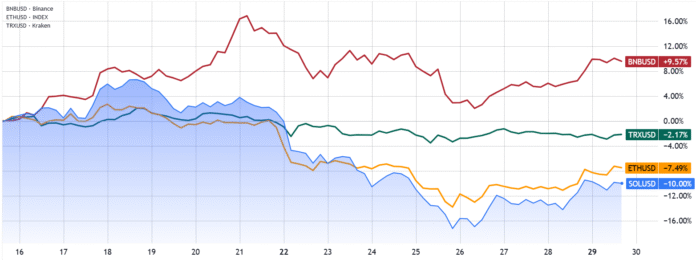

Solana’s native token, Sol (SOL), has experienced a 10.5% increase in value after testing the $191 level on Friday. Despite this rebound, the token’s price remains 10% lower over the past two weeks compared to competitors Ether (ETH) and BNB (BNB). Investors are now weighing the chances of SOL reaching $250 and attempting to understand the factors behind its weaker performance.

Sol/USD (blue) against BNB, TRX, ETH. Source: Tradingview / Cointelegraph

Market Analysis and Investor Sentiment

The investor mood improved over the weekend after US President Donald Trump signaled his intention to avoid a state closure of non-essential federal authorities. However, Congress did not ensure the 60 votes necessary to pass a temporary financing law by Tuesday, which, according to Yahoo Finance, risked “unpredictable and immediate economic waves”.

In the meantime, gold reached an all-time high of $3,833 on Monday, continuing to underline the US fiscal debt prospects. Even if legislators complete a short-term deal, the Ministry of Finance must still pay more than $1 trillion a year. This expansion of government income and expenses pushes savers to tight assets, including cryptocurrencies.

Solana Network Activity and Fees

Although the wider cryptocurrency market managed to gain on Monday, Sol could not hold the $212 level. Part of the frustration among investors is based on falling activities in the entire Solana network. In the past seven days, the number of transactions on Solana has decreased by 10%, while the fees, according to Nansen, decreased by almost 50%.

Top blockchains are classified from seven days of network fees. Source: Nansen

In contrast, several competitors recorded remarkable increases, including a fee jump of 56% for the BNB chain, while Arbitrum more than doubled their fees compared to the previous week.

Perpetual Futures and Decentralized Exchange Activities

The rapid expansion of synthetic perpetual futures on Hyperliquid, Aster, and Edgex has also burdened the sentiment towards Sol. Solana once headed decentralized exchange activities via platforms such as Meteora, Raydium, and Pump, which caused many Sol owners to overestimate the network’s competitive advantage for fees and user experiences.

Chains that are classified by eternal trade volumes. Source: Defillama

Hyperliquid has decided to start its own chain to reduce fees and eliminate the maximum extract value of the validators (MEV). Aster, a project supported by YZI Labs (formerly Binance Labs) and currently integrated into the BNB chain, also plans to introduce its own layer 1 network.

Solana’s Native Token and Inflation Risks

For Sol bulls, the strongest catalyst for the reversal of the token’s underperformance is the expected approval of standard stock exchange funds (ETFs) by the US Securities and Exchange Commission (SEC). The regulatory authority faces a final period on October 10, and analysts have a 95% or higher approval rate, which drives hopes for significant tributaries in the first months of trade.

Sol’s dynamics also depend on how investors consider the natives. Critics warn that Solana’s inflation is a risk because the almost 1,000 validators of the network and their significant furnishing and operating costs.

Source: x/Boxmining

According to X User ‘Boxmining’, 76% of the validator income in the Solana network is more from newly issued coins than from MEV or priority fees. The analysis raises questions about the sustainability of the Stakken reward rate in the coming years, which could weigh up the demand for a Solana ETF.

Traders should not accept a drop in price from just one weaker Onchain activity, since traces of companies that collect SOL reserves and the potential approval of a spot-ETF could create the stage for a Sol-Rallye to $250.

This article serves general information purposes and should not be regarded as legal or investment advice. The views, thoughts, and opinions expressed here are solely those of the author and do not necessarily reflect the views and opinions of Cointelegraph or do not necessarily represent them.

For more information, visit https://cointelegraph.com/news/sol-price-recovers-but-new-highs-depend-on-multiple-factors?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound