rates of $17.4 billion for Bitcoin options on Friday, while Okx and CME follow with $1.9 billion. The number of call (buy) options exceeds put (sell) contracts, reflecting the consistent optimism of cryptocurrency traders. However, the demand for neutral to bullish Bitcoin positions is widespread, with open interest rates 20% below call positions of $12.6 billion.

September BTC Monthly Options Abiry Open Interest at Deribit, USD. Source: laevitas.ch

Trader Positioning and Market Sentiment

The positioning of traders at Deribit Exchange shows that neutral to bullish bets are aimed at the range of $95,000 to $110,000, which is becoming increasingly unlikely. A significant part of the call contracts was placed at a highly optimistic level, with open interest rates of $6.6 billion from $120,000 and more waiting, making around $3.3 billion US dollars realistic. Meanwhile, 81% of the put options for Deribit are $110,000 or lower, with only $1.4 billion active.

Bitcoin 30-day options Delta reflection in Deribit (put call). Source: laevitas.ch

Delta Skew and Market Uncertainty

The Bitcoin options Delta Skew shows a moderate fear with 13%, with put options trading with a premium compared to equivalent call contracts. Under neutral conditions, this display should remain between -6% and 6%, signaling that whales and market makers are restless about the current downward risk at the current level of $113,500. The macroeconomic uncertainty, including the data of the US gross domestic product (GDP), weekly unemployment claims, and the upcoming government bonds, could shift the mood of traders and impact the price of Bitcoin.

Probable Scenarios and Price Dynamics

Based on current price trends, there are three probable scenarios in Deribit:

-

Between $107,000 and $110,000: Calls of $1 billion (buy) compared to puts (sell) of $2 billion, with the net result favoring put instruments by $1 billion.

-

Between $110,100 and $112,000: $1.4 billion calls to $1.4 billion puts, leading to a balanced result.

-

Between $112,100 and $115,000: $1.66 billion calls compared to $1 billion put, preferring calls for $660 million.

It can be premature to count out bears, as the mood of traders could shift depending on the most important macroeconomic publications. An increasingly fragile economic background supports additional interest reductions through the US Federal Reserve, usually an optimistic driver for risk assets such as cryptocurrencies. However, persistent concerns about labor market weakness contain risk, which negatively affects the Bitcoin price.

The monthly expiry of Bitcoin options in September is currently inclined in favor of bulls, although a decisive decline below $112,000 cannot be excluded. For more information on Bitcoin and cryptocurrency market analysis, visit https://cointelegraph.com/news/bitcoin-bulls-favored-in-22-6b-btc-monthly-options-expiry