Solana Price Analysis: A Potential Rebound on the Horizon

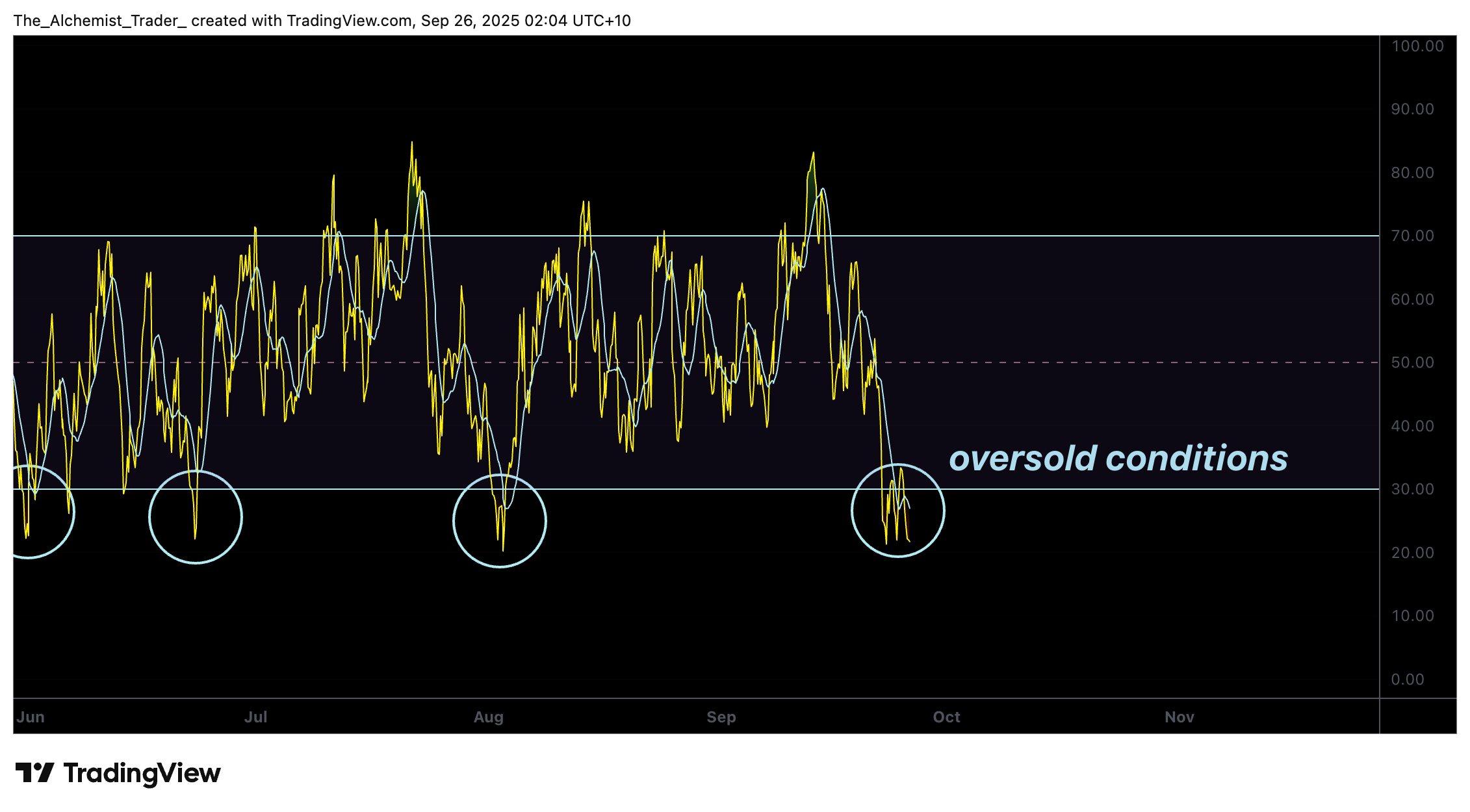

The Solana price has experienced a significant withdrawal from the $260 resistance level, dropping into the $200 support zone. With the Relative Strength Index (RSI) now in oversold territory, traders are watching for a potential bounce. This development is crucial for Solana’s future price action, as it may indicate a reversal of the current bearish trend.

A closer examination of the price chart reveals that Solana’s price action shifted rapidly after reaching almost $260. A sequence of higher highs and higher lows formed a bullish structure until resistance limited progress. The rejection triggered an aggressive sell-off that broke through the point of control (POC) and the value area high (VAH) before finding its footing in the $200 support region. This zone coincides with the 0.618 Fibonacci retracement level, an area where Solana has historically reacted with strong reversals.

Key Technical Points to Consider

Several technical indicators suggest that Solana is due for a potential rebound. The 0.618 Fibonacci retracement level, combined with oversold RSI conditions, creates a strong technical confluence. If the $200 support level holds, Solana has the potential to return to the $230-$260 range. Additionally, the RSI, which is currently below the 30 threshold, indicates oversold conditions that are rarely sustained for an extended period.

Historical patterns indicate that Solana often bounces from the 0.618 Fibonacci level to previous highs. The latest bearish expansion was sharp and aggressive, reflecting earlier movements where Solana respected the 0.618 Fibonacci retracement as a key turning point. This support level, with a high timeframe, offers a technically significant level that buyers could be attracted to, looking for value in the sale.

Solusdt (4H) -Dart, Source: Tradingview

Solusdt (4H) -Dart, Source: Tradingview

From a structural perspective, the $200 support level has more weight than just aligning with the Fibonacci level. It also reflects a psychological round number level where liquidity pools tend to congregate. A bounce from this level could restore Solana’s bullish trajectory by turning the price campaign back towards neutral volume levels such as VAH and eventually testing the $260 resistance level.

Relative strength index (RSI), source: tradingview

Relative strength index (RSI), source: tradingview

Upcoming Price Campaign Expectations

In the short term, Solana favors a rebound scenario. A successful defense of the $200 support zone could trigger a rotation back to the $230-$260 range. Momentum indicators continue to support this narrative, with the RSI showing oversold conditions that are rarely maintained for an extended period. If demand inflows return to these low levels, this could mark the exhaustion of the current bearish leg and set the stage for another bullish impulse.

For more information on Solana’s price action and market analysis, visit https://crypto.news/solana-price-crashes-to-200-support-as-rsi-reaches-oversold-conditions/