US Securities and Exchange Commission Halts Trading with QMMM Holdings

The US Securities and Exchange Commission (SEC) has temporarily suspended trading with QMMM Holdings, a crypto treasury firm, due to potential stock manipulations. This decision comes just a week after the regulatory body launched an investigation into certain crypto financial companies. According to the SEC, the alleged manipulation was facilitated by unknown individuals who promoted QMMM shares on social media, artificially inflating the price and volume.

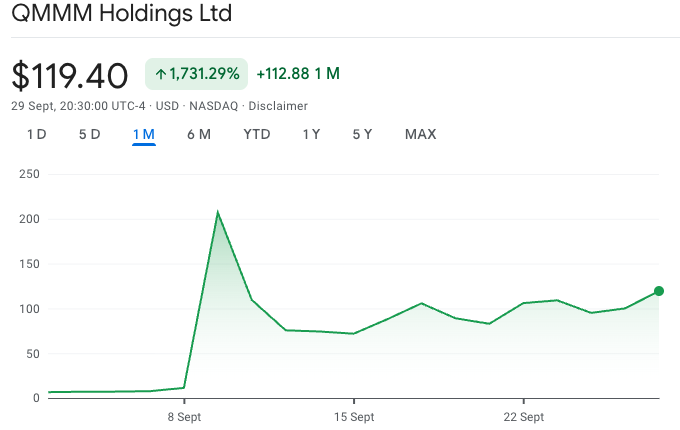

The QMMM stock price had increased by over 1,700% last month after the company announced its plans to hold Bitcoin (BTC), Ether (ETH), and Solana (SOL) on September 9. This significant surge in stock price has raised concerns about potential market manipulation. The SEC and QMMM Holdings did not immediately respond to requests for comments.

Crypto Strategy Under Scrutiny

Carl Capolingua, senior editor of the Market Analysis Platform Market Index, stated that such SEC trade suspensions are “generally due to consequences for corporate management.” He added that if the SEC can link the unknown individuals promoting the company’s stock to employees or management, the punishments could be severe, including hefty fines or prison sentences. Capolingua emphasized that QMMM’s crypto strategy is “probably not an exam” for the SEC, as the primary concern is the alleged illegal stock promotion.

Tony Sycamore, an analyst at IG Australia, advised investors that if they want crypto exposure, “these types of Hagel-Mary play are not the right way to do it.” He cautioned that investing in companies with questionable crypto strategies can be risky and may not provide the desired exposure to the cryptocurrency market.

QMMM’s Significant Profits Before Trading Halt

The shares of QMMM Holdings (QMMM) closed at $119.40 on Friday, after increasing by over 1,730% last month. The company’s stock price surged to an all-time high of $207 after announcing plans to build a crypto analysis platform and initially issue $100 million for storing cryptocurrencies. The QMMM shares last month recorded significant profits in the announcement of the crypto plans. Source: Google Finance

SEC and Finra Investigate Crypto Treasury Bonds

The SEC’s trading suspension on QMMM follows a report in the Wall Street Journal on Thursday, which stated that the regulatory body and the Financial Industry Regulatory Authority (Finra) had contacted companies that had recently adopted a crypto treasury strategy. The report highlighted concerns about unusually high trading volume and pricing gains before the public announcement of these companies’ crypto pivots.

The SEC rules prohibit companies from selectively disclosing public information, as those with access to such information could use or avoid public losses before the disclosure. The recent trend of crypto treasury companies has raised concerns about market manipulation and the potential for companies to collapse if the value of their investments exceeds their market value.

For more information on this topic, please visit https://cointelegraph.com/news/sec-pauses-trading-crypto-treasury-firm-qmmm?utm_source=rss_feed&utm_medium=rss_tag_regulation&utm_campaign=rss_partner_inbound