Bitcoin Price Retreats Below $110,000 Support Level Amid Rising ETF Outflows

The Bitcoin price has retreated below the $110,000 support level, sparking concerns among investors. According to recent data, two risky chart patterns have formed, while exchange-traded fund (ETF) outflows continue to rise. As of Saturday, September 27, Bitcoin (BTC) was trading at approximately $109,600, down 12% from its all-time high and hovering at its lowest level since September 2.

The decline in Bitcoin price can be attributed to the easing demand from American investors. Data compiled by SoSoValue shows that ETF inflows have slowed in the past two weeks, with all Bitcoin ETFs experiencing outflows of $902 million this week, after adding $886 million a week earlier. This significant decrease in ETF inflows has raised concerns about the potential impact on the Bitcoin price.

Formation of Risky Chart Patterns

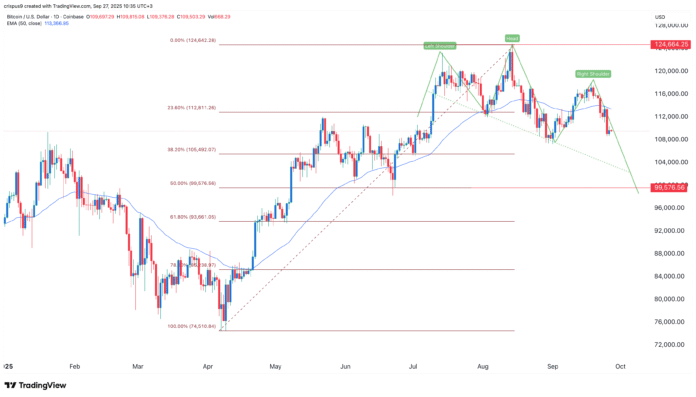

A closer look at the daily timeframe chart reveals that the Bitcoin price has slowly formed a head-and-shoulders pattern, which often signals further downside. The price has also moved below the 50-day Exponential Moving Average, while the Relative Strength Index has pointed downwards. These patterns suggest further downside potential to the 50% Fibonacci Retracement level at $100,000.

Additionally, the weekly chart indicates that the Bitcoin price has formed a rising wedge chart pattern, characterized by two converging trendlines that are rising. These two lines are nearing their confluence, indicating a potential bearish breakout. Oscillators like the Relative Strength Index and the MACD have formed a bearish divergence pattern as they have moved downwards, while the price kept rising. These two patterns also indicate further downside in the coming weeks.

Impact of Federal Reserve Officials’ Warnings

One potential reason for the weakness in Bitcoin price is the warning from Federal Reserve officials about interest rate cuts. Officials like Austan Goolsbee, Beth Hammack, and Raphael Bostic cautioned that the Fed should be cautious when cutting rates, citing the persistent inflation above the 2% target and the strong labor market. The economy has also shown resilience, with a recent report indicating a 3.8% expansion in the second quarter. The number of Americans filing for jobless claims has dropped significantly in the past few weeks.

Upcoming Catalysts for Bitcoin Price

Looking ahead, the next important catalyst for Bitcoin and other coins will be the non-farm payrolls data on Friday. These numbers will help determine whether the Fed will cut interest rates in the October meeting. The outcome of this meeting will have a significant impact on the Bitcoin price, and investors are advised to keep a close eye on the developments.

BTC price chart | Source: crypto.news

BTC price chart | Source: crypto.news

Bitcoin chart | Source: crypto.news

Bitcoin chart | Source: crypto.news

For more information on the Bitcoin price and its potential impact on the cryptocurrency market, please visit the original source link: https://crypto.news/bitcoin-price-forms-risky-patterns-etf-outflows-rise/